Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all the question please 600 720 Question 1 Decio plc is considering two alternative proposals for financing an investment of 240 million. The first

answer all the question please

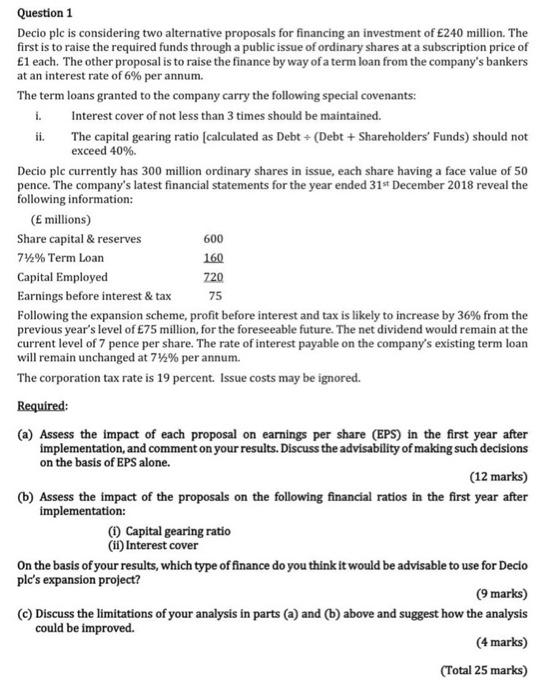

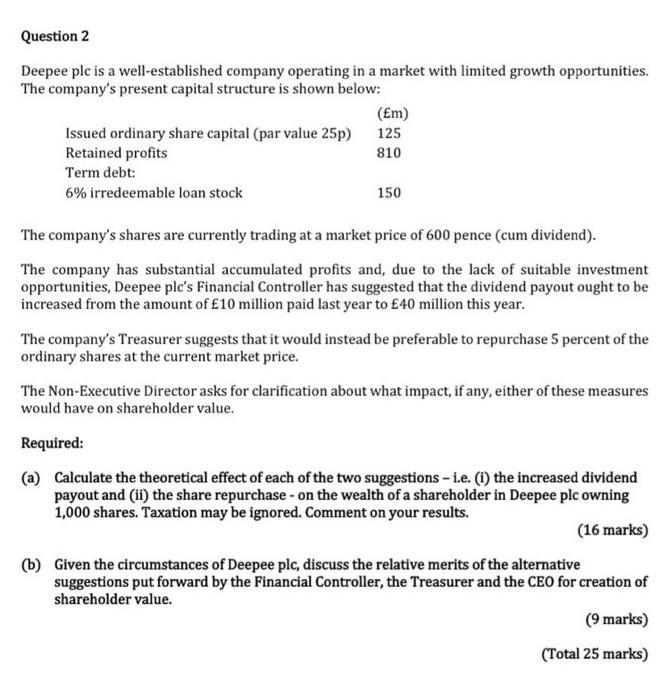

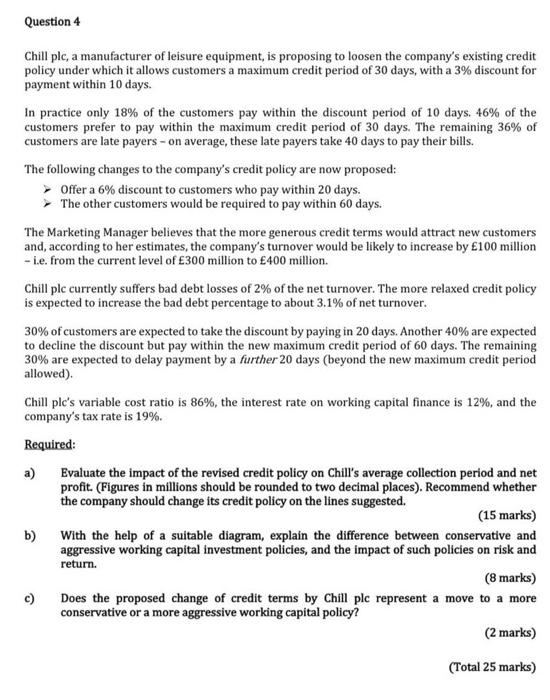

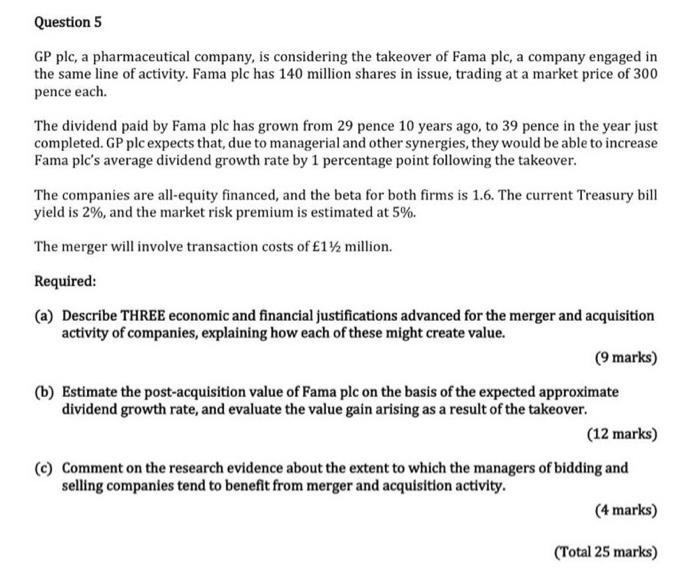

600 720 Question 1 Decio plc is considering two alternative proposals for financing an investment of 240 million. The first is to raise the required funds through a public issue of ordinary shares at a subscription price of E1 each. The other proposal is to raise the finance by way of a term loan from the company's bankers at an interest rate of 6% per annum. The term loans granted to the company carry the following special covenants: 1. Interest cover of not less than 3 times should be maintained. ii. The capital gearing ratio (calculated as Debt + (Debt + Shareholders' Funds) should not exceed 40%. Decio plc currently has 300 million ordinary shares in issue, each share having a face value of 50 pence. The company's latest financial statements for the year ended 31st December 2018 reveal the following information: (5 millions) Share capital & reserves 74% Term Loan 160 Capital Employed Earnings before interest & tax 75 Following the expansion scheme, profit before interest and tax is likely to increase by 36% from the previous year's level of 75 million, for the foreseeable future. The net dividend would remain at the current level of 7 pence per share. The rate of interest payable on the company's existing term loan will remain unchanged at 74% per annum. The corporation tax rate is 19 percent. Issue costs may be ignored. Required: (a) Assess the impact of each proposal on earnings per share (EPS) in the first year after implementation, and comment on your results. Discuss the advisability of making such decisions on the basis of EPS alone. (12 marks) (b) Assess the impact of the proposals on the following financial ratios in the first year after implementation: (1) Capital gearing ratio (11) Interest cover On the basis of your results, which type of finance do you think it would be advisable to use for Decio ple's expansion project? (9 marks) (c) Discuss the limitations of your analysis in parts (a) and (b) above and suggest how the analysis could be improved. (4 marks) (Total 25 marks) Question 2 Deepee plc is a well-established company operating in a market with limited growth opportunities. The company's present capital structure is shown below: (m) Issued ordinary share capital (par value 25p) 125 Retained profits 810 Term debt: 6% irredeemable loan stock 150 The company's shares are currently trading at a market price of 600 pence (cum dividend). The company has substantial accumulated profits and, due to the lack of suitable investment opportunities, Deepee ple's Financial Controller has suggested that the dividend payout ought to be increased from the amount of 10 million paid last year to 40 million this year. The company's Treasurer suggests that it would instead be preferable to repurchase 5 percent of the ordinary shares at the current market price. The Non-Executive Director asks for clarification about what impact, if any, either of these measures would have on shareholder value. Required: (a) Calculate the theoretical effect of each of the two suggestions - i.e. (i) the increased dividend payout and (ii) the share repurchase - on the wealth of a shareholder in Deepee plc owning 1,000 shares. Taxation may be