Answer ALL questions please. I really need to get the correct solutions for the questions below. thank you!!!

Please let me know if this pictures are more clear, thank you and sorry about that!

Please help and let me know if images are unclear. Answer ALL questions please!

Omg its not a quiz or test!!!! This is homework and I am trying to get help since thats why I pay for CHEGG to get hw help. This is pathetic. I just need help solving those problems ^^^^ so please answer them.

Help

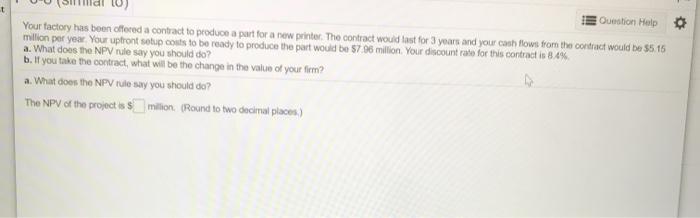

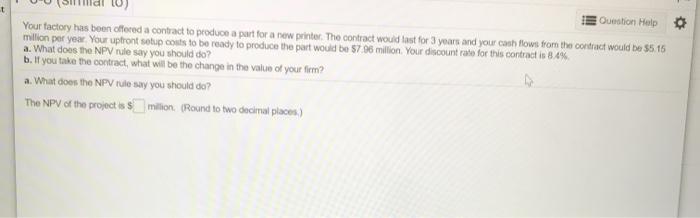

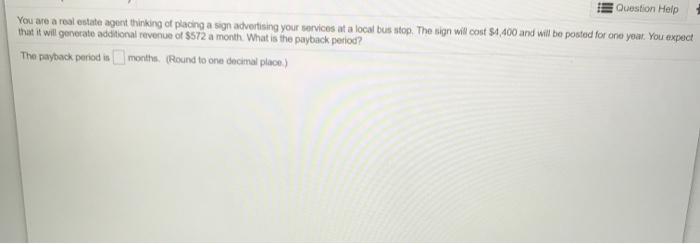

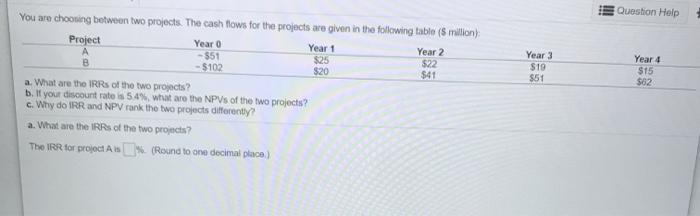

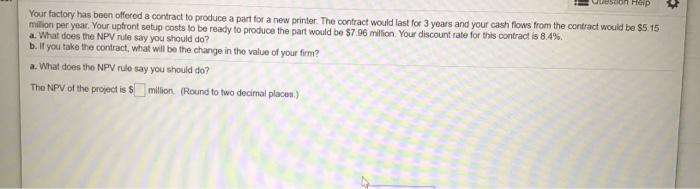

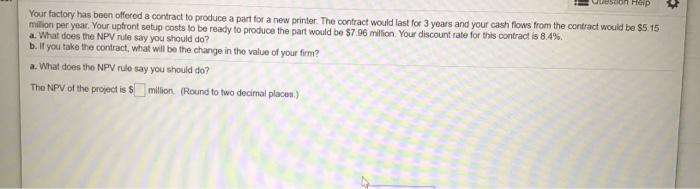

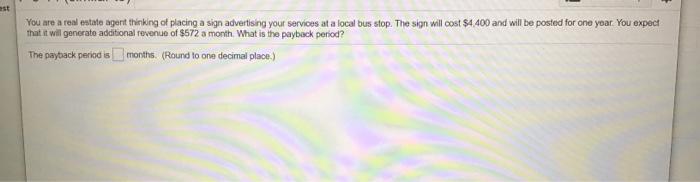

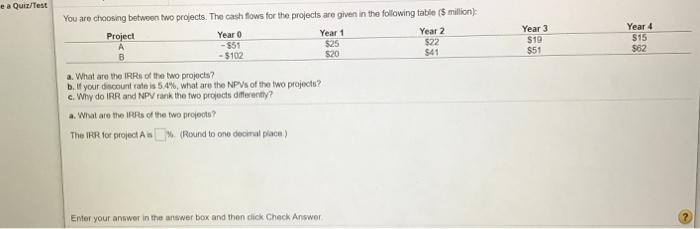

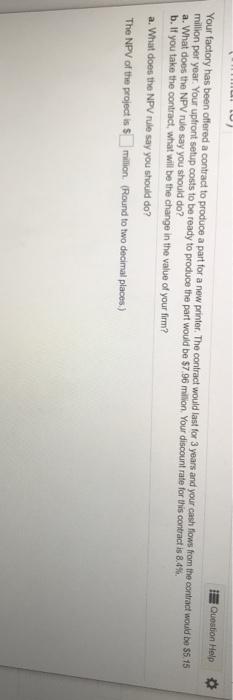

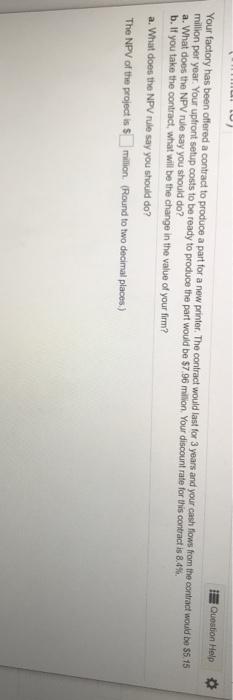

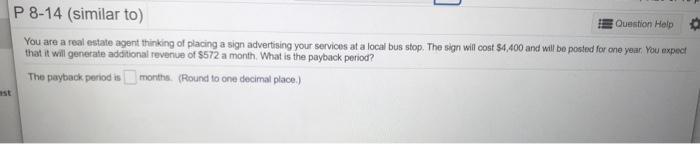

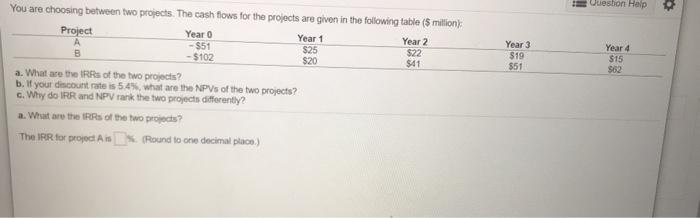

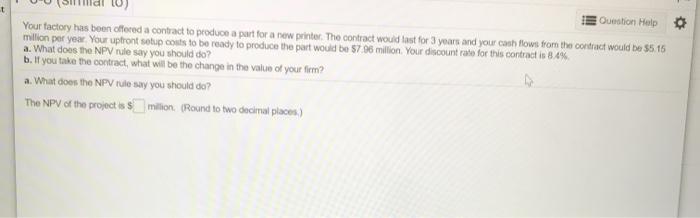

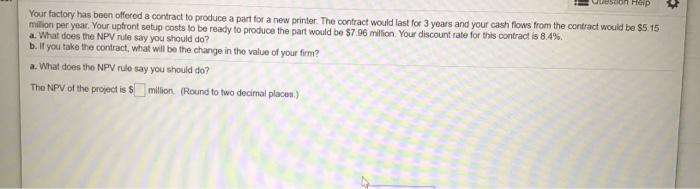

Your factory has been offered a contract to produce a part for a new print. The contact for you and your chow from the cost out to be Tady to produce the part would be $700 milion your discount for this contact a. What does the NPV say you should do? ts. you to the contract, what will be the change in the value of your fom? a. What does the NPV tu say you should do The NPV of the project is _millon (Round to two decimal places) You are long lang ang your servis a local bus o The 800 le posted for one year wil 572 month What is the bed The produce decimal place) Year 2 57 $61 Year 599 Year $15 You are choosing between two projects. The cash flows for the projects are given in the following table 5 milion Project Year Year 1 -551 $25 $102 $20 a. What are the IRRs of the two projects? b. If your discount rate is 54% what are the NPVs of the two projects? c. Why do IRR and NPV tank the two projects different a. What are the is at the two project? The IRR for project is Round to one omal poo) t E Question Help Your factory has been offered a contract to produce a part for a new pinter. The contract would last for 3 years and your cash flows from the contract would be $515 million per year Your uptront setup costs to be ready to produce the part would be 57 96 million. Your discount rate for this contract is 8.4% b. If you take the contract, what will be the change in the value of your fem? a. What does the NPV tule say you should do? The NPV of the projects smilion (Round to two decimal places) Question Help You are a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $4,400 and will be posted for one year. You expect that it