Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer ALL Questions Question 1 Simon Johnson left university 6 years ago with a Bachelor's degree in Finance. Although he is contented with his

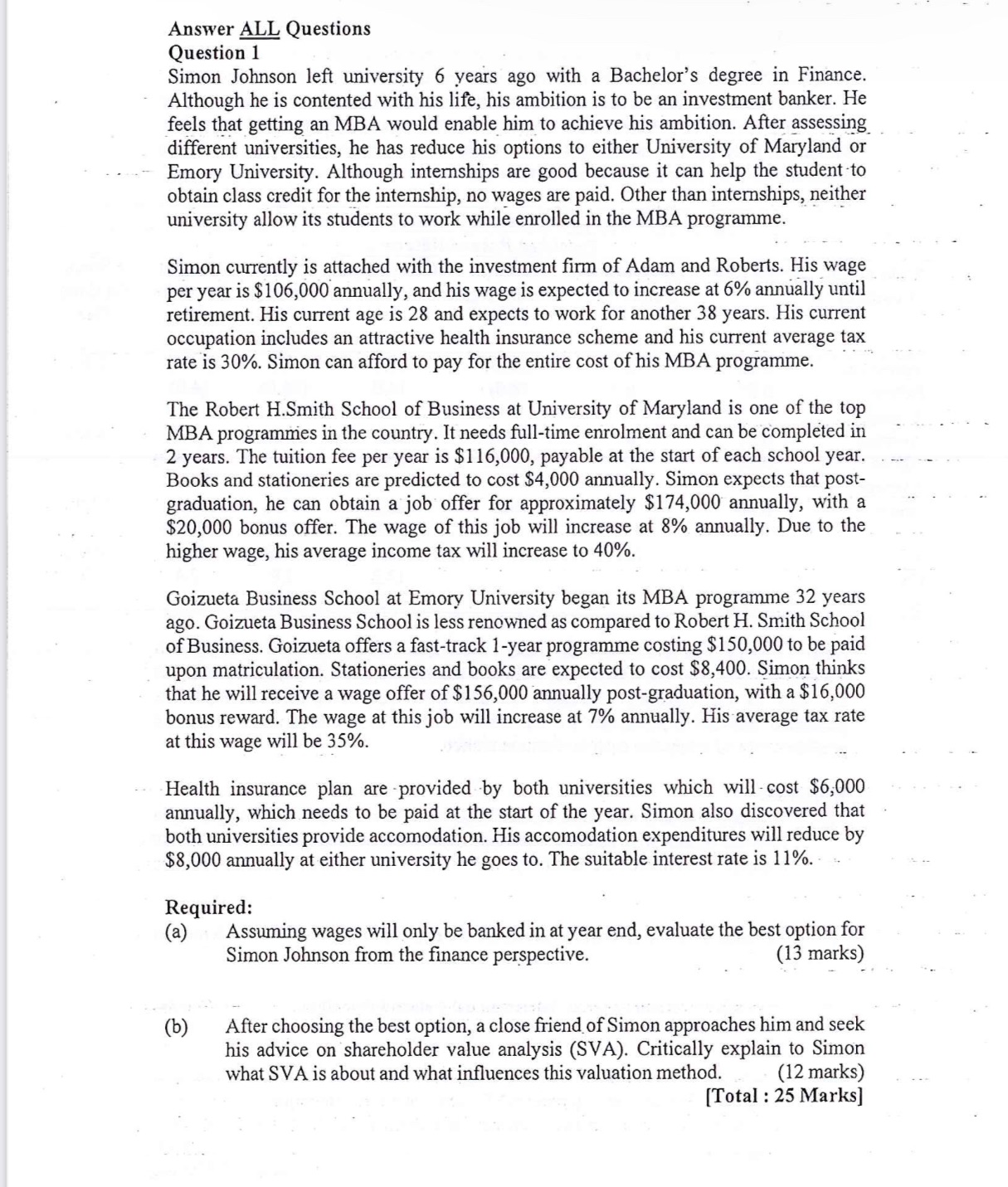

Answer ALL Questions Question 1 Simon Johnson left university 6 years ago with a Bachelor's degree in Finance. Although he is contented with his life, his ambition is to be an investment banker. He feels that getting an MBA would enable him to achieve his ambition. After assessing different universities, he has reduce his options to either University of Maryland or Emory University. Although internships are good because it can help the student to obtain class credit for the internship, no wages are paid. Other than internships, neither university allow its students to work while enrolled in the MBA programme. Simon currently is attached with the investment firm of Adam and Roberts. His wage per year is $106,000 annually, and his wage is expected to increase at 6% annually until retirement. His current age is 28 and expects to work for another 38 years. His current occupation includes an attractive health insurance scheme and his current average tax rate is 30%. Simon can afford to pay for the entire cost of his MBA programme. The Robert H.Smith School of Business at University of Maryland is one of the top MBA programmes in the country. It needs full-time enrolment and can be completed in 2 years. The tuition fee per year is $116,000, payable at the start of each school year. Books and stationeries are predicted to cost $4,000 annually. Simon expects that post- graduation, he can obtain a job offer for approximately $174,000 annually, with a $20,000 bonus offer. The wage of this job will increase at 8% annually. Due to the higher wage, his average income tax will increase to 40%. Goizueta Business School at Emory University began its MBA programme 32 years ago. Goizueta Business School is less renowned as compared to Robert H. Smith School of Business. Goizueta offers a fast-track 1-year programme costing $150,000 to be paid upon matriculation. Stationeries and books are expected to cost $8,400. Simon thinks that he will receive a wage offer of $156,000 annually post-graduation, with a $16,000 bonus reward. The wage at this job will increase at 7% annually. His average tax rate at this wage will be 35%. Health insurance plan are provided by both universities which will cost $6,000 annually, which needs to be paid at the start of the year. Simon also discovered that both universities provide accomodation. His accomodation expenditures will reduce by $8,000 annually at either university he goes to. The suitable interest rate is 11%. Required: (a) (b) Assuming wages will only be banked in at year end, evaluate the best option for Simon Johnson from the finance perspective. (13 marks) After choosing the best option, a close friend of Simon approaches him and seek his advice on shareholder value analysis (SVA). Critically explain to Simon what SVA is about and what influences this valuation method. (12 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started