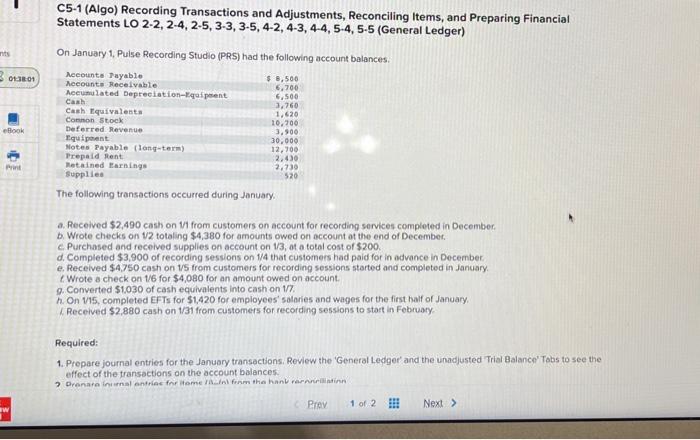

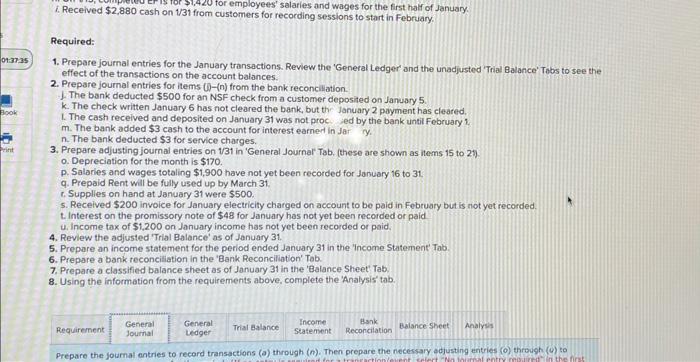

C5-1 (Algo) Recording Transactions and Adjustments, Reconciling Items, and Preparing Financial Statements LO 2-2, 2-4, 2-5, 3-3, 3-5, 4-2, 4-3, 4-4, 5-4, 5-5 (General Ledger) On January 1, Pulse Recording Studio (PRS) had the following account balances. The following transactions occurred during Janyary. a. Received $2,490 cash on 1/1 from customers on account for recording services completed in December. b. Wrote checks on 1/2 totaling $4,380 for amounts owed on account ot the end of December. C. Purchased and received supplies on account on 1/3, at a total cost of $200. d. Completed $3,900 of recording sessions on 1/4 that customers had paid for in advance in December. e. Recelved $4,750 cash on 1/5 from customers for recording sessions started and completed in January. t Wrote a check on 1/6 for $4,080 for an amount owed on account. g. Converted $1.030 of cash equivalents into cash on 1/7. h. On v15, completed EFTs for $1,420 for employees' salaries and wages for the first half of January. i. Received $2.880 cash on 1/31 from customers for recording sessions to start in February. Required: 1. Prepare journal entries for the Januory transactions. Review the 'General Ledger' and the unadjusted Trial Balance' Tabs to see the effect of the transactions on the account balances. 1. Received $2,880 cash on 1/31 from customers for recording sessiges for the first half of January. recording sessions to start in February. Required: 1. Prepare journal entries for the January transactions. Review the 'General Ledger' and the unadjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. 2. Prepare journal entries for items (0)(n) from the bank reconciliation. 1. The bank deducted $500 for an NSF check from a customer deposited on January 5 . k. The check written January 6 has not cleared the bank, but thr January 2 payment has cleared, 1. The cash received and deposited on January 31 was not proc. ed by the bank until February 1. m. The bank added $3 cash to the account for interest earner in Jar y. n. The bank deducted $3 for service charges. 3. Prepare adjusting journal entries on 1/31 in 'General Journal Tab. (these are shown as items 15 to 21). o. Depreciation for the month is $170. p. Salaries and wages totaling $1,900 have not yet been recorded for January 16 to 31 . q. Prepaid Rent will be fully used up by March 31 . t. Supplles on hand at January 31 were $500. 5. Received $200 invoice for January electricity charged on account to be paid in February but is not yet recorded. t. Interest on the promissory note of $48 for January has not yet been recorded or paid u. Income tax of $1,200 on January income has not yet been recorded or paid. 4. Review the adjusted 'Trial Balance' as of January 31. 5. Prepare an income statement for the period ended January 31 in the 'Income Statement' Tab. 6. Prepare a bank teconciliation in the 'Bank Reconciliation' Tab. 7. Prepare a classified balance sheet as of January 31 in the 'Balance Sheet' Tab, 8. Using the information from the requirements above, complete the 'Analysis' tab