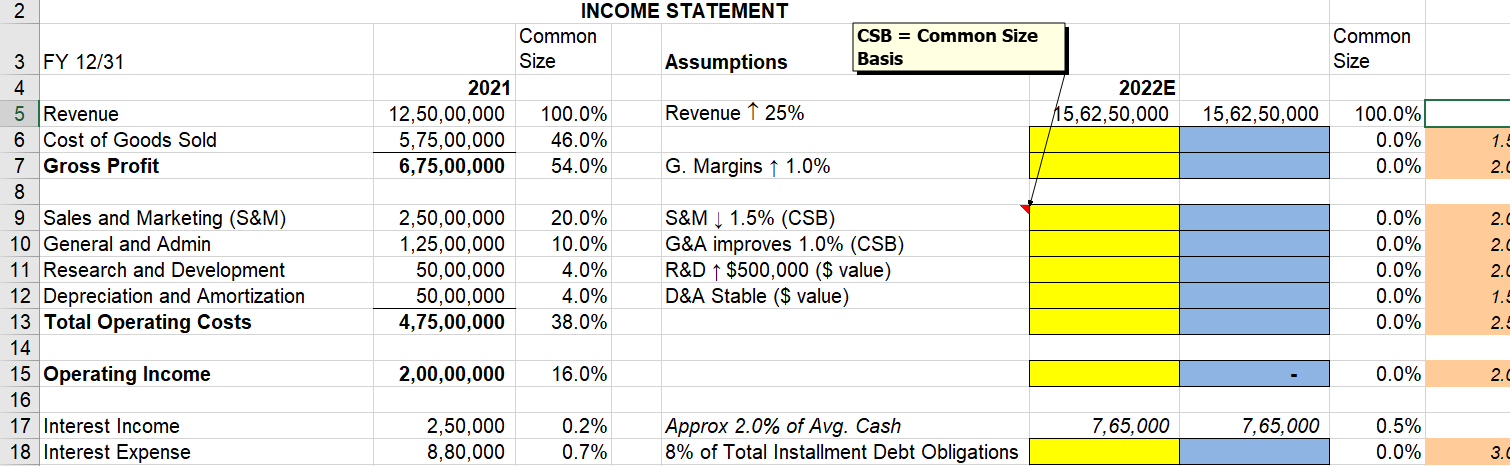

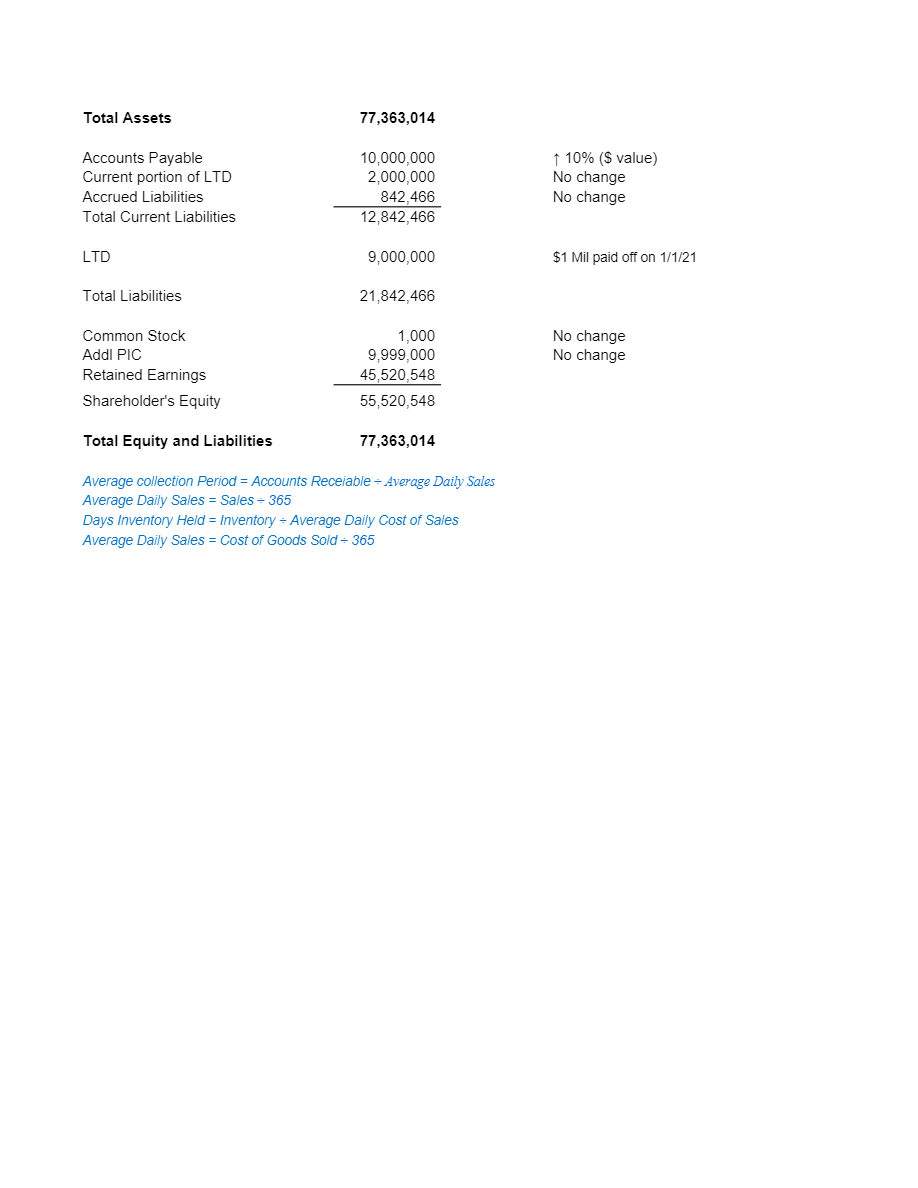

Answer all the yellow boxes,

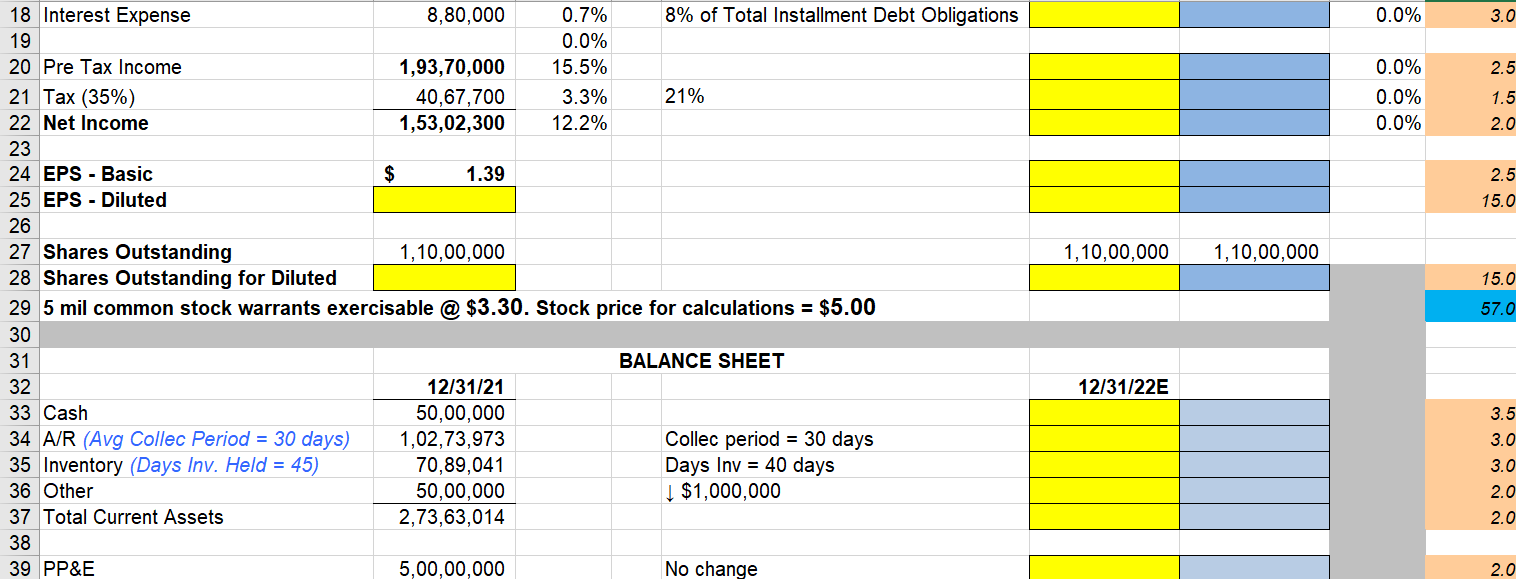

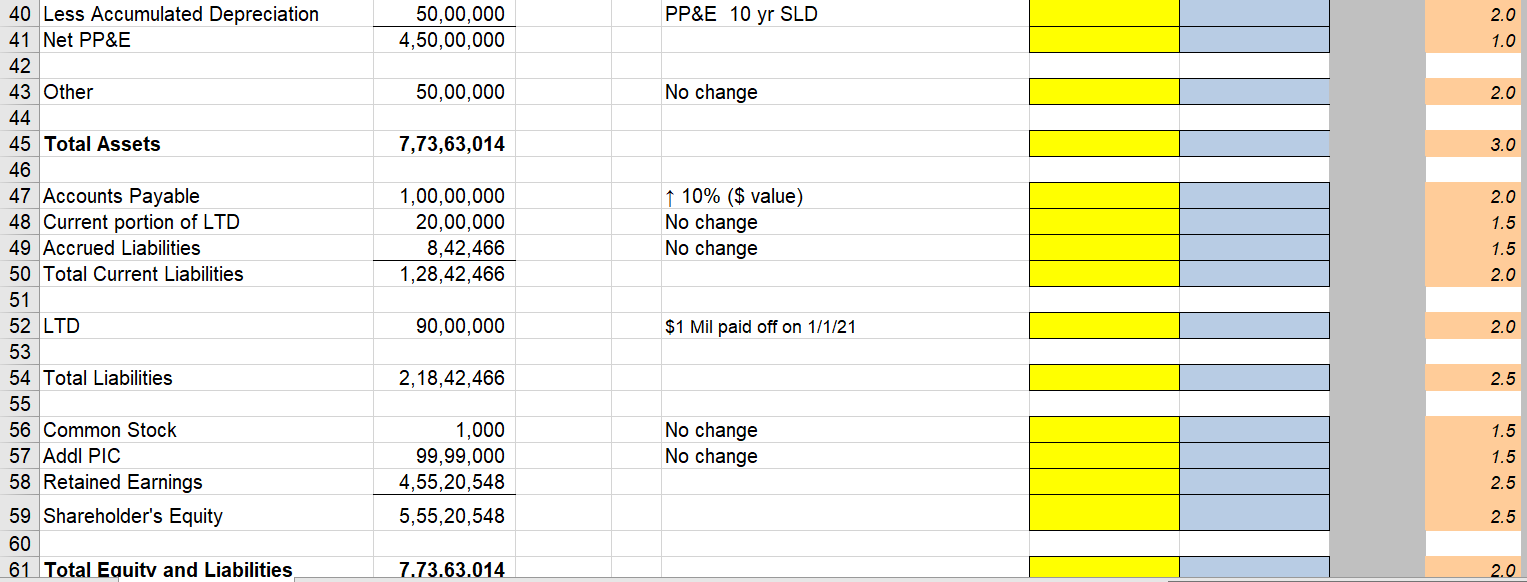

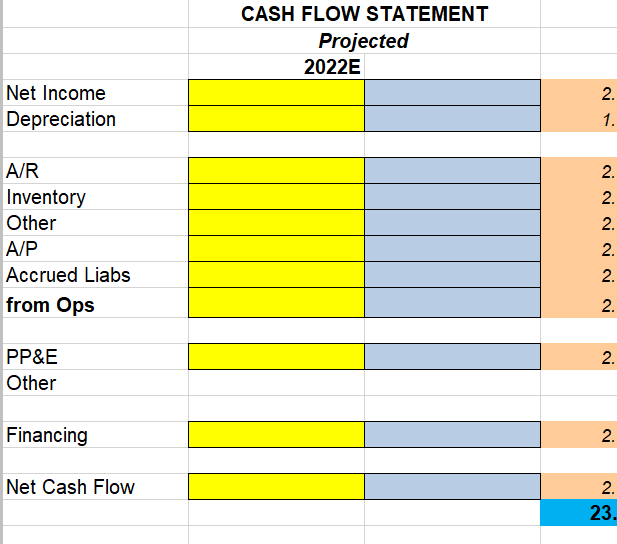

2 INCOME STATEMENT Common CSB = Common Size Common 3 FY 12/31 Size Assumptions Basis Size 4 2021 2022E 5 Revenue 12,50,00,000 100.0% Revenue 1 25% 15,62,50,000 15,62,50,000 100.0% 6 Cost of Goods Sold 5,75,00,000 46.0% 0.0% 7 Gross Profit 6,75,00,000 54.0% G. Margins 1 1.0% 0.0% 2. 8 9 Sales and Marketing (S&M) 2,50,00,000 20.0% S&M | 1.5% (CSB) 0.0% N 10 General and Admin 1,25,00,000 10.0% G&A improves 1.0% (CSB) 0.0% NO 11 Research and Development 50,00,000 4.0% R&D + $500,000 ($ value) 0.0% 2. 12 Depreciation and Amortization 50,00,000 4.0% D&A Stable ($ value) 0.0% 13 Total Operating Costs 4,75,00,000 38.0% 0.0% 2. 