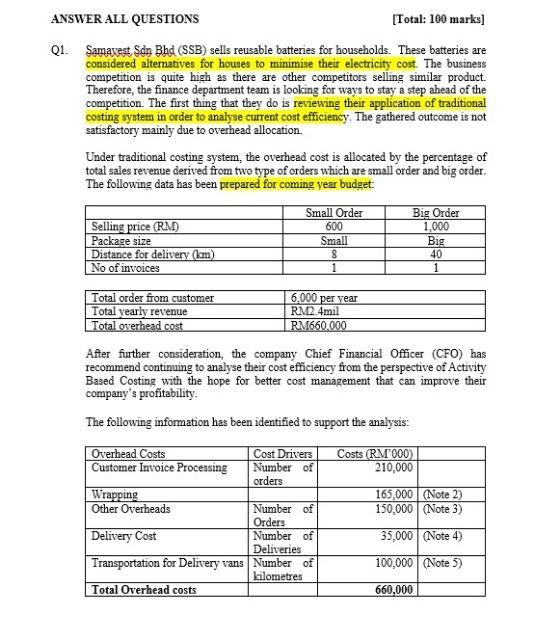

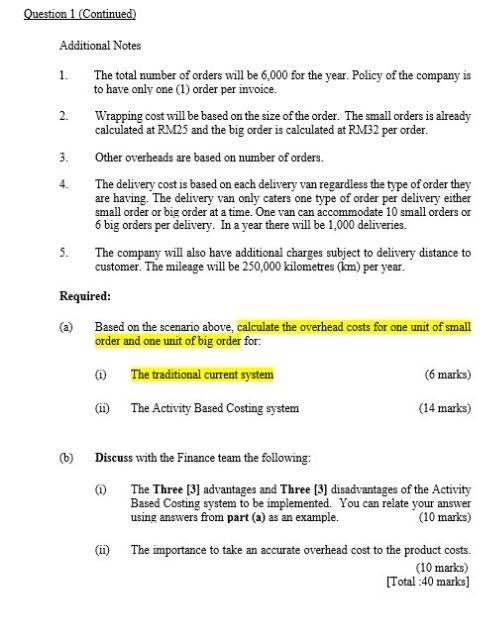

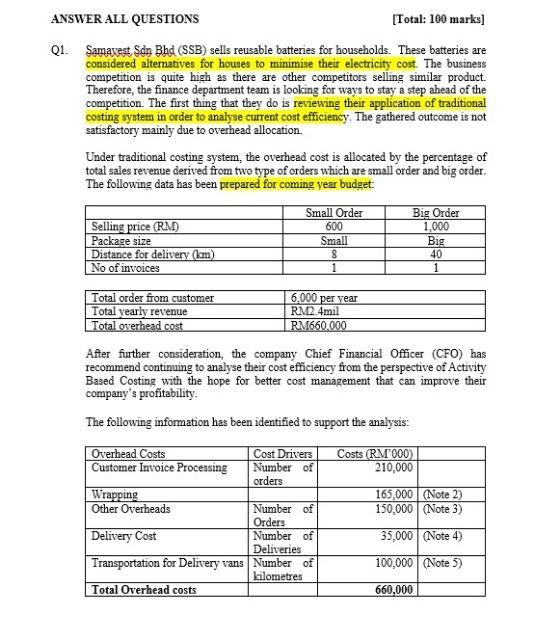

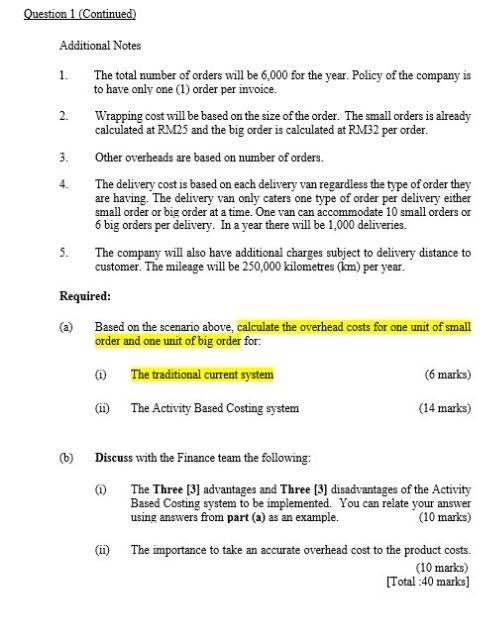

ANSWER ALL QUESTIONS [Total: 100 marks) Q1. Samavest Sdn Bhd (SSB) sells reusable batteries for households. These batteries are considered alternatives for houses to minimise their electricity cost. The business competition is quite high as there are other competitors selling similar product. Therefore, the finance department team is looking for ways to stay a step ahead of the competition. The first thing that they do is reviewing their application of traditional costing system in order to analyse current cost efficiency. The gathered outcome is not satisfactory mainly due to overhead allocation. Under traditional costing system, the overhead cost is allocated by the percentage of total sales revenue derived from two type of orders which are small order and big order. The following data has been prepared for coming year budget: Selling price (RM) Package size Distance for delivery (kom) No of invoices Small Order 600 Small 8 1 Big Order 1,000 Big 40 1 Total order from customer Total yearly revenue Total overhead cost 6,000 per year RM2.4mil RM660.000 After further consideration, the company Chief Financial Officer (CFO) has recommend continuing to analyse their cost efficiency from the perspective of Activity Based Costing with the hope for better cost management that can improve their company's profitability. The following information has been identified to support the analysis: Costs (RM 000 210,000 165,000 (Note 2) 150,000 (Note 3) Overhead Costs Cost Drivers Customer Invoice Processing Number of orders Wrapping Other Overheads Number of Orders Delivery Cost Number of Deliveries Transportation for Delivery vans Number of kilometres Total Overhead costs 35,000 (Note 4) 100,000 (Note 5) 660,000 Question 1 (Continued) 2. Additional Notes 1. The total number of orders will be 6,000 for the year. Policy of the company is to have only one (1) order per invoice. Wrapping cost will be based on the size of the order. The small orders is already calculated at RM25 and the big order is calculated at RM32 per order. 3. Other overheads are based on number of orders. The delivery cost is based on each delivery van regardless the type of order they are having. The delivery van only caters one type of order per delivery either small order or big order at a time. One van can accommodate 10 small orders or 6 big orders per delivery. In a year there will be 1,000 deliveries. 5. The company will also have additional charges subject to delivery distance to customer. The mileage will be 250,000 kilometres (km) per year. Required: Based on the scenario above, calculate the overhead costs for one unit of small order and one unit of big order for: The traditional current system (6 marks) (1) The Activity Based Costing system (14 marks) 6) Discuss with the Finance team the following: The Three [3] advantages and Three (3) disadvantages of the Activity Based Costing system to be implemented. You can relate your answer using answers from part (a) as an example. (10 marks) (ii) The importance