Question

Answer ALL the questions in this section. Question 1 (16 Marks) INFORMATION: The following information has been provided by Aveng Limited to be used in

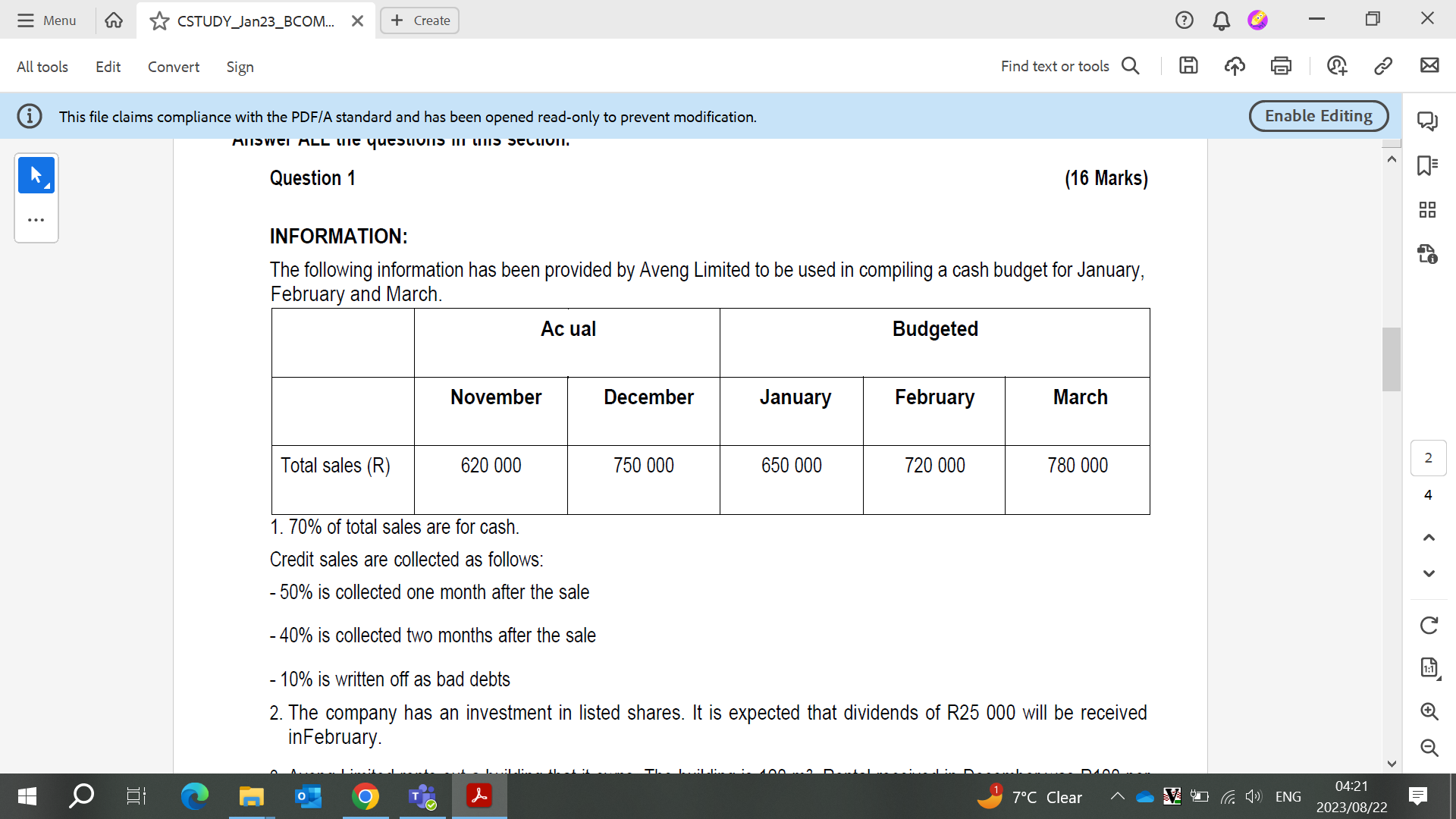

Answer ALL the questions in this section. Question 1 (16 Marks) INFORMATION: The following information has been provided by Aveng Limited to be used in compiling a cash budget for January, February and March. Ac ual Budgeted November December January February March Total sales (R) 620 000 750 000 650 000 720 000 780 000 1. 70% of total sales are for cash. Credit sales are collected as follows: - 50% is collected one month after the sale - 40% is collected two months after the sale - 10% is written off as bad debts 2. The company has an investment in listed shares. It is expected that dividends of R25 000 will be received inFebruary. 3. Aveng Limited rents out a building that it owns. The building is 120 m2. Rental received in December was R100 per m2. Rental is expected to increase by 10% from 1 February. 4. Purchases are as follows: Ac ual Budgeted November December January February March Total purchases (R) 360 000 280 000 320 000 370 000 380 000 - 40% of purchases are for cash. Credit purchases are paid for as follows - 60% one month after purchase - 40% two months after purchase 5. Equipment is currently leased under an operational lease. Monthly payments of R4 200 are made on the last day ofevery month. 6. Aveng will purchase a new delivery vehicle on 1 February at a cost of R220 000. This purchase will be fundedthrough an instalment sale agreement. A deposit of 20% will be made on purchase and the remainder will be paid in monthly instalments of R6 500 beginning on 28 February. 7. Salaries for December amounted to R125 000. An annual increase of 8% will be effective from 1 January.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started