Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all questions please Fraser, Ormiston 11e, Self-Study Quiz Question 1 Why should an individual learn to read and interpret financial statements? a Individuals cannot

Answer all questions please

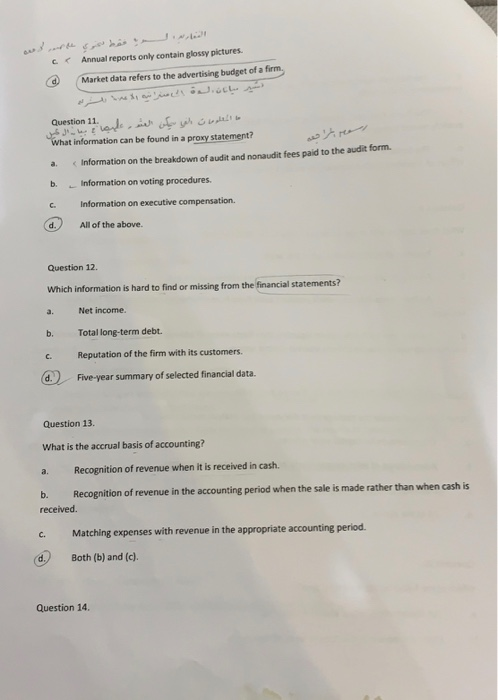

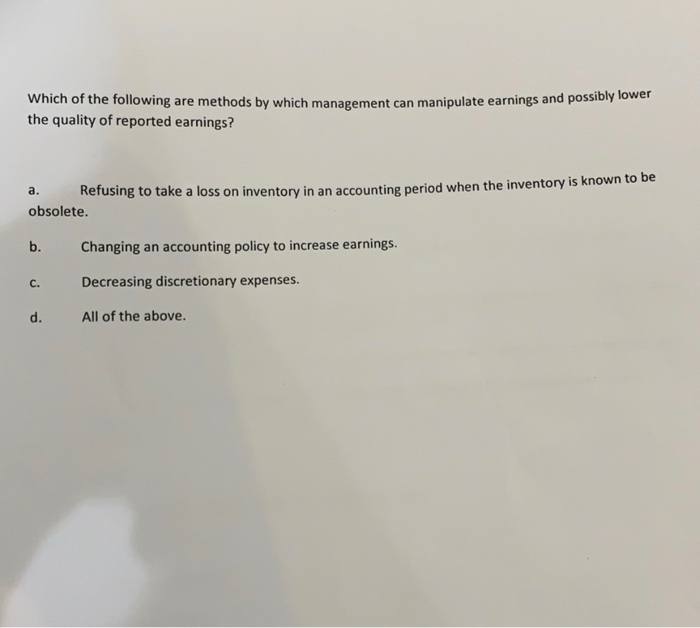

Fraser, Ormiston 11e, Self-Study Quiz Question 1 Why should an individual learn to read and interpret financial statements? a Individuals cannot necessarily rely on auditors and management of firms to offer honest information about the financial well-being of firms. b. An individual need not learn to read and interpret financial statements because auditors offer a report indicating whether the company is financially sound or not. c. Learning to read and interpret financial statements will enable individuals to gain employment. Understanding financial statements will guarantee at least a 20% return on investments. d. Question 2. Which of the following organizations write accounting rules? a. SOX, SEC, and IASB. b) C. d. FASB, SEC, and IASB. FASB and Congress. EDGAR and IASB. Question 3. What is the goal of the IASB? To work with the SEC to create a set of accounting rules for publicly held companies. b. To create a set of accounting rules that Europe and the United States will follow. To create a set of accounting rules for countries other than the United States. d) To have worldwide acceptance of a set of international financial reporting standards Question 4 What are the basic financial statements provided in an annual report? Balance sheet, income statement, statement of cash flows, and statement of stockholders equity. b. Balance sheet and income statement. Statement of financial earnings and statement of stockholders' equity. d. Balance sheet, income statement, and statement of cash flows. - What items are included in the notes to the financial statements? Detail about particular accounts. b. Summary of accounting policies. Changes in accounting policies, if any. All of the above Question 6. sw t What does an unqualified auditor's report indicate? a. Certain managers within the firm are unqualified and, as such, are not fairly or adequately representing the interests of the shareholders. b. The financial statements present fairly the financial position, the results of operations, and the changes in cash flows for the company. There are certain factors that might impair the firm's ability to continue as a going concern. d. The financial statements unfairly and inaccurately present the company's financial position for the accounting period. Question 7. Which of the following statements is false? a. The Sarbanes-Oxley Act of 2002 was the cause of the demise of Enron. . The Norwalk Agreement in 2002 was a result of the FASB and IASB agreeing to work toward a convergence of standards. The Public Company Accounting Oversight Board is responsible for monitoring auditors of all publicly owned companies. d. The Sarbanes-Oxley Act of 2002 requires the chief executive officer and the chief financial officer of a publicly traded company to certify the accuracy of the financial statements. Question 8. What does Section 404 of the Sarbanes-Oxley Act of 2002 require? a. Rotation of audit partners every five years. b. A ten-year jail sentence and $1 million fine for violations of the act. C Auditor independence, which prohibits audit firms from offering any services other than audit services. d. A statement by the company regarding the effectiveness of internal controls and a disclosure of any material weaknesses in a firm's internal control system ,9 Question What subject(s) should the management discussion and analysis section discuss? a , Commitments for capital expenditures b. A breakdown of sales increases into price and volume components. It Liquidity. d. All of the above. Question 10 Which of the following statements is true? The shareholders' letter should be ignored. a. b. Public relations material should be used cautiously. Annual reports only contain glossy pictures. Market data refers to the advertising budget of a firm, What information can be found in a proxy statement? a Information on the breakdown of audit and nonaudit fees paid to the audit form. b. Information on voting procedures. Information on executive compensation. C. d. All of the above. Question 12. Which information is hard to find or missing from the financial statements? Net income. b. Total long-term debt. c. Reputation of the firm with its customers. d. Five-year summary of selected financial data. Question 13. What is the accrual basis of accounting? a. Recognition of revenue when it is received in cash. b. Recognition of revenue in the accounting period when the sale is made rather than when cash is received Matching expenses with revenue in the appropriate accounting period. d. Both (b) and (c) Question 14. Which of the following are methods by which management can manipulate earnings and pos the quality of reported earnings? a. Refusing to take a loss on inventory in an accounting period when the inventory is known to be obsolete. Changing an accounting policy to increase earnings. C. Decreasing discretionary expenses. All of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started