Answered step by step

Verified Expert Solution

Question

1 Approved Answer