ignored. Comment on your results. (16 marks) (b) Given the circumstances of Deepee plc, discuss the relative merits of the alternative suggestions put forward by the Financial Controller, the Treasurer and the CEO for creation of shareholder value. (9 marks) (Total 25 marks) Question 4 Chill plc, a manufacturer of leisure equipment, is proposing to loosen the company's existing credit policy under which it allows customers a maximum credit period of 30 days, with a 3% discount for payment within 10 days. In practice only 18% of the customers pay within the discount period of 10 days. 46% of the customers prefer to pay within the maximum credit period of 30 days. The remaining 36% of customers are late payers - on average, these late payers take 40 days to pay their bills. The following changes to the company's credit policy are now proposed: Offer a 6% discount to customers who pay within 20 days. The other customers would be required to pay within 60 days. The Marketing Manager believes that the more generous credit terms would attract new customers and, according to her estimates, the company's turnover would be likely to increase by 100 million - i.e. from the current level of 300 million to 400 million. Chill plc currently suffers bad debt losses of 2% of the net turnover. The more relaxed credit policy is expected to increase the bad debt percentage to about 3.1% of net turnover. 30% of customers are expected to take the discount by paying in 20 days. Another 40% are expected to decline the discount but pay within the new maximum credit period of 60 days. The remaining 30% are expected to delay payment by a further 20 days beyond the new maximum credit period allowed). Chill ple's variable cost ratio is 86%, the interest rate on working capital finance is 12%, and the company's tax rate is 19%. Required: Evaluate the impact of the revised credit policy on Chill's average collection period and net profit. (Figures in millions should be rounded to two decimal places). Recommend whether the company should change its credit policy on the lines suggested. (15 marks) b) With the help of a suitable diagram, explain the difference between conservative and aggressive working capital investment policies, and the impact of such policies on risk and return. (8 marks) c) Does the proposed change of credit terms by Chill plc represent a move to a more conservative or a more aggressive working capital policy? (2 marks) (Total 25 marks) Question 5 GP plc, a pharmaceutical company, is considering the takeover of Fama plc, a company engaged in the same line of activity. Fama plc has 140 million shares in issue, trading at a market price of 300 pence each. The dividend paid by Fama plc has grown from 29 pence 10 years ago, to 39 pence in the year just completed. GP plc expects that, due to managerial and other synergies, they would be able to increase Fama plc's average dividend growth rate by 1 percentage point following the takeover. The companies are all-equity financed, and the beta for both firms is 1.6. The current Treasury bill yield is 2%, and the market risk premium is estimated at 5%. The merger will involve transaction costs of 1% million. Required: (a) Describe THREE economic and financial justifications advanced for the merger and acquisition activity of companies, explaining how each of these might create value. (9 marks) (b) Estimate the post-acquisition value of Fama plc on the basis of the expected approximate dividend growth rate, and evaluate the value gain arising as a result of the takeover. (12 marks) (c) Comment on