answer all three parts of the question please. i will thumns up for correct answers and fast response

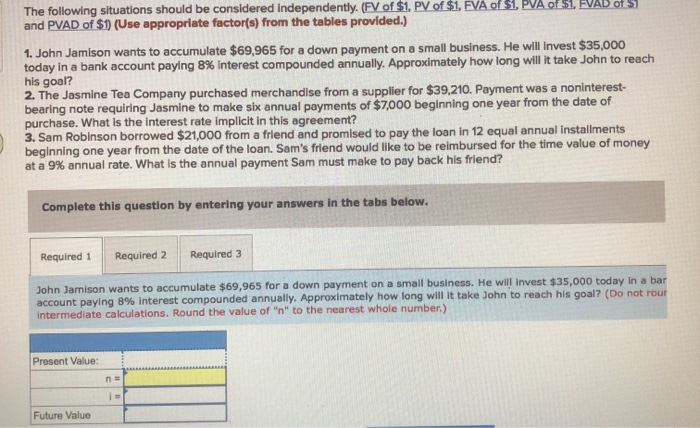

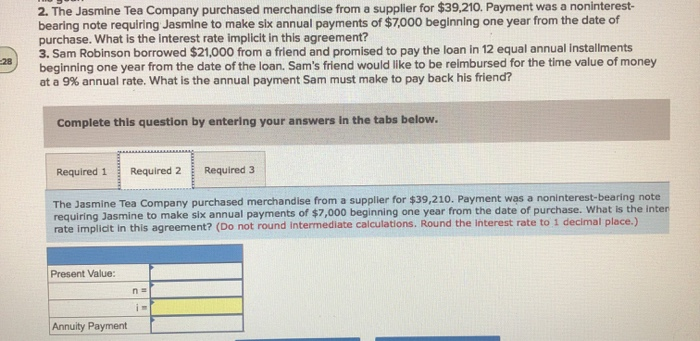

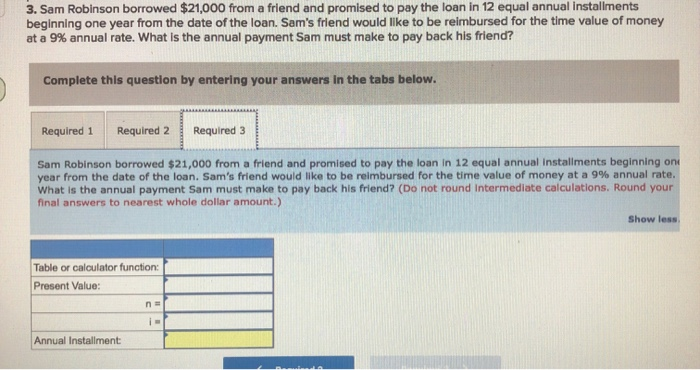

The following situations should be considered Independently. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of 51 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. John Jamison wants to accumulate $69,965 for a down payment on a small business. He will invest $35,000 today in a bank account paying 8% interest compounded annually. Approximately how long will it take John to reach his goal? 2. The Jasmine Tea Company purchased merchandise from a supplier for $39,210. Payment was a noninterest- bearing note requiring Jasmine to make six annual payments of $7,000 beginning one year from the date of purchase. What is the interest rate implicit in this agreement? 3. Sam Robinson borrowed $21,000 from a friend and promised to pay the loan in 12 equal annual Installments beginning one year from the date of the loan. Sam's friend would like to be reimbursed for the time value of money at a 9% annual rate. What is the annual payment Sam must make to pay back his friend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 John Jamison wants to accumulate $69,965 for a down payment on a small business. He will invest $35,000 today in a bar account paying 8% Interest compounded annually. Approximately how long will it take John to reach his goal? (Do not rout Intermediate calculations. Round the value of "n" to the nearest whole number.) Present Value: no Future Value 2. The Jasmine Tea Company purchased merchandise from a supplier for $39,210. Payment was a noninterest- bearing note requiring Jasmine to make six annual payments of $7,000 beginning one year from the date of purchase. What is the interest rate implicit in this agreement? 3. Sam Robinson borrowed $21,000 from a friend and promised to pay the loan in 12 equal annual installments beginning one year from the date of the loan. Sam's friend would like to be relmbursed for the time value of money at a 9% annual rate. What is the annual payment Sam must make to pay back his friend? -28 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 The Jasmine Tea Company purchased merchandise from a supplier for $39,210. Payment was a noninterest-bearing note requiring Jasmine to make six annual payments of $7,000 beginning one year from the date of purchase. What is the inter rate implicit in this agreement? (Do not round Intermediate calculations. Round the interest rate to 1 decimal place.) Present Value: n- Annuity Payment 3. Sam Robinson borrowed $21,000 from a friend and promised to pay the loan in 12 equal annual installments beginning one year from the date of the loan. Sam's friend would like to be reimbursed for the time value of money at a 9% annual rate. What is the annual payment Sam must make to pay back his friend? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Sam Robinson borrowed $21,000 from a friend and promised to pay the loan in 12 equal annual Installments beginning on year from the date of the loan. Sam's friend would like to be reimbursed for the time value of money at a 9% annual rate. What is the annual payment Sam must make to pay back his friend? (Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount.) Show less Table or calculator function: Present Value: Annual Installment