Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all questions pllzz It's a real estate question, using excel and lease functions (HINT: Below each scenario, first, set up the cash flow and

answer all questions pllzz

It's a real estate question, using excel and lease functions

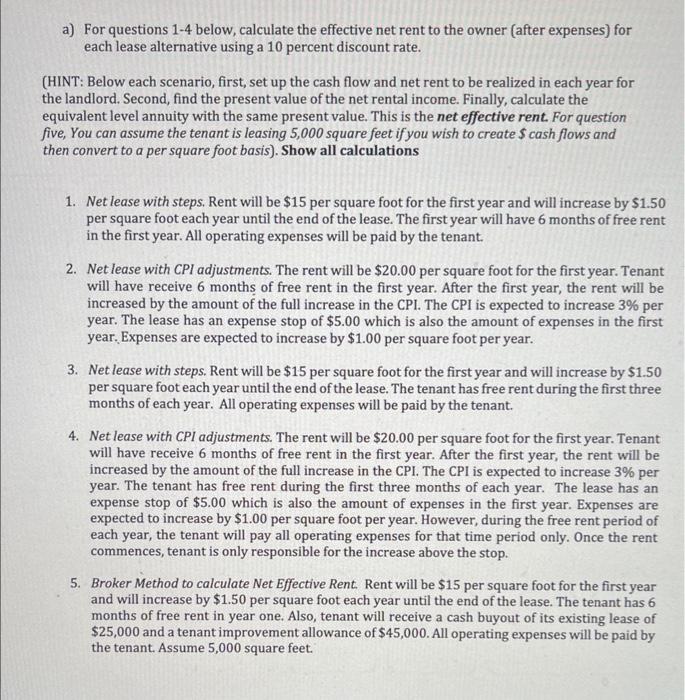

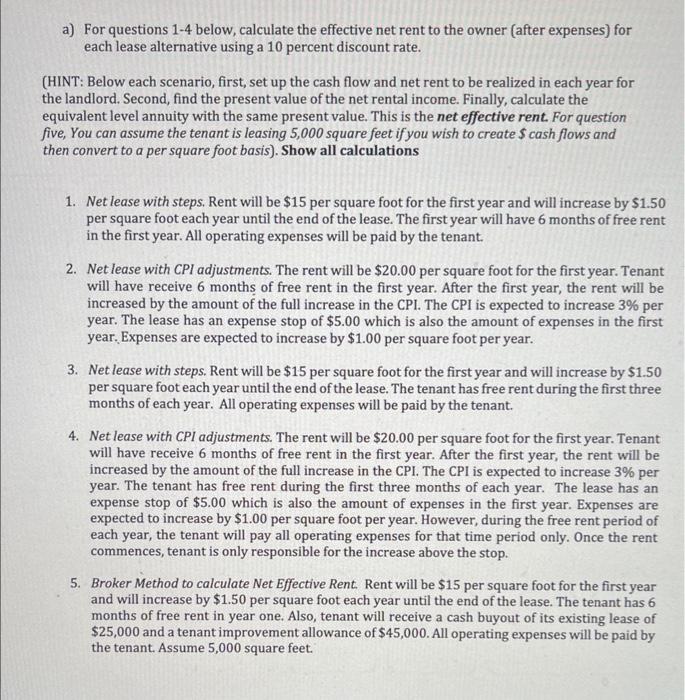

(HINT: Below each scenario, first, set up the cash flow and net rent to be realized in each year for the landlord. Second, find the present value of the net rental income. Finally, calculate the equivalent level annuity with the same present value. This is the net effective rent. For question five, You can assume the tenant is leasing 5,000 square feet if you wish to create $ cash flows and then convert to a per square foot basis). Show all calculations 1. Net lease with steps. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The first year will have 6 months of free rent in the first year. All operating expenses will be paid by the tenant. 2. Net lease with CPI adjustments. The rent will be $20.00 per square foot for the first year. Tenant will have receive 6 months of free rent in the first year. After the first year, the rent will be increased by the amount of the full increase in the CPI. The CPI is expected to increase 3% per year. The lease has an expense stop of $5.00 which is also the amount of expenses in the first year. Expenses are expected to increase by $1.00 per square foot per year. 3. Netlease with steps. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The tenant has free rent during the first three months of each year. All operating expenses will be paid by the tenant. 4. Net lease with CPI a djustments. The rent will be $20.00 per square foot for the first year. Tenant will have receive 6 months of free rent in the first year. After the first year, the rent will be increased by the amount of the full increase in the CPI. The CPI is expected to increase 3% per year. The tenant has free rent during the first three months of each year. The lease has an expense stop of $5.00 which is also the amount of expenses in the first year. Expenses are expected to increase by $1.00 per square foot per year. However, during the free rent period of each year, the tenant will pay all operating expenses for that time period only. Once the rent commences, tenant is only responsible for the increase above the stop. 5. Broker Method to calculate Net Effective Rent. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The tenant has 6 months of free rent in year one. Also, tenant will receive a cash buyout of its existing lease of $25,000 and a tenant improvement allowance of $45,000. All operating expenses will be paid by the tenant. Assume 5,000 square feet. (HINT: Below each scenario, first, set up the cash flow and net rent to be realized in each year for the landlord. Second, find the present value of the net rental income. Finally, calculate the equivalent level annuity with the same present value. This is the net effective rent. For question five, You can assume the tenant is leasing 5,000 square feet if you wish to create $ cash flows and then convert to a per square foot basis). Show all calculations 1. Net lease with steps. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The first year will have 6 months of free rent in the first year. All operating expenses will be paid by the tenant. 2. Net lease with CPI adjustments. The rent will be $20.00 per square foot for the first year. Tenant will have receive 6 months of free rent in the first year. After the first year, the rent will be increased by the amount of the full increase in the CPI. The CPI is expected to increase 3% per year. The lease has an expense stop of $5.00 which is also the amount of expenses in the first year. Expenses are expected to increase by $1.00 per square foot per year. 3. Netlease with steps. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The tenant has free rent during the first three months of each year. All operating expenses will be paid by the tenant. 4. Net lease with CPI a djustments. The rent will be $20.00 per square foot for the first year. Tenant will have receive 6 months of free rent in the first year. After the first year, the rent will be increased by the amount of the full increase in the CPI. The CPI is expected to increase 3% per year. The tenant has free rent during the first three months of each year. The lease has an expense stop of $5.00 which is also the amount of expenses in the first year. Expenses are expected to increase by $1.00 per square foot per year. However, during the free rent period of each year, the tenant will pay all operating expenses for that time period only. Once the rent commences, tenant is only responsible for the increase above the stop. 5. Broker Method to calculate Net Effective Rent. Rent will be $15 per square foot for the first year and will increase by $1.50 per square foot each year until the end of the lease. The tenant has 6 months of free rent in year one. Also, tenant will receive a cash buyout of its existing lease of $25,000 and a tenant improvement allowance of $45,000. All operating expenses will be paid by the tenant. Assume 5,000 square feet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started