the research evidence about the extent to which the managers of bidding and selling companies tend to benefit from merger and acquisition activity. (4 marks) (Total 25 marks) 600 720 Question 1 Decio plc is considering two alternative proposals for financing an investment of 240 million. The first is to raise the required funds through a public issue of ordinary shares at a subscription price of E1 each. The other proposal is to raise the finance by way of a term loan from the company's bankers at an interest rate of 6% per annum. The term loans granted to the company carry the following special covenants: 1. Interest cover of not less than 3 times should be maintained. ii. The capital gearing ratio (calculated as Debt + (Debt + Shareholders' Funds) should not exceed 40%. Decio plc currently has 300 million ordinary shares in issue, each share having a face value of 50 pence. The company's latest financial statements for the year ended 31st December 2018 reveal the following information: (5 millions) Share capital & reserves 74% Term Loan 160 Capital Employed Earnings before interest & tax 75 Following the expansion scheme, profit before interest and tax is likely to increase by 36% from the previous year's level of 75 million, for the foreseeable future. The net dividend would remain at the current level of 7 pence per share. The rate of interest payable on the company's existing term loan will remain unchanged at 74% per annum. The corporation tax rate is 19 percent. Issue costs may be ignored. Required: (a) Assess the impact of each proposal on earnings per share (EPS) in the first year after implementation, and comment on your results. Discuss the advisability of making such decisions on the basis of EPS alone. (12 marks) (b) Assess the impact of the proposals on the following financial ratios in the first year after implementation: (1) Capital gearing ratio (11) Interest cover On the basis of your results, which type of finance do you think it would be advisable to use for Decio ple's expansion project? (9 marks) (c) Discuss the limitations of your analysis in parts (a) and (b) above and suggest how the analysis could be improved. (4 marks) (Total 25 marks) Question 2 Deepee plc is a well-established company operating in a market with limited growth opportunities. The company's present capital structure is shown below: (m) Issued ordinary share capital (par value 25p) 125 Retained profits 810 Term debt: 6% irredeemable loan stock 150 The company's shares are currently trading at a market price of 600 pence (cum dividend). The company has substantial accumulated profits and, due to the lack of suitable investment opportunities, Deepee ple's Financial Controller has suggested that the dividend payout ought to be increased from the amount of 10 million paid last year to 40 million this year. The company's Treasurer suggests that it would instead be preferable to repurchase 5 percent of the ordinary shares at the current market price. The Non-Executive Director asks for clarification about what impact, if any, either of these measures would have on shareholder value. Required: (a) Calculate the theoretical effect of each of the two suggestions - i.e. (i) the increased dividend payout and (ii) the share repurchase - on the wealth of a shareholder in Deepee plc owning 1,000 shares. Taxation may be ignored. Comment on your results. (16 marks) (b) Given the circumstances of Deepee plc, discuss the relative merits of the alternative suggestions put forward by the Financial Controller, the Treasurer and the CEO for creation of