14 15 Operating Income 2,00,00,000 16.0% 0.0% 2. 16 17 Interest Income 2,50,000 0.2% Approx 2.0% of Avg. Cash 7, 65,000 7, 65,000 0.5% 18 Interest Expense 8,80,000 0.7% 8% of Total Installment Debt Obligations 0.0%18 Interest Expense 8,80,000 0.7% 8% of Total Installment Debt Obligations 0.0% 3.0 19 0.0% 20 Pre Tax Income 1,93,70,000 15.5% 0.0% 2.5 21 Tax (35%) 40,67,700 3.3% 21% 0.0% 1.5 22 Net Income 1,53,02,300 12.2% 0.0% 2.0 23 24 EPS - Basic $ 1.39 2.5 25 EPS - Diluted 15.0 26 27 Shares Outstanding 1, 10,00,000 1, 10,00,000 1, 10,00,000 28 Shares Outstanding for Diluted 15.0 29 5 mil common stock warrants exercisable @ $3.30. Stock price for calculations = $5.00 57.0 30 31 BALANCE SHEET 32 12/31/21 12/31/22E 33 Cash 50,00,000 3.5 34 A/R (Avg Colleceriod = 30 days) 1,02,73,973 Collecperiod = 30 days 3.0 35 Inventory (Days Inv. Held = 45) 70,89,041 Days Inv = 40 days 3.0 36 Other 50,00,000 1 $1,000,000 2. 37 Total Current Assets 2,73,63,014 2.0 38 39 PP&E 5,00,00,000 No change 2. 040 Less Accumulated Depreciation 50,00,000 PP&E 10 yr SLD 2.0 41 Net PP&E 4,50,00,000 1.0 42 43 Other 50,00,000 No change 2.0 44 45 Total Assets 7,73,63,014 3.0 46 47 Accounts Payable 1,00,00,000 1 10% ($ value) 2.0 48 Current portion of LTD 20,00,000 No change 1.5 49 Accrued Liabilities 8,42,466 No change 1.5 50 Total Current Liabilities 1,28,42,466 2.0 51 52 LTD 90,00,000 $1 Mil paid off on 1/1/21 2.0 53 54 Total Liabilities 2, 18,42,466 2.5 55 56 Common Stock 1,000 No change 1.5 57 Addl PIC 99,99,000 No change 1.5 58 Retained Earnings 4,55,20,548 2.5 59 Shareholder's Equity 5,55,20,548 2.5 60 61 Total Equity and Liabilities 7.73.63.014 2.0CASH FLOW STATEMENT Projected 2022E Net Income 2. Depreciation 1 . A/R Inventory Other N N NN NN A/P Accrued Liabs from Ops PP &E 2. Other Financing 2. Net Cash Flow 2. 23Total Assets 77,363,014 Accounts Payable 10,000,000 + 10% ($ value) Current portion of LTD 2,000,000 No change Accrued Liabilities 842,466 No change Total Current Liabilities 12,842,466 LTD 9,000,000 $1 Mil paid off on 1/1/21 Total Liabilities 21,842,466 Common Stock 1,000 No change Addl PIC 9,999,000 No change Retained Earnings 45,520,548 Shareholder's Equity 55,520,548 Total Equity and Liabilities 77,363,014 Average collection Period = Accounts Receiable - Average Daily Sales Average Daily Sales = Sales - 365 Days Inventory Held = Inventory = Average Daily Cost of Sales Average Daily Sales = Cost of Goods Sold - 365