Answered step by step

Verified Expert Solution

Question

1 Approved Answer

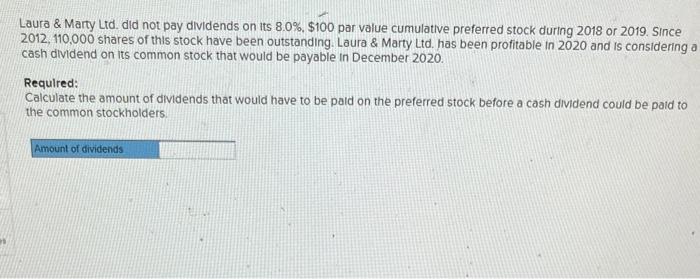

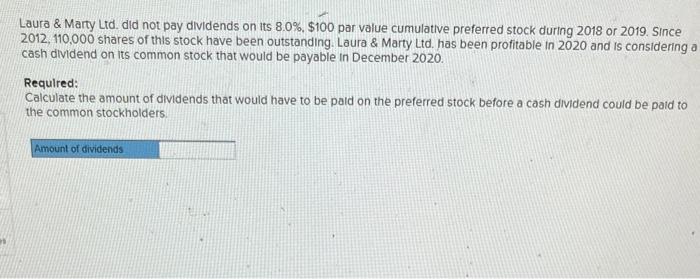

answer all questions or thumbs down Laura & Marty Lid. did not pay dividends on its 8.0%.$100 par value cumulative preferred stock during 2018 or

