Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all questions Question 1 The PSB is well established accountancy and consultancy firm that has been providing services throughout the Caribbean since the 1970s.

Answer all questions

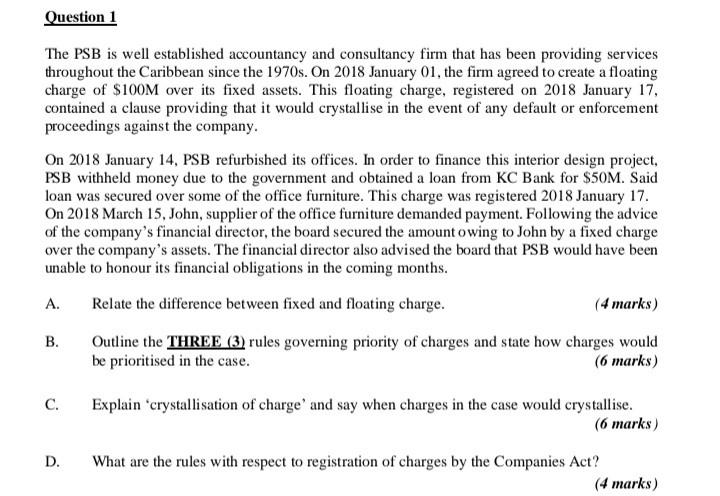

Question 1 The PSB is well established accountancy and consultancy firm that has been providing services throughout the Caribbean since the 1970s. On 2018 January 01, the firm agreed to create a floating charge of $100M over its fixed assets. This floating charge, registered on 2018 January 17, contained a clause providing that it would crystallise in the event of any default or enforcement proceedings against the company. On 2018 January 14, PSB refurbished its offices. In order to finance this interior design project, PSB withheld money due to the government and obtained a loan from KC Bank for $50M. Said loan was secured over some of the office furniture. This charge was registered 2018 January 17. On 2018 March 15, John, supplier of the office furniture demanded payment. Following the advice of the company's financial director, the board secured the amount owing to John by a fixed charge over the company's assets. The financial director also advised the board that PSB would have been unable to honour its financial obligations in the coming months. A. Relate the difference between fixed and floating charge. (4 marks) B. Outline the THREE (3) rules governing priority of charges and state how charges would be prioritised in the case. (6 marks) C. Explain "crystallisation of charge' and say when charges in the case would crystallise. (6 marks) D. What are the rules with respect to registration of charges by the Companies Act? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started