Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all the questions you can. Thank you in advance! The average annual rate of return for your start up company for the past several

Answer all the questions you can. Thank you in advance!

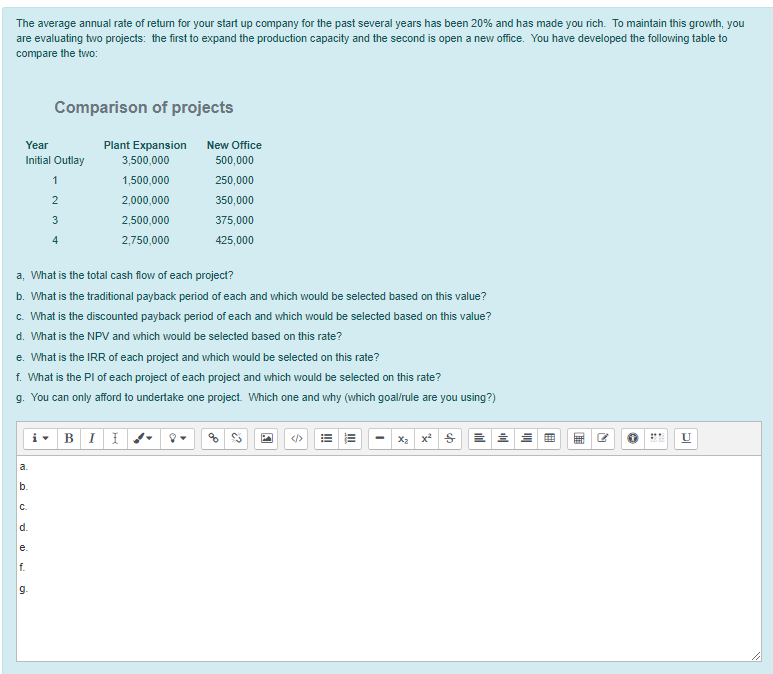

The average annual rate of return for your start up company for the past several years has been 20% and has made you rich. To maintain this growth, you are evaluating two projects: the first to expand the production capacity and the second is open a new office. You have developed the following table to compare the two Comparison of projects Year Initial Outlay Plant Expansion 3,500,000 1,500,000 2,000,000 2,500,000 2,750,000 New Office 500,000 250,000 350,000 375,000 425,000 a, What is the total cash flow of each project? b. What is the traditional payback period of each and which would be selected based on this value? c. What is the discounted payback period of each and which would be selected based on this value? d. What is the NPV and which would be selected based on this rate? e. What is the IRR of each project and which would be selected on this rate? f. What is the Pl of each project of each project and which would be selected on this rate? 9. You can only afford to undertake one project. Which one and why (which goal/rule are you using?)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started