to take an accurate overhead cost to the product costs. (10 marks) [Total :40 marks) ANSWER ALL QUESTIONS [Total: 100 marks) Q1. Samavest Sdn Bhd (SSB) sells reusable batteries for households. These batteries are considered alternatives for houses to minimise their electricity cost. The business competition is quite high as there are other competitors selling similar product. Therefore, the finance department team is looking for ways to stay a step ahead of the competition. The first thing that they do is reviewing their application of traditional costing system in order to analyse current cost efficiency. The gathered outcome is not satisfactory mainly due to overhead allocation. Under traditional costing system, the overhead cost is allocated by the percentage of total sales revenue derived from two type of orders which are small order and big order. The following data has been prepared for coming year budget: Selling price (RM) Package size Distance for delivery (kom) No of invoices Small Order 600 Small 8 1 Big Order 1,000 Big 40 1 Total order from customer Total yearly revenue Total overhead cost 6,000 per year RM2.4mil RM660.000 After further consideration, the company Chief Financial Officer (CFO) has recommend continuing to analyse their cost efficiency from the perspective of Activity Based Costing with the hope for better cost management that can improve their company's profitability. The following information has been identified to support the analysis: Costs (RM 000 210,000 165,000 (Note 2) 150,000 (Note 3) Overhead Costs Cost Drivers Customer Invoice Processing Number of orders Wrapping Other Overheads Number of Orders Delivery Cost Number of Deliveries Transportation for Delivery vans Number of kilometres Total Overhead costs 35,000 (Note 4) 100,000 (Note 5) 660,000 Question 1 (Continued) 2. Additional Notes 1. The total number of orders will be 6,000 for the year. Policy of the company is to have only one (1) order per invoice. Wrapping cost will be based on the size of the order. The small orders is already calculated at RM25 and the big order is calculated at RM32 per order. 3. Other overheads are based on number of orders. The delivery cost is based on each delivery van regardless the type of order they are having. The delivery van only caters one type of order per delivery either small order or big order at a time. One van can accommodate 10 small orders or 6 big orders per delivery. In a year there will be 1,000 deliveries. 5. The company will also have additional charges subject to delivery distance to customer. The mileage will be 250,000 kilometres (km) per year. Required: Based on the scenario above, calculate the overhead costs for one unit of small order and one unit of big order for: The traditional current system (6 marks) (1) The Activity Based Costing system (14 marks) 6) Discuss with the Finance team the following: The Three [3] advantages and Three (3) disadvantages of the Activity Based Costing system to be implemented. You can relate your answer using answers from part (a) as an example. (10 marks) (ii) The importance to take an accurate overhead cost to the product costs. (10 marks) [Total :40 marks)