Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all three pleasse will leave positive feedback Westchester Corp. is considering Projects S and L, whose cash flows are shown below. These projects are

answer all three pleasse will leave positive feedback

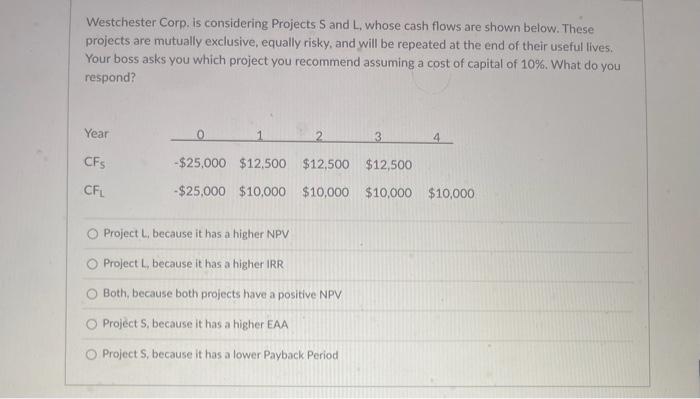

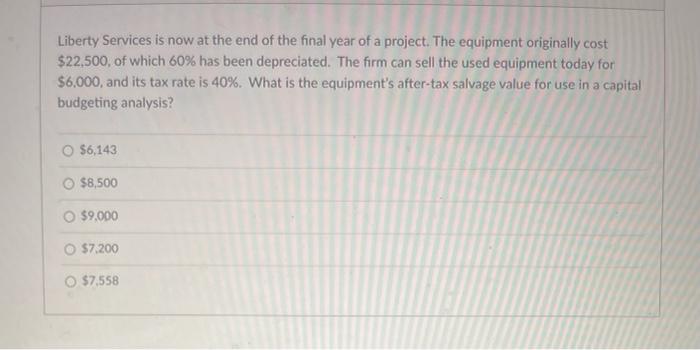

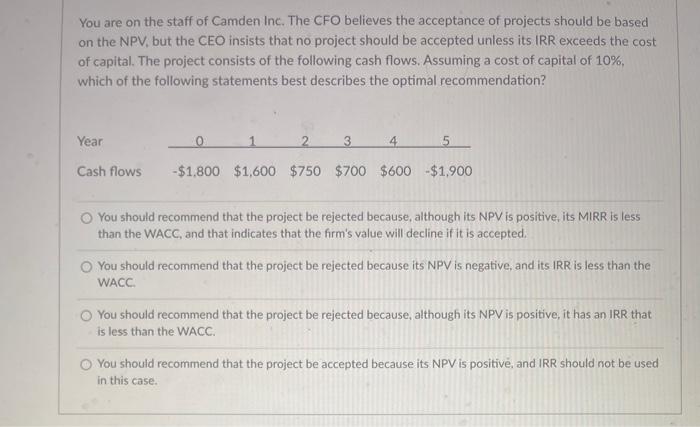

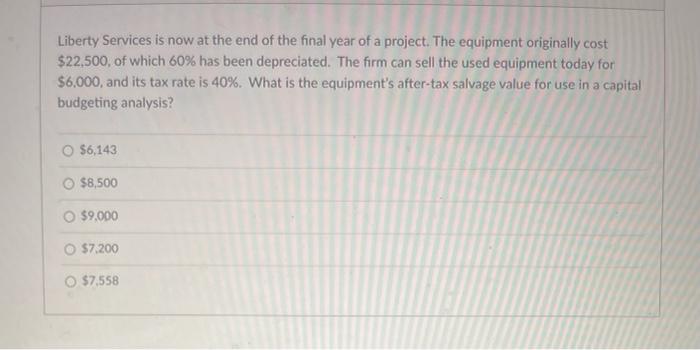

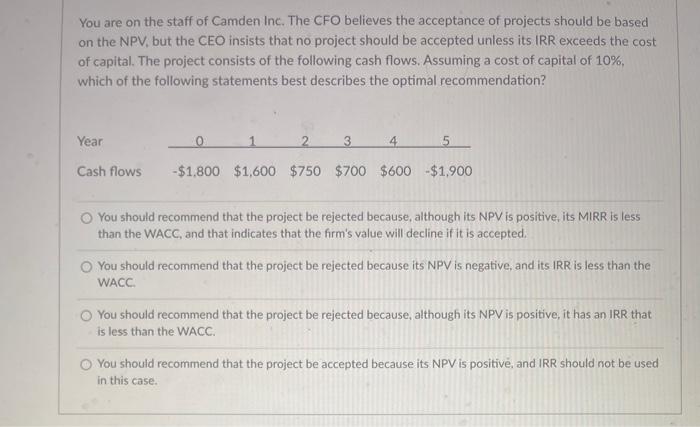

Westchester Corp. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and will be repeated at the end of their useful lives. Your boss asks you which project you recommend assuming a cost of capital of 10%. What do you respond? Project L, because it has a higher NPV Project L, because it has a higher IRR Both, because both projects have a positive NPV Project S, because it has a higher EAA Project S, because it has a lower Payback Period Liberty Services is now at the end of the final year of a project. The equipment originally cost $22,500, of which 60% has been depreciated. The firm can sell the used equipment today for $6.000, and its tax rate is 40%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? $6,143 $8,500 $9,000 $7,200 $7.558 You are on the staff of Camden Inc. The CFO believes the acceptance of projects should be based on the NPV, but the CEO insists that no project should be accepted unless its IRR exceeds the cost of capital. The project consists of the following cash flows. Assuming a cost of capital of 10%, which of the following statements best describes the optimal recommendation? You should recommend that the project be rejected because, although its NPV is positive, its MIRR is less than the WACC, and that indicates that the firm's value will decline if it is accepted. You should recommend that the project be rejected because its NPV is negative, and its IRR is less than the WACC. You should recommend that the project be rejected because, although its NPV is positive, it has an IRR that is less than the WACC. You should recommend that the project be accepted because its NPV is positive, and IRR should not be used in this case

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started