answer all questions or thumbs down

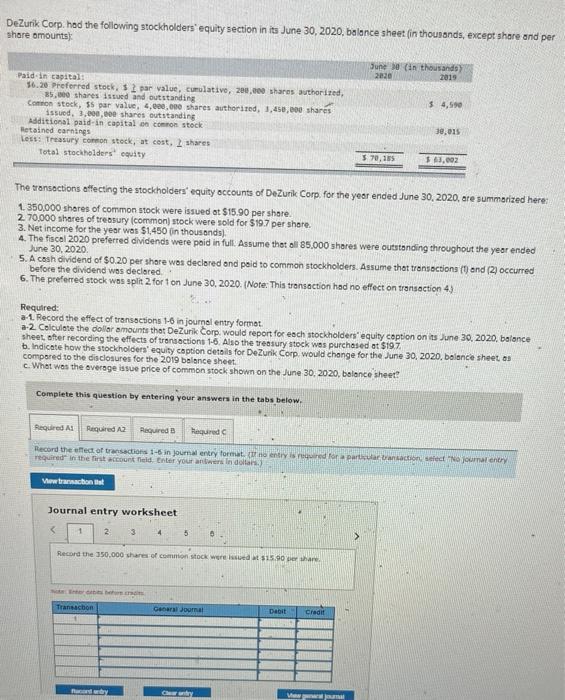

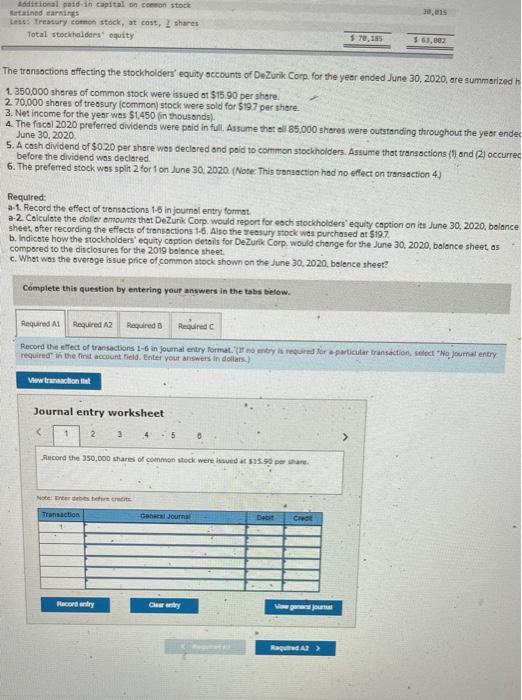

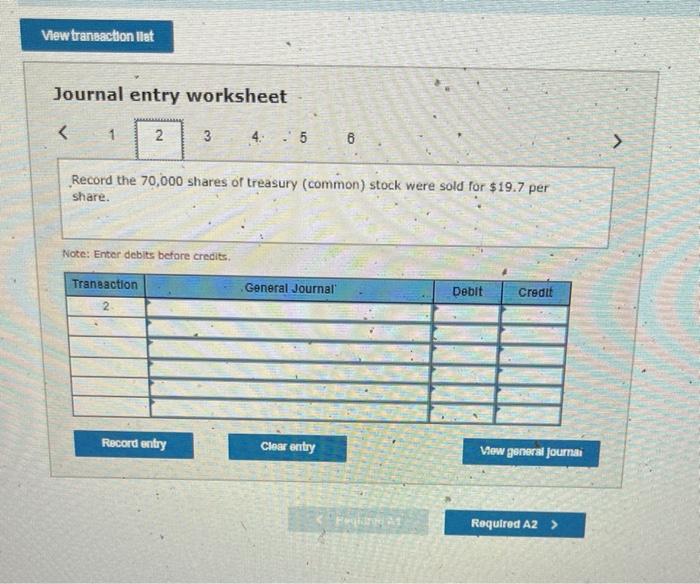

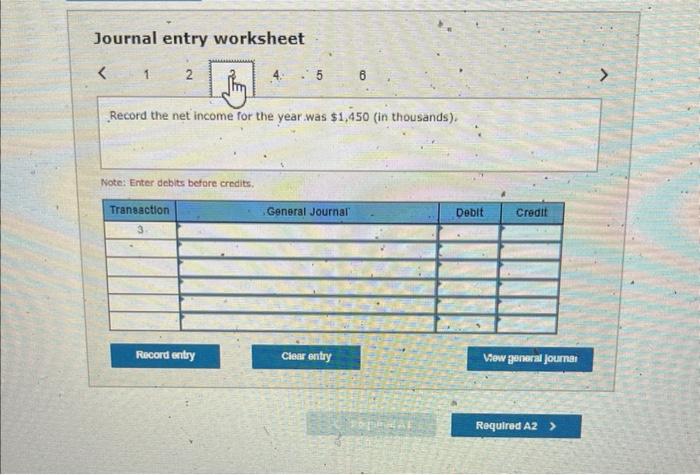

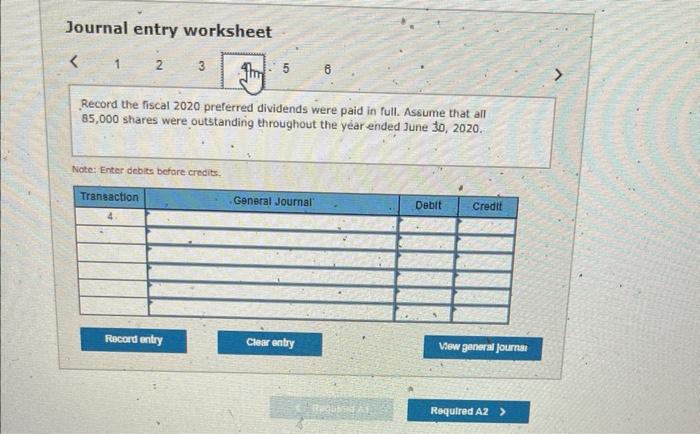

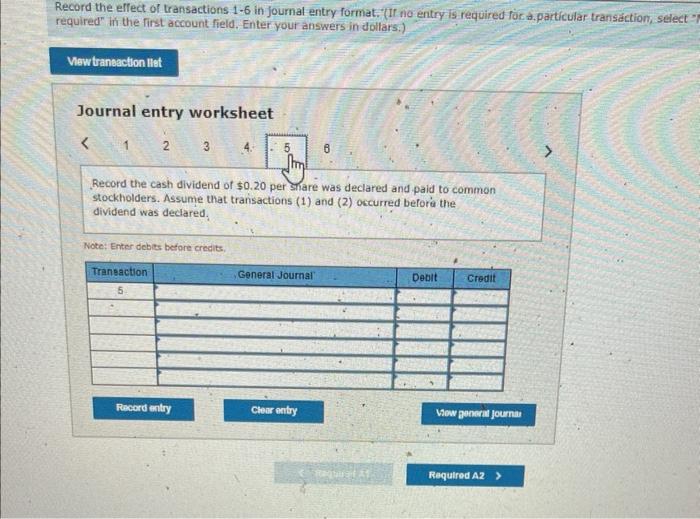

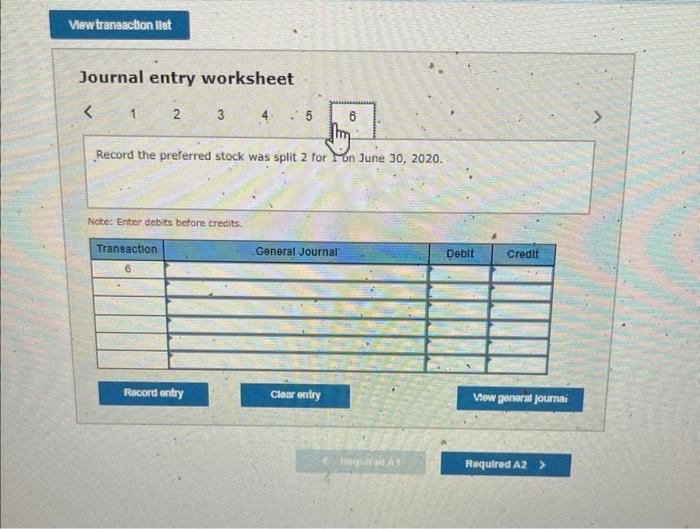

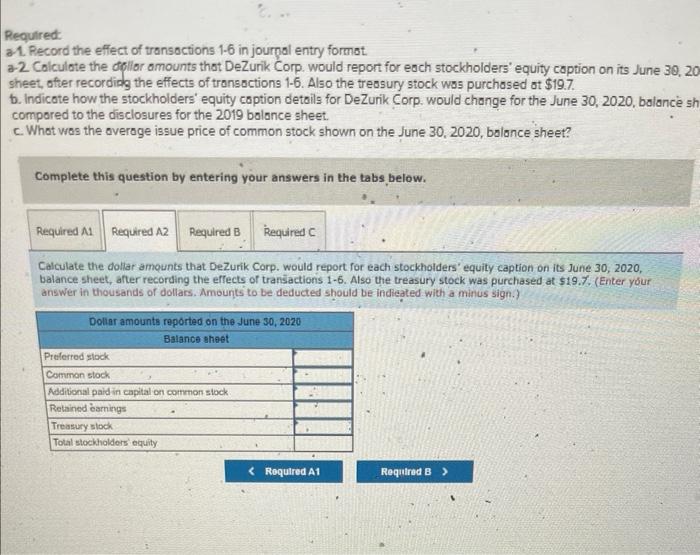

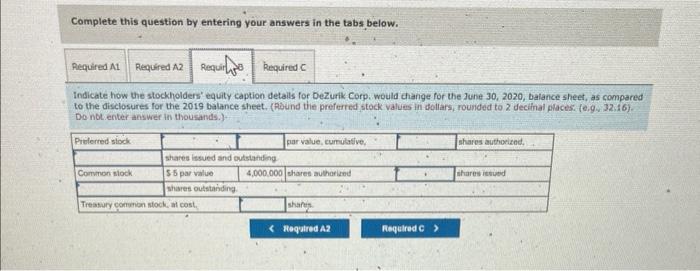

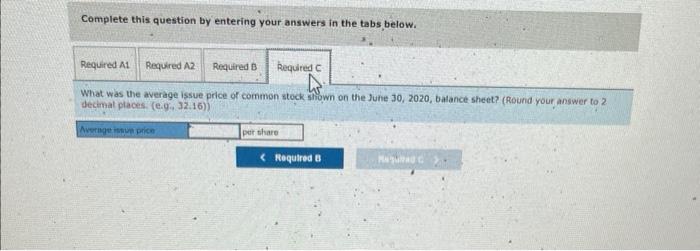

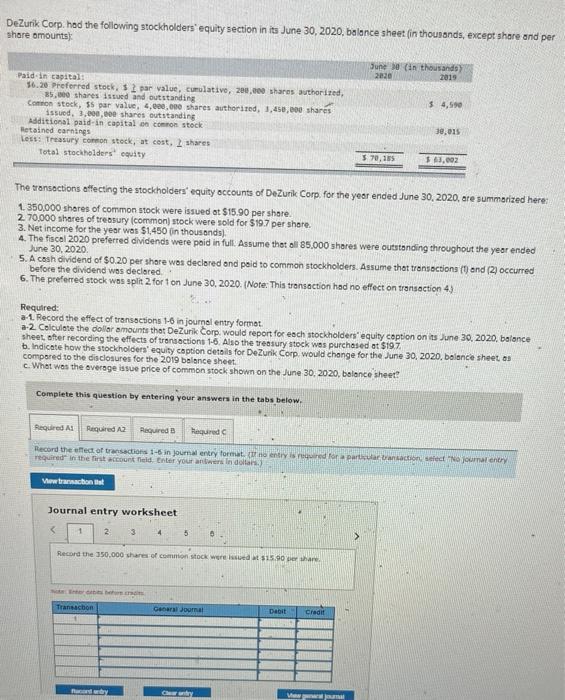

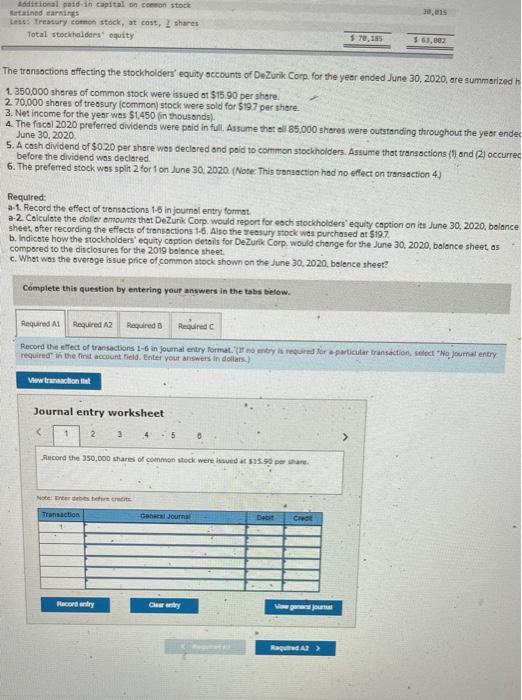

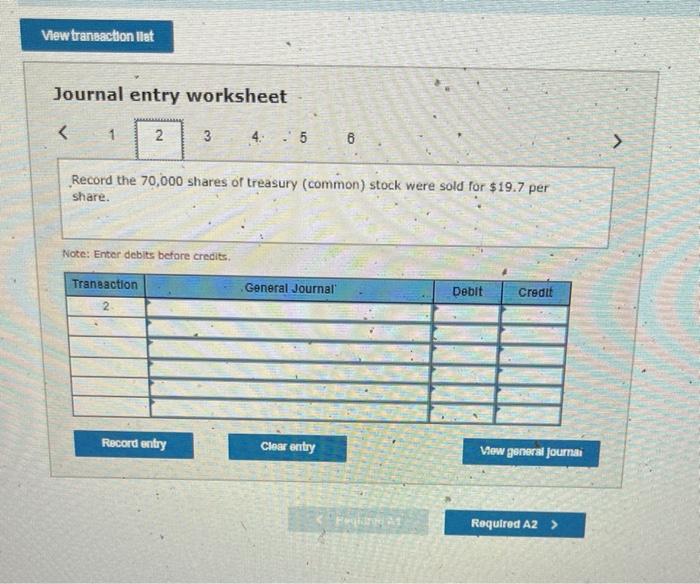

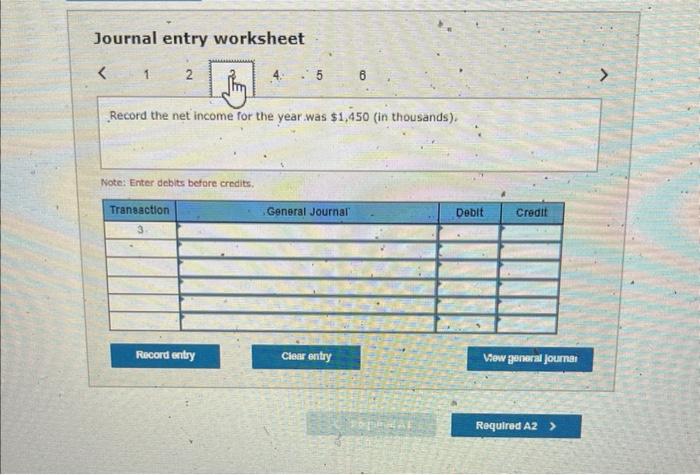

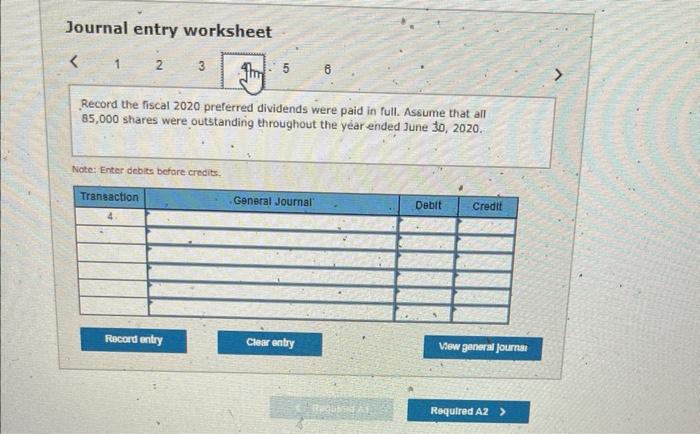

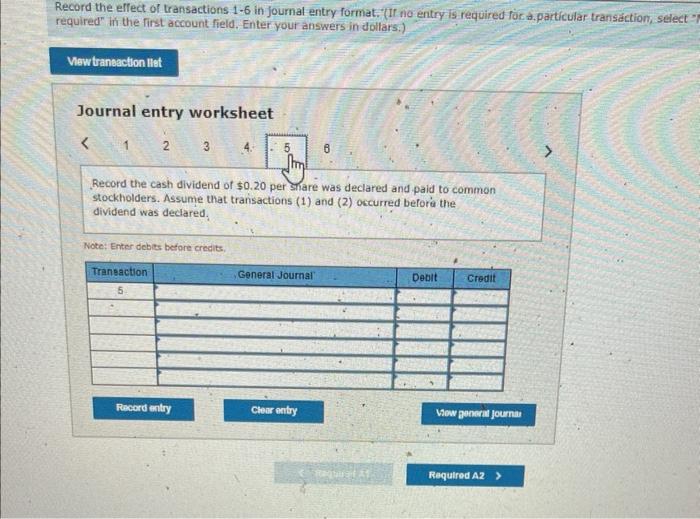

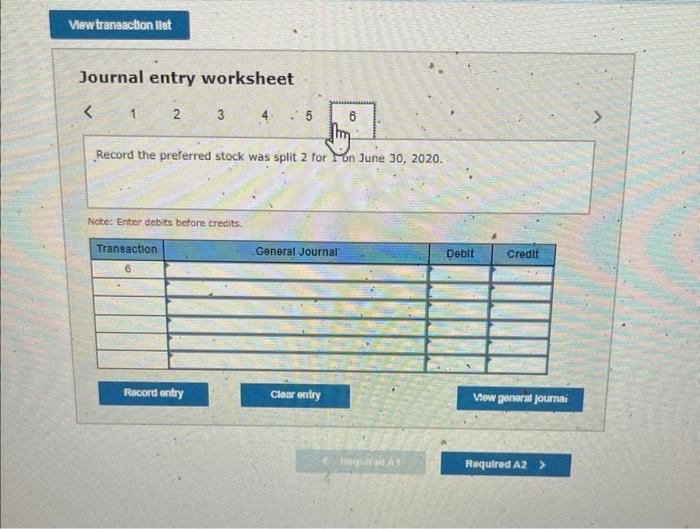

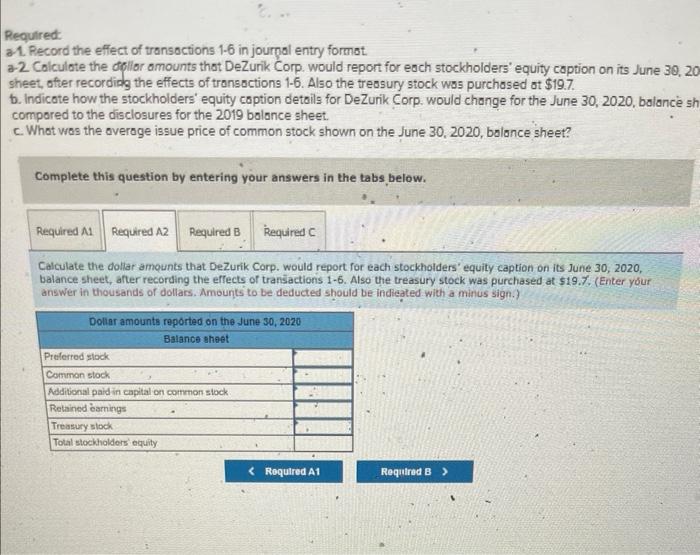

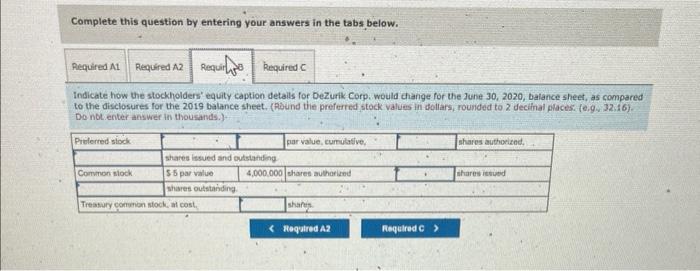

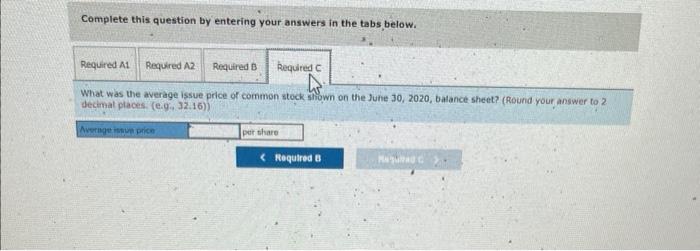

