Answered step by step

Verified Expert Solution

Question

1 Approved Answer

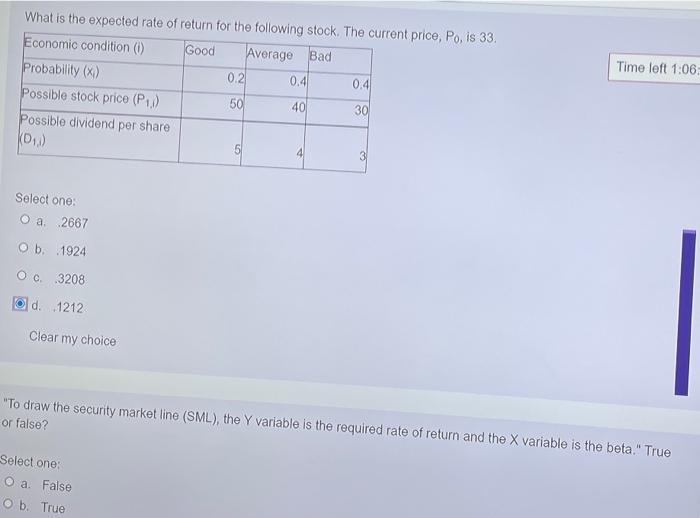

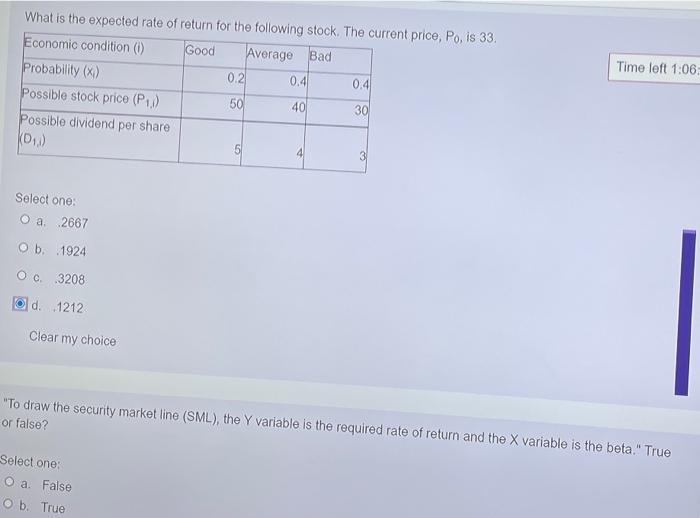

answer all questions or dont answer at all please Time left 1:06 What is the expected rate of return for the following stock. The current

answer all questions or dont answer at all please

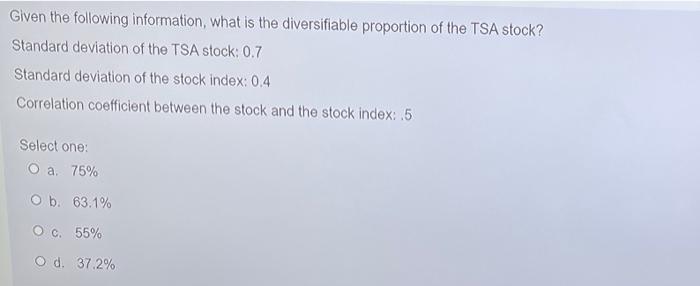

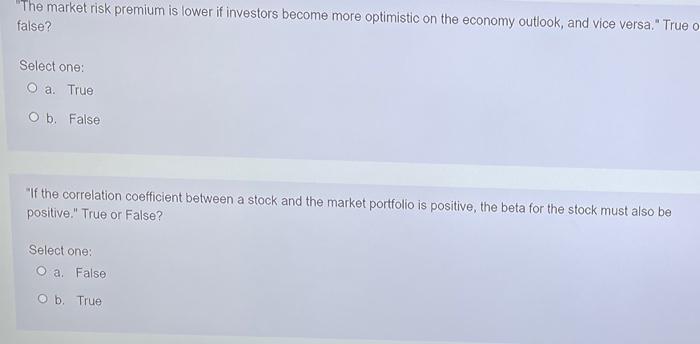

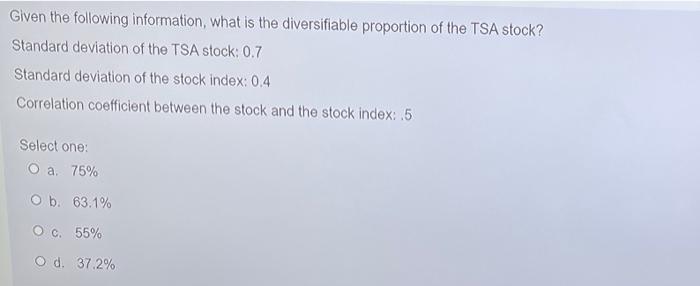

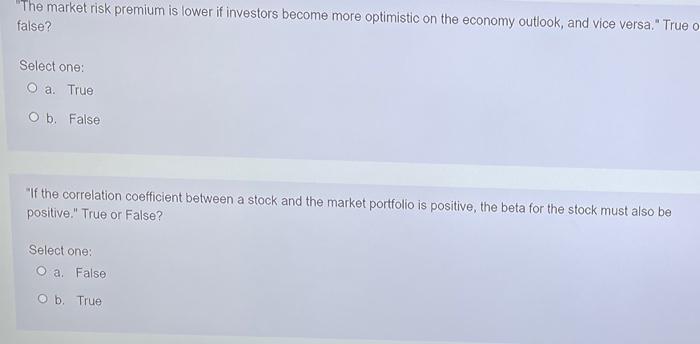

Time left 1:06 What is the expected rate of return for the following stock. The current price, Po, is 33. Economic condition (1) Good Average Bad Probability (x) 0.2 0.4 0.4 Possible stock price (P.) 50 40 30 Possible dividend per share 013) 4 5 3 Select one: O a 2667 Ob. 1924 Oc. 3208 Od. 1212 Clear my choice "To draw the security market line (SML), the Y variable is the required rate of return and the X variable is the beta." True or false? Select one: O a False O b. True Given the following information, what is the diversifiable proportion of the TSA stock? Standard deviation of the TSA stock: 0.7 Standard deviation of the stock index: 0.4 Correlation coefficient between the stock and the stock index: 5 Select one: O a 75% Ob 63.1% O c. 55% O d. 37.2% "The market risk premium is lower if investors become more optimistic on the economy outlook, and vice versa." True o false? Select one: O a. True Ob. False "If the correlation coefficient between a stock and the market portfolio is positive, the beta for the stock must also be positive." True or False? Select one: O a False Ob. True

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started