will generate additional revenue of $572 a month. What is the payback period? The payback period is months. (Round to one decimal place) Question Help Year 4 Year 3 $19 $51 You are choosing between two projects. The cash flows for the projects are given in the following tablo (5 milion) Project Year Year 1 Year 2 - $51 $25 522 B - $102 $20 $41 a. What are the IRRs of the two projects? b. If your discount rate 5.4%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects different a. What are the IRR of the two projects? The IRR for project An (Round to one decimal place $15 $62 con op Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.15 milion per year. Your upfront setup costs to be ready to produce the part would be $7.96 million your discount rate for this contract is 8.4% a. What does the NPV nie say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million (Round to two decimal placus.) You nre a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $4.400 and will be posted for one year. You expect that it will generate additional revenue of $572 a month. What is the payback period? The paytack period is months. (Round to one decimal place) e a Quix/Test You are choosing between two projects. The cash flows for the projects are given in the following table ($ million Project Year Year 1 Year 2 - $51 $25 $22 - $102 520 Year 3 $19 $51 Year 4 S15 $62 a. What are the IRR of the two projects? b. If your discount rate is 54%, what are the NPVs of the two projects? c. Why do IRR and NPV tank the two projects differently? a. What are the IRR of the two projects? The IRR for project is Round to ono decimal plan) Enter your answer in the answer box and then click Check Answer Question Help Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $515 million per year. Your upfront setup costs to be ready to produce the part would be $796 million your discount rate for this contract is 8.4% a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million (Round to two decimal places) P 8-14 (similar to) Question Help You are a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $4,400 and will be posted for one year You expect that it will generate additional revenue of $572 a month. What is the payback period? The pwyback period as montre. (Round to one decimal place.) !! Uuestion Help Year 3 $19 $51 You are choosing between two projects. The cash flows for the projects are given in the following table ($ million) Project Year 0 Year 1 Year 2 - $51 $25 $22 - $102 $20 $41 a. What are the IRR of the two projects? b. If your discount rate is 5.4%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the res of the two projects? The IRR for project is I. (Round to che decimal place.) Year 4 $15 $62