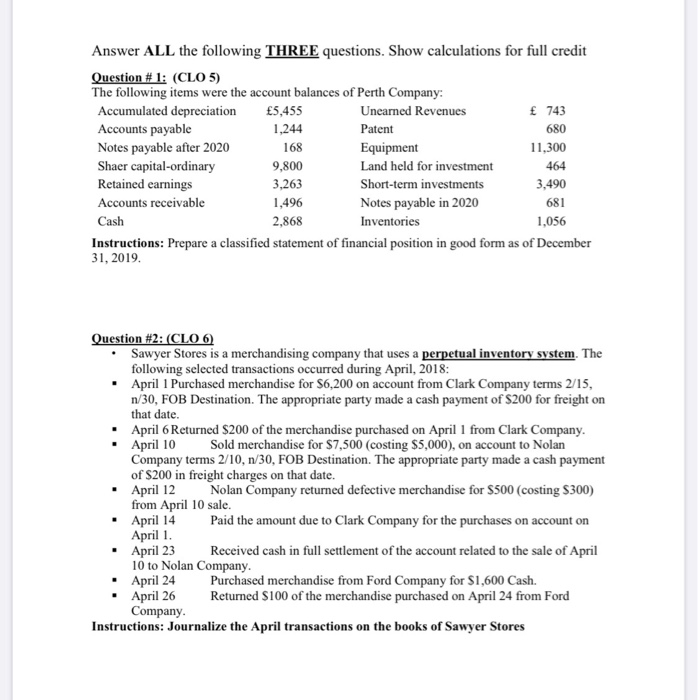

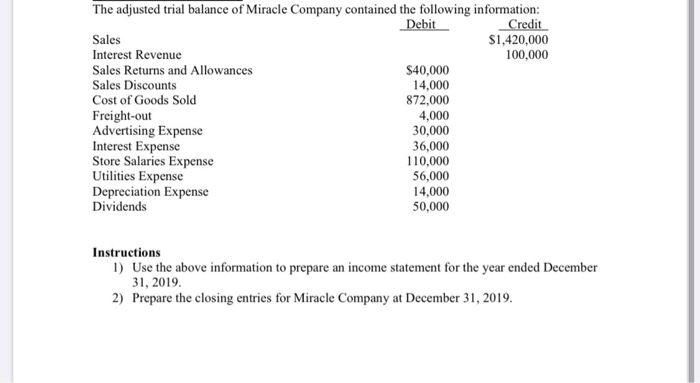

Answer ALL the following THREE questions. Show calculations for full credit Question #1: (CLO 5) The following items were the account balances of Perth Company: Accumulated depreciation 5,455 Unearned Revenues 743 Accounts payable 1,244 Patent 680 Notes payable after 2020 168 Equipment 11.300 Shaer capital-ordinary 9,800 Land held for investment 464 Retained earnings 3,263 Short-term investments 3,490 Accounts receivable 1,496 Notes payable in 2020 681 Cash 2,868 Inventories 1,056 Instructions: Prepare a classified statement of financial position in good form as of December 31, 2019 Question #2: (CLO6) Sawyer Stores is a merchandising company that uses a perpetual inventory system. The following selected transactions occurred during April, 2018: April 1Purchased merchandise for S6,200 on account from Clark Company terms 2/15, n/30, FOB Destination. The appropriate party made a cash payment of $200 for freight on that date. April 6 Returned $200 of the merchandise purchased on April 1 from Clark Company April 10 Sold merchandise for $7,500 (costing $5,000), on account to Nolan Company terms 2/10, 1/30, FOB Destination. The appropriate party made a cash payment of $200 in freight charges on that date. April 12 Nolan Company returned defective merchandise for $500 (costing $300) from April 10 sale. . April 14 Paid the amount due to Clark Company for the purchases on account on April 1. . April 23 Received cash in full settlement of the account related to the sale of April 10 to Nolan Company. . April 24 Purchased merchandise from Ford Company for $1,600 Cash. April 26 Returned $100 of the merchandise purchased on April 24 from Ford Company. Instructions: Journalize the April transactions on the books of Sawyer Stores The adjusted trial balance of Miracle Company contained the following information: Debit Credit Sales $1,420,000 Interest Revenue 100.000 Sales Returns and Allowances $40,000 Sales Discounts 14,000 Cost of Goods Sold 872,000 Freight-out 4,000 Advertising Expense 30,000 Interest Expense 36,000 Store Salaries Expense 110,000 Utilities Expense 56,000 Depreciation Expense 14,000 Dividends 50,000 Instructions 1) Use the above information to prepare an income statement for the year ended December 31, 2019. 2) Prepare the closing entries for Miracle Company at December 31, 2019