Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all the ff questions 1. Which statement is correct? a Financial prices mean the present value of all expected cash flows and the potential

answer all the ff questions

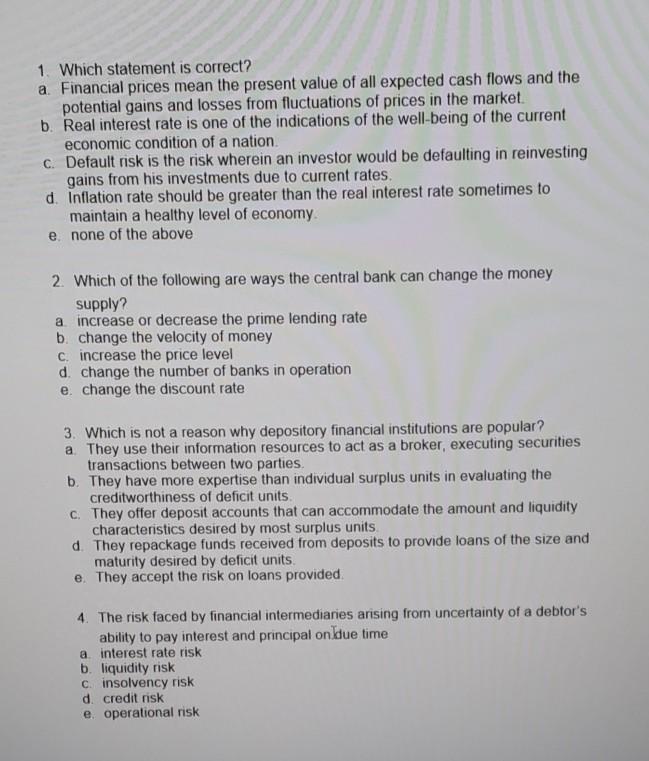

1. Which statement is correct? a Financial prices mean the present value of all expected cash flows and the potential gains and losses from fluctuations of prices in the market. b. Real interest rate is one of the indications of the well-being of the current economic condition of a nation. C. Default risk is the risk wherein an investor would be defaulting in reinvesting gains from his investments due to current rates. d. Inflation rate should be greater than the real interest rate sometimes to maintain a healthy level of economy e none of the above 2. Which of the following are ways the central bank can change the money supply? a increase or decrease the prime lending rate b. change the velocity of money c. increase the price level d. change the number of banks in operation e. change the discount rate 3. Which is not a reason why depository financial institutions are popular? a. They use their information resources to act as a broker, executing securities transactions between two parties. b. They have more expertise than individual surplus units in evaluating the creditworthiness of deficit units c. They offer deposit accounts that can accommodate the amount and liquidity characteristics desired by most surplus units d. They repackage funds received from deposits to provide loans of the size and maturity desired by deficit units e. They accept the risk on loans provided 4. The risk faced by financial intermediaries arising from uncertainty of a debtor's ability to pay interest and principal on due time a interest rate risk b. liquidity risk cinsolvency risk d. credit risk e operational riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started