shareholder value. (9 marks) (Total 25 marks) Question 4 Chill plc, a manufacturer of leisure equipment, is proposing to loosen the company's existing credit policy under which it allows customers a maximum credit period of 30 days, with a 3% discount for payment within 10 days. In practice only 18% of the customers pay within the discount period of 10 days. 46% of the customers prefer to pay within the maximum credit period of 30 days. The remaining 36% of customers are late payers - on average, these late payers take 40 days to pay their bills. The following changes to the company's credit policy are now proposed: Offer a 6% discount to customers who pay within 20 days. The other customers would be required to pay within 60 days. The Marketing Manager believes that the more generous credit terms would attract new customers and, according to her estimates, the company's turnover would be likely to increase by 100 million - i.e. from the current level of 300 million to 400 million. Chill plc currently suffers bad debt losses of 2% of the net turnover. The more relaxed credit policy is expected to increase the bad debt percentage to about 3.1% of net turnover. 30% of customers are expected to take the discount by paying in 20 days. Another 40% are expected to decline the discount but pay within the new maximum credit period of 60 days. The remaining 30% are expected to delay payment by a further 20 days beyond the new maximum credit period allowed). Chill ple's variable cost ratio is 86%, the interest rate on working capital finance is 12%, and the company's tax rate is 19%. Required: Evaluate the impact of the revised credit policy on Chill's average collection period and net profit. (Figures in millions should be rounded to two decimal places). Recommend whether the company should change its credit policy on the lines suggested. (15 marks) b) With the help of a suitable diagram, explain the difference between conservative and aggressive working capital investment policies, and the impact of such policies on risk and return. (8 marks) c) Does the proposed change of credit terms by Chill plc represent a move to a more conservative or a more aggressive working capital policy? (2 marks) (Total 25 marks) Question 5 GP plc, a pharmaceutical company, is considering the takeover of Fama plc, a company engaged in the same line of activity. Fama plc has 140 million shares in issue, trading at a market price of 300 pence each. The dividend paid by Fama plc has grown from 29 pence 10 years ago, to 39 pence in the year just completed. GP plc expects that, due to managerial and other synergies, they would be able to increase Fama plc's average dividend growth rate by 1 percentage point following the takeover. The companies are all-equity financed, and the beta for both firms is 1.6. The current Treasury bill yield is 2%, and the market risk premium is estimated at 5%. The merger will involve transaction costs of 1% million. Required: (a) Describe THREE economic and financial justifications advanced for the merger and acquisition activity of companies, explaining how each of these might create value. (9 marks) (b) Estimate the post-acquisition value of Fama plc on the basis of the expected approximate dividend growth rate, and evaluate the value gain arising as a result of the takeover. (12 marks) (c) Comment on the research evidence about the extent to which the managers of bidding and selling companies tend to benefit from merger and acquisition activity. (4 marks) (Total 25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started