Answer all three questions, please

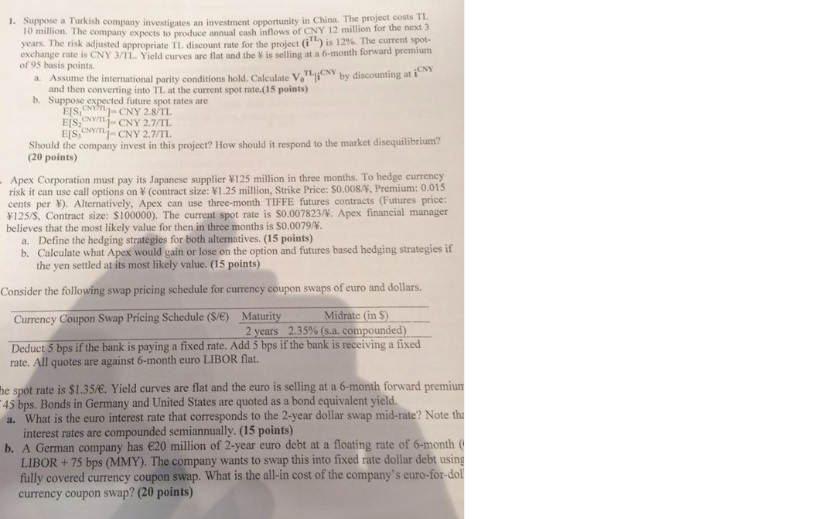

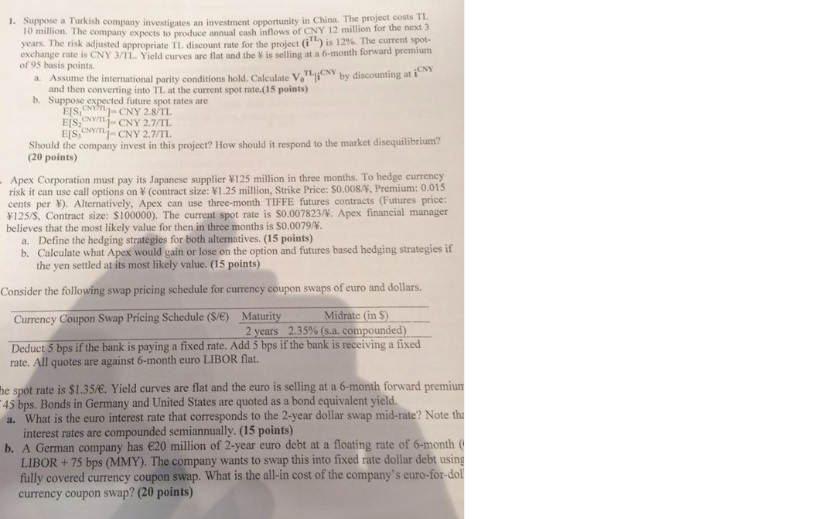

1. Suppose a Turkish company investigates an investment opportunity in China. The project costs TL 10 million. The company expects to produce annual cash inflows of CNY 12 million for the next 3 years. The risk adjusted appropriate il discount rate for the project (") is 12%. The current spot- exchange rate is CNY 3/12. Yield curves are flat and the Vis selling at a 6-month forward premium of 95 basis points a. Assume the international parity conditions hold. Calculate V.", by discounting at CNY and then converting into TL at the current spot rate (15 points) b. Suppose expected future spot rates are ELS, C-CNY 2.8/TL EISN-CNY 2.7/TL EjSj-CNY 2.7/TL Should the company invest in this project? How should it respond to the market disequilibrium? (20 points) - Apex Corporation must pay its Japanese supplier 125 million in three months. To hedge currency risk it can use call options on (contract size: 1.25 million, Strike Price: $0.008/%, Premium: 0.015 cents per ). Alternatively, Apex can use three-month TIFFE futures contracts (Futures price: 125/5, Contract size: $100000). The current spot rate is $0.007823/4. Apex financial manager believes that the most likely value for then in three months is 0.0079/4. a. Define the hedging strategies for both alternatives. (15 points) b. Calculate what Apex would gain or lose on the option and futures based hedging strategies if the yen settled at its most likely value. (15 points) Consider the following swap pricing schedule for currency coupon swaps of euro and dollars. Currency Coupon Swap Pricing Schedule (S/E) Maturity Midrate (in) 2 years 2.35% (s.l. compounded) Deduct 5 bps if the bank is paying a fixed rate. Add 5 bps if the bank is receiving a fixed rate. All quotes are against 6-month euro LIBOR flat. the spot rate is $1.35/. Yield curves are flat and the euro is selling at a 6-month forward premium -45 bps. Bonds in Germany and United States are quoted as a bond equivalent yield. a. What is the euro interest rate that corresponds to the 2-year dollar swap mid-rate? Note thi interest rates are compounded semiannually. (15 points) b. A German company has 20 million of 2-year euro debt at a floating rate of 6-month LIBOR + 75 bps (MMY). The company wants to swap this into fixed rate dollar debt using fully covered currency coupon swap. What is the all-in cost of the company's euro-for-doll currency coupon swap? (20 points) 1. Suppose a Turkish company investigates an investment opportunity in China. The project costs TL 10 million. The company expects to produce annual cash inflows of CNY 12 million for the next 3 years. The risk adjusted appropriate il discount rate for the project (") is 12%. The current spot- exchange rate is CNY 3/12. Yield curves are flat and the Vis selling at a 6-month forward premium of 95 basis points a. Assume the international parity conditions hold. Calculate V.", by discounting at CNY and then converting into TL at the current spot rate (15 points) b. Suppose expected future spot rates are ELS, C-CNY 2.8/TL EISN-CNY 2.7/TL EjSj-CNY 2.7/TL Should the company invest in this project? How should it respond to the market disequilibrium? (20 points) - Apex Corporation must pay its Japanese supplier 125 million in three months. To hedge currency risk it can use call options on (contract size: 1.25 million, Strike Price: $0.008/%, Premium: 0.015 cents per ). Alternatively, Apex can use three-month TIFFE futures contracts (Futures price: 125/5, Contract size: $100000). The current spot rate is $0.007823/4. Apex financial manager believes that the most likely value for then in three months is 0.0079/4. a. Define the hedging strategies for both alternatives. (15 points) b. Calculate what Apex would gain or lose on the option and futures based hedging strategies if the yen settled at its most likely value. (15 points) Consider the following swap pricing schedule for currency coupon swaps of euro and dollars. Currency Coupon Swap Pricing Schedule (S/E) Maturity Midrate (in) 2 years 2.35% (s.l. compounded) Deduct 5 bps if the bank is paying a fixed rate. Add 5 bps if the bank is receiving a fixed rate. All quotes are against 6-month euro LIBOR flat. the spot rate is $1.35/. Yield curves are flat and the euro is selling at a 6-month forward premium -45 bps. Bonds in Germany and United States are quoted as a bond equivalent yield. a. What is the euro interest rate that corresponds to the 2-year dollar swap mid-rate? Note thi interest rates are compounded semiannually. (15 points) b. A German company has 20 million of 2-year euro debt at a floating rate of 6-month LIBOR + 75 bps (MMY). The company wants to swap this into fixed rate dollar debt using fully covered currency coupon swap. What is the all-in cost of the company's euro-for-doll currency coupon swap? (20 points)