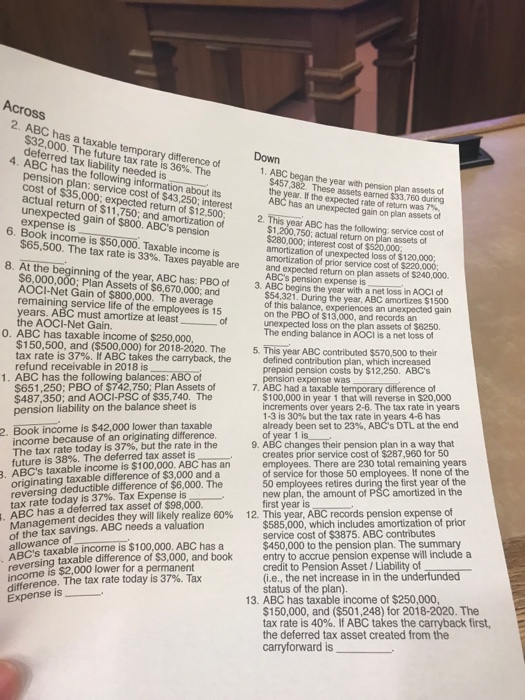

Answer all questions in the picture and show work!

Across 2. ABC has a taxable te difference of 4. ABC has the following information about its $32,000. The future tax rate is 36%. The deferred tax liability needed is . pension plan: service cost of $43,250: interest cost of $35,000; actual return of $11,750; and amortization of unexpected gain of $800. ABC's pension expense is 1. ABC began the year with pension plan assets of 2. This year ABC has the tolonolan assets of $457,382. These assets earned $33,760 during the year. If the expected rate ot return was 7%, ABC has an unexpected gain on plan assets of expected return of $12.500: $1,200,750; actual return on plan assets of $280,000; interest cost of $520,000 amortization of unexpected loss of $120,000; 6. Book income is $50,000. Taxable income is $65,500. The tax rate is 33%. Taxes payable are amortization of prior service cost of $220,000; and expected retrn on plan assets of $240,000. $6,000,000; Plan Assets of $6,670,000; and AOCI-Net Gain of $800,000. The average remaining service life of the employees is 15 years. ABC must amortize at least the AOCi-Net Gain. year with a net loss in AOc of of this balance, experiences an unexpected gain on the PBO of $13,000, and records an unexpected loss on the plan assets of $6250. The ending balance in AOCI is a net loss of 0. ABC has taxable income of $250,000 $150,500, and ($500,000) for 2018-2020. The 5. This tax rate is 37%. If ABC takes the carryback, the refund receivable in 2018 is year ABC contributed $570,500 to thei defined contribution pla prepaid pension costs by $12,250. ABC's pension expense was 1. ABC has the following balances: ABO of 7. ABC had a taxable temporary difference of $100,000 in year 1 that will reverse in $20,000 increments over years 2-6. The tax rate in years 1_3 is 30% but the tax rate in years 4-6 has already been set to 23%, ABC's DTL at the end of year 1 is $651.250: PBO of $742,750; Plan Assets of $487,350; and AOCI-PSC of $35,740. The pension liability on the balance sheet is income because of an originating difference The tax rate today is 37%, but the rate in the future is 38%. The deferred tax asset is 2. Book income is $42,000 lower than taxable 9. ABC changes their pension plan in a way that creates prior service cost of $287,960 for 50 employees. There are 230 total remaining years of service for those 50 employees. If none of the 50 employees retires during the first year of the new plan, the amount of PSC amortized in the first year is s $100,000. ABC has an originating taxable difference of $3,000 and a reversing deductible difference of $6,000. The tax rate . ABC's taxable income i is 37%. Tax Expense is- . ABC has a deferred tax assetof $98,000 12. Thisyear, ABC records pension expense of $585,000, which includes amortization of prior service cost of $3875. ABC contributes realize 60% Management decides they will of the tax savings. ABC needs a allowance ble income is $100,000. ABC has a $450,000 to the pension plan. The summary taxable difference of $3,000, and book entry to accrue pension expense will include a credit to Pension Asset/Liability of (i.e., the net increase in in the underfunded reversa is $2,000 lower for a permanent difference. The tax rate today is 37%. Tax status of the plan) $150,000, and ($501,248) for 2018-2020. The is 13. ABC has taxable income of $250,000 tax rate is 40%. If ABC takes the carryback first, the deferred tax asset created from the carryforward is