Laura \& Marty Lid. did not pay dividends on its 8.0%.$100 par value cumulative preferred stock during 2018 or 2019 . Since 2012,110,000 shares of this stock have been outstanding. Laura \& Marty Ltd. has been profitable in 2020 and is considering a cash dividend on its common stock that would be payable in December 2020. Required: Calculate the amount of dividends that would have to be paid on the preferred stock before a cash dividend couid be paid to the common stockholders. DeZurik Corp. had the following stockholders' equity section in its June 30, 2020, balonce sheet (in thounands, exicept share and per? shore ortounts)? The transoctions affecting the stockholders" equity occounts of Dezuric Corp. for the yeor ended June 30,2020 , are summarized here: 1. 350.000 shares of common stock were issued ot $15.90 per share. 2. 70.000 wheres of treosury (common) stock were sold for $19.7 per share. 3. Net income for the year was $1,450 (in thous onds). 4. The fiscol 2020 preferted dividends were poid in full. Assume thot oll 85.000 shares were outstanding throughout the yeor ended hune 30, 2020. 5. A cosh cividend of $0.20 per share was declored and paid to common stockholders. Assume thet tronsoctions (t) and (2) occurred before the dividend was declared. 6. The preferred stock was split 2 for 1 on June 30, 2020. (Nore: This transaction had no effect on tranisoction 4.3. Requlfed: a-1. Pecord the effect of transsctions 1.6 in journel entry formot. a-2. Coliculate the dollar amounts thot DeZurik Corp. would report for esch stochholders" equity coption on is Jume 30,2020 , baisnce sheet, titer recording the effects of transoctions 1.6. Also the treasury stock was purchosed at $197. b. Indicate how the stockholders' equity coption detoils for DeZurik Corp. would change for the June 30, 2020 . bolltnce sheet as: compored to the dis closures for the 2019 bolance sheet. c. Whst was the overage issue price of common stock shown on the June 30,2020 , bolance sheet? Complete this question by entering your answers in the tabs below. required in the first acrourit neid. tinter your anbwers ln dotate.) Journal entry worksheet The transoctions affecting the stockholders' equity sccounts of DeZurik Corp. for the yesr ended June 30, 2020, are summorized h 1. 350,000 sheres of common stock were issued at $15.90 per share. 2.70.000 shares of treosury (common) stock were sold for $193 per shere. 3. Net income for the yeor was $1,450 (in thousonds). 4. The focti 2020 preferted dividends were psid in full. Assume that al 85,000 sheres were outstanding throughout the year endec June 30,2020 5. A cosh dividend of $0.20 per share wos declared and poid to common stockholders. Assuime that transoctions (t) and (2) occurrec before the dividend was declored. 6. The preferred stock was split 2 for 1 on zune 30. 2020. (Nose: This tronasction had no effect on transaction 4) Reciulred: a-1. Record the effect of tronsocsons 16 in joums entry format. a-2. Coiculote the dolior amounts that DeZurik Corp. would report for eoch stockholders' equity coption on its June 30, 2020, bolance sheet, ster recording the effects of transactiona 1.6, Also the zeasury stock wal purchased ot 519.7. b. Indicote how the stockholders' equity coption detsis for DeZuric Corp would chenge for the June 30, 2020, balence sheet, as compored to the disclosures for the 2019 baience sheet. c. What was the overoge issue price of common atock shown on the June 30,2020, belance sheet? Complete this question by entering your answers in the tabs below. required" in the finst account field. Enter your arwsers in dollars.) Journal entry worksheet Fecord the 350,000 whare of cointran stock wert isued of s13.52 per share. Node: Trene tobits tedpe duerts. Journal entry worksheet 4. :5 6 Record the 70,000 shares of treasury (common) stock were sold for $19.7 per share. Note: Enter deblits before credits. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started