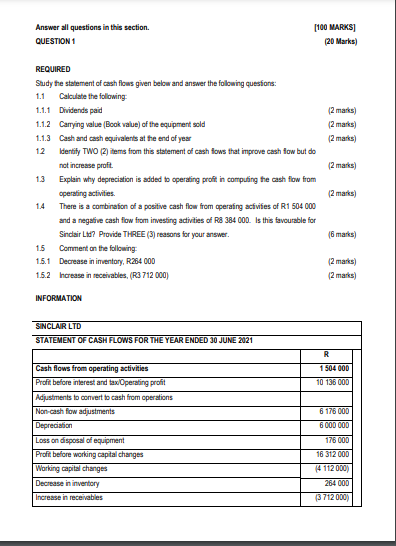

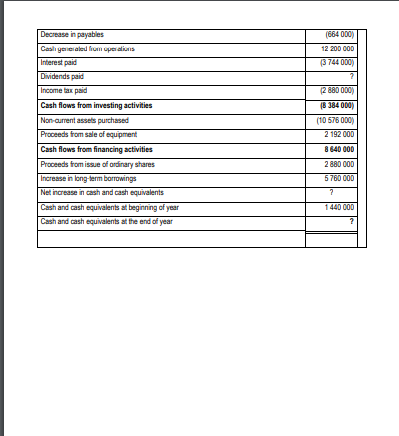

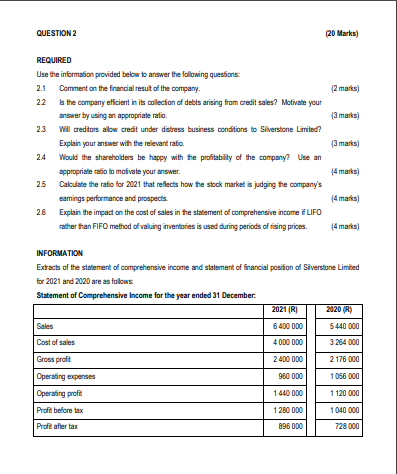

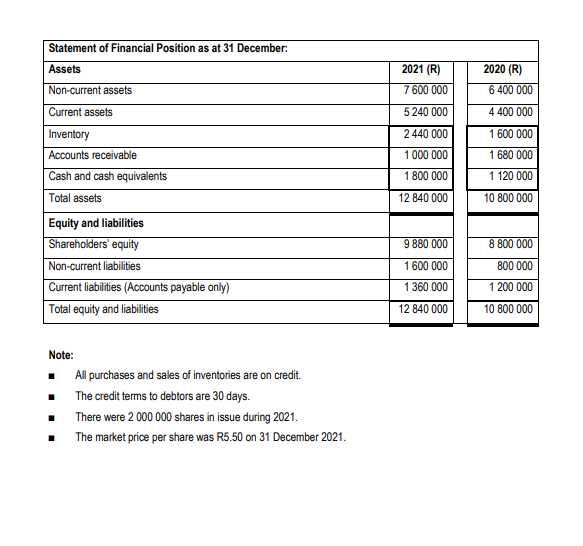

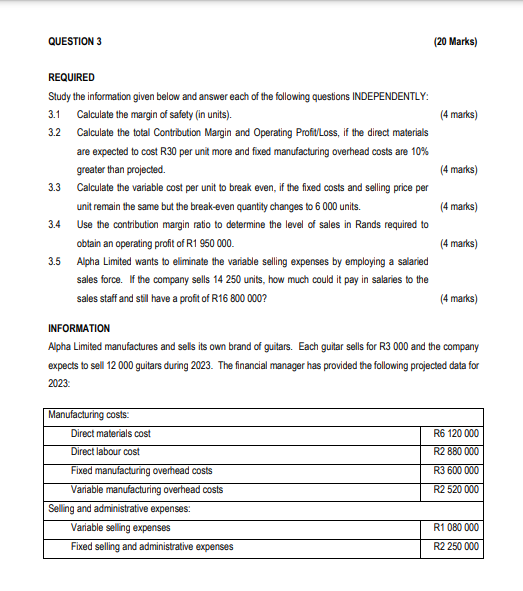

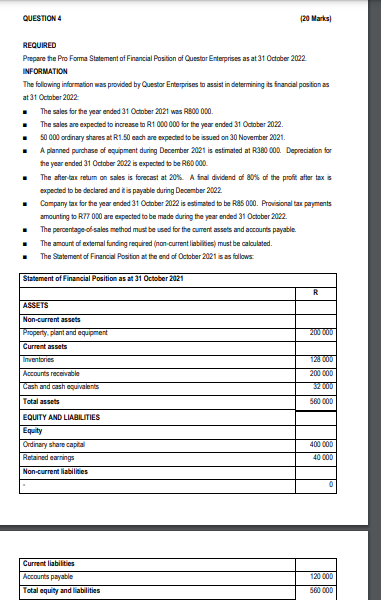

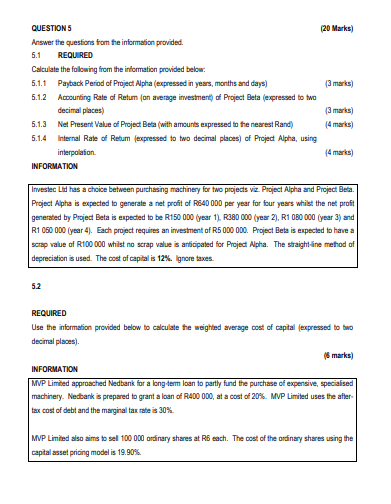

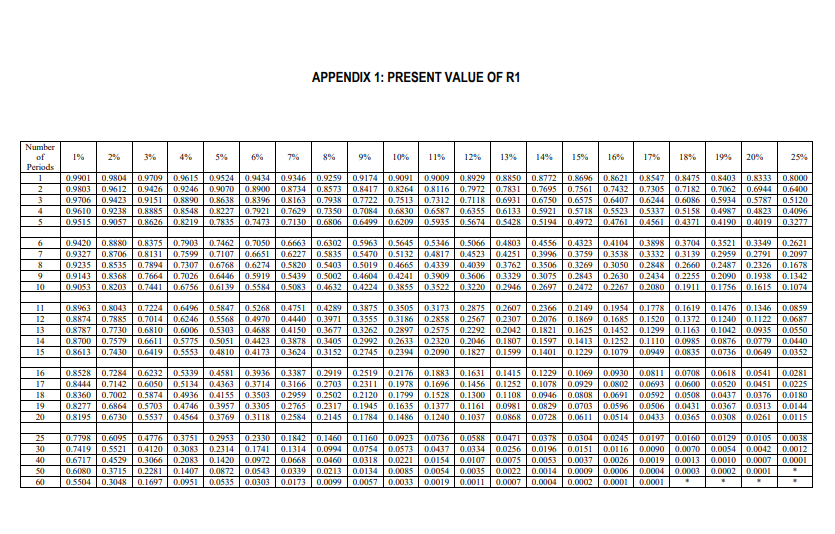

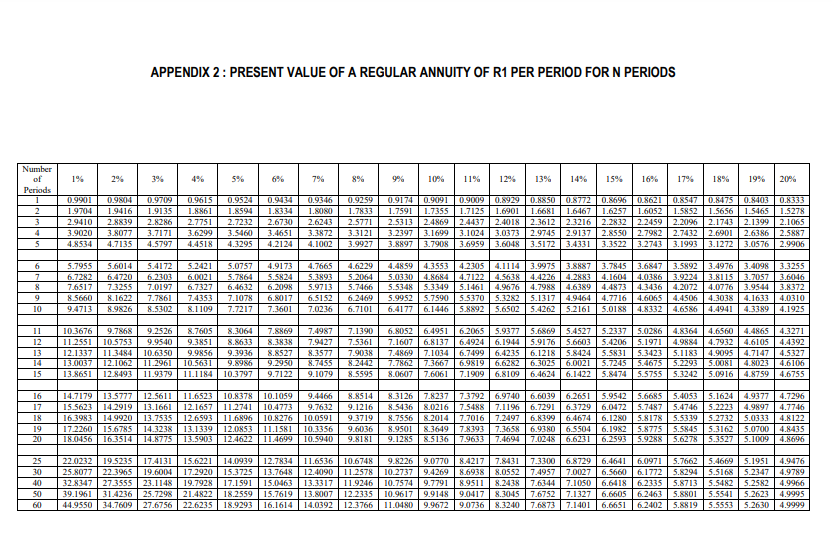

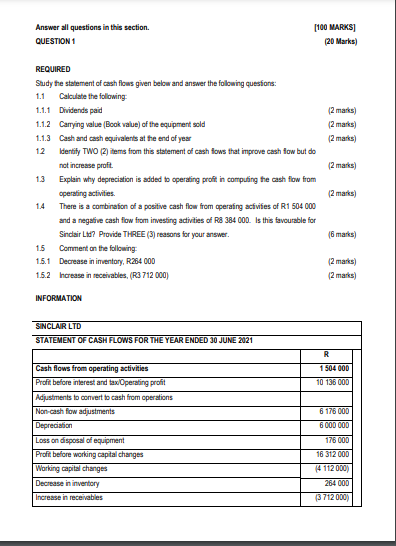

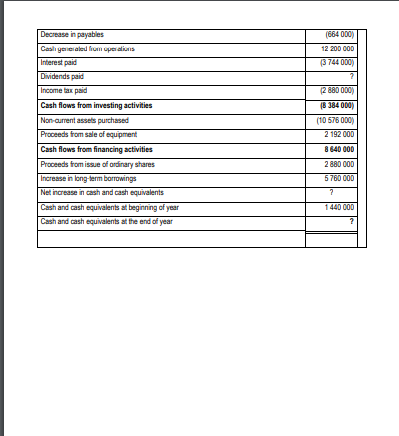

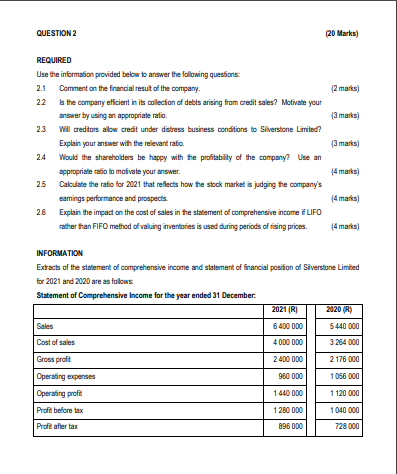

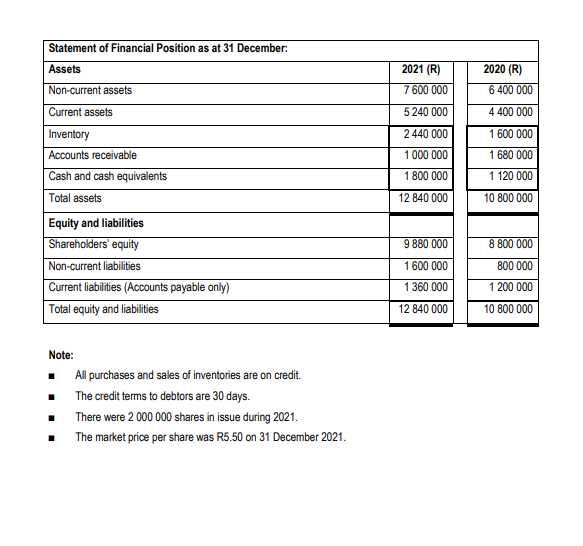

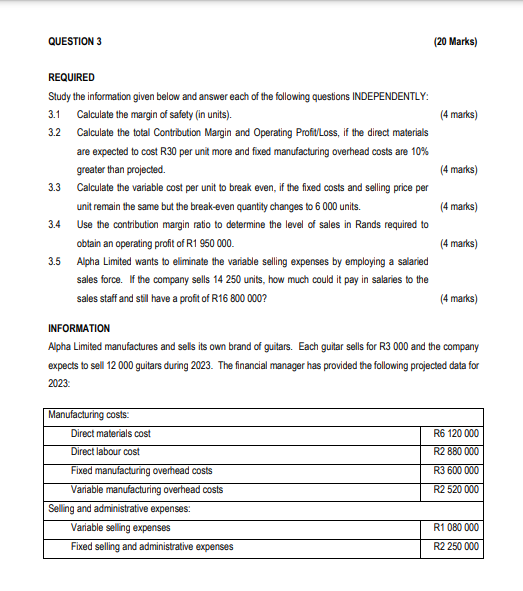

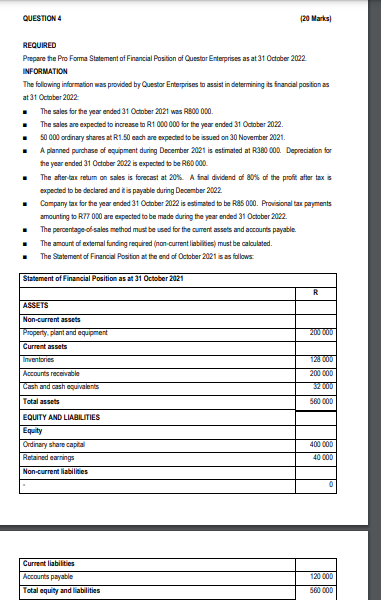

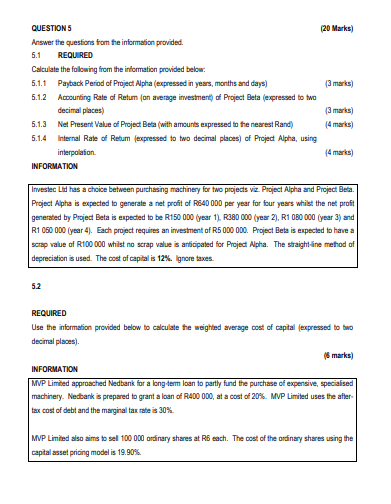

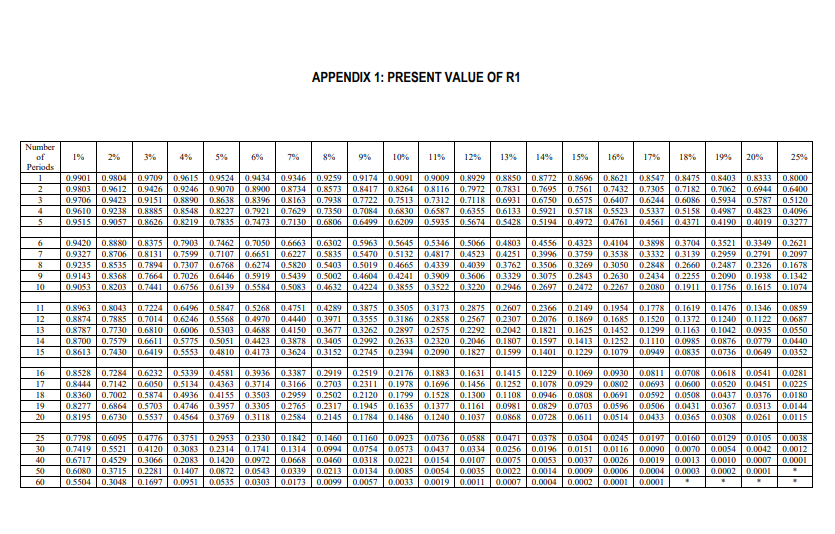

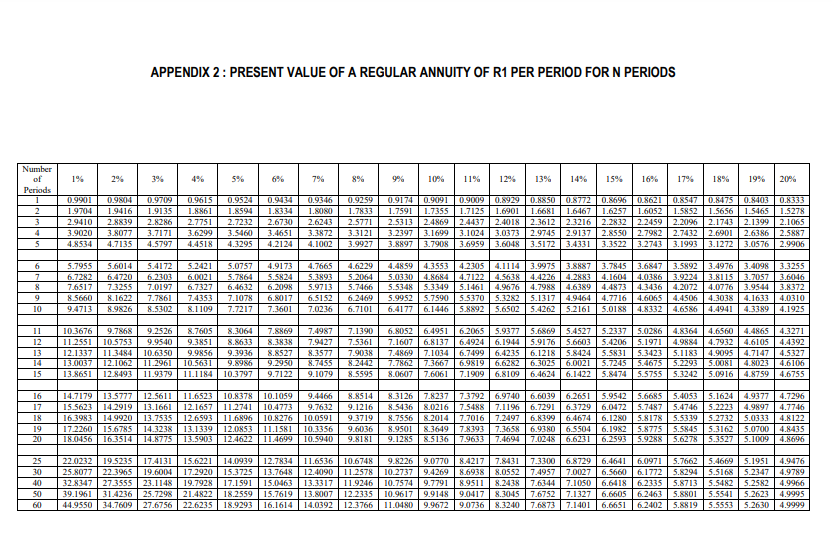

Answer all questions in this section. [100 MAPoKS] QUESTION 1 (20 Marks) REQUIPED Sydy the statement of cash flows given below and answer the folowing quesfions: 1.1 Calculate the following: 1.1.1 Dividends paid (2 marks) 1.1.2 Carrying value (Book value) of the equipment sold (2 marks) 1.1.3 Cash and cash equivalents at the end of year (2 marks) 12 Identify TWO (2) items from this statement of cash fows that improve cash fow but do not increase pruft. (2 marks) 1.3 Explain why depreciation is added to operating profi, in campuing the cash fow from operafing activities. (2 marks) 1.4 There is a combinafon of a positive cash flow from operaing acfivies of R1 504000 and a negative cash fow from irvesting adivities of PB 384000 . Is this favourable for Sindair Ltd? Pruvide THREE (3) reasons for your answer. (6 marks) 1.5 Comment on the following: 1.5.1 Decrease in imventary, R264 000 (2 marks) 1.5.2 hcrease in receivables, (R3 712 000) (2 marks) INFOPUATIDN SiNCLAR LTD STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 30 JUNE 2021 \begin{tabular}{|l|r|} \hline Decrease in payables & (664000) \\ \hline Cash yenieialed fiom ope diuns & 12200000 \\ \hline Interest paid & (3744000) \\ \hline Dividends paid & ? \\ \hline Income tax paid & (2880000) \\ \hline Cash flows from investing activities & (8384000) \\ \hline Non-arrent assets purchased & (10576000) \\ \hline Proceeds fom sale of equipment: & 2192000 \\ \hline Cash flows from financing activities & 840000 \\ \hline Proceeds fom issue of arfinary shares & 2880000 \\ \hline Increasse in long-term borrumings & 5760000 \\ \hline Net increase in cash and cash equivalents & ? \\ \hline Cash and cash equivalents at beginning of year & 1440000 \\ \hline Cash and cash equivalents at the end of year & ? \\ \hline & \\ \hline \end{tabular} REQUIPED Use the information provided below to answer the folowing quesions: 2.1 Comment on the francial resut of the company. (2 marks) 2.2 Is the company efficient in its mlecfion of debts arising fram credit sales? Motivate your answer by using an appropriate rafio. (3 marks) 2.3 Wil redfors alow credit under distress business condifons to Silverstone Limited? Explain your answer with the relevart ratio. (3 marks) 2.4 Would the shareholders be happy with the profitabilty of the company? Use an appropriate ratio to mofvate your answer. (4 marks) 2.5 Calculate the ratio for 2021 that reflects how the stock market is judging the company's eamings performance and prospects. (4 marks) 2.6 Explain the impact on the cost of sales in the statement of comprehensive incame if LIFO rather than FIFO method of valuing inverthries is used during periods of rising prices. (4 marks) INFOPMATION Extracts of the statement of comprehensive income and statement of francial posifon of Slverstone Limd for 2021 and 2020 are as follows Statement of Comprehensive income for the year ended 31 December: Note: - All purchases and sales of inventories are on credit. - The credit terms to debtors are 30 days. - There were 2000000 shares in issue during 2021. - The market price per share was R5.50 on 31 December 2021. REQUIRED Study the information given below and answer each of the following questions INDEPENDENTLY: 3.1 Calculate the margin of safety (in units). (4 marks) 3.2 Calculate the total Contribution Margin and Operating ProfitLoss, if the direct materials are expected to cost R30 per unit more and fixed manufacturing overhead costs are 10% greater than projected. (4 marks) 3.3 Calculate the variable cost per unit to break even, if the fixed costs and selling price per unit remain the same but the break-even quantity changes to 6000 units. (4 marks) 3.4 Use the contribution margin ratio to determine the level of sales in Rands required to obtain an operating profit of R1 950000 . (4 marks) 3.5 Alpha Limited wants to eliminate the variable selling expenses by employing a salaried sales force. If the company sells 14250 units, how much could it pay in salaries to the sales staff and still have a profit of R16 800000 ? (4 marks) INFORMATION Alpha Limited manufactures and sels its own brand of guitars. Each guitar sells for R3 000 and the company expects to sell 12000 guitars during 2023. The financial manager has provided the following projected data for 2023: REQUIRED Prepare the Pro Forma Statement of Financial Pasition of Cuestor Enterprises as at 31 Oddoes 2022. INFORMATION The following information was provided by Questor Enterprises to assist in determining is financial postion as at 31 October 2002 - The sales for the year ended 31 Odaber 2021 was R500 030. - The sales are expected to increase to R1 000000 for the year ended 31 Odober 2022. - 50000 ordinary shares at R1.50 each are expected to be issued on 30 November 2021. - A planned purchase of equipment during December 2021 is estimated at Ra80 000 . Depreciation for the year ended 31 Octaber 2022 is expected to be R60 000 . The affertax retum on sales is forecast at 20%. A final dividend of 80% of the profit after tax is expected to be declared and ti is payable during December 2022. - Company tax for the year ended 31 Odober 2022 is essimated to be Pas 050 . Provisional tax payments amounting to RT7 050 are expected to be made during the year ended 31 Octaber 2022. - The percentage of sales method must be used for the current assets and accounts payable. - The anount of external funding required (inon-current labites) must be caloulated. The Satement of Financial Position at the end of October 2021 is as follows: QUESTION 5 (20 Marks) Answer the questions fom the information provided. 5.1 REQURED Calculate the following from the information provided below: 5.1.1 Payback Period of Praject Apha (expressed in years, months and days) (3 marks) 5.1.2 Acoounting Rate of Retum (an average imestmente) of Project Deta (expressed to two decimal places) (3 marks) 5.1.3 Net Present Value of Projed Beta (with amounts expressed to the nearest Rand) (4 marks) 5.1.4 Internal Rate of Retum (expressed to two decinal places) of Project Alpha, using interpolafon. (4 marks) INFOPMATION Irvesiec Lit has a choice between purchasing machinery for two projects viz. Project Alpha and Project Beta. Project Apha is expected to generate a net profit of P6i40 000 per year for four years whikt the net profit generated by Project Beta is eapeded to be R150 000 (year 1). R380 000 (year 2), R1 080000 (year 3) and R1 060000 (year 4). Each project requies an imestment of R5 000000 . Project Beta is eapected to have a scrap value of R100 000 whilst no scrap value is anticipated for Projed Apha. The strightlline method of depreciation is used. The cost of capital is 12%. Ignore taxes. 52 REQUIPED Use the information provided below to calculate the weighted average cost of capial fexpressed to two decimal places). (5 marks) INFOPMATION MVP Limed appruached Nedbank for a longterm loan to partly fund the purchase of expensive, speciaised machinery. Nedbark is prepared to grant a loan of RA00 000, at a cost of 20%. MVP Limited uses the affertax cost of debt and the marginal tax rate is 30%. MNP Limied also aims to sel 100000 ardinary shares at R6 each. The cost of the ordinary shares using the capial asset pricing model is 19.90%. APPENDIX 1: PRESENT VALUE OF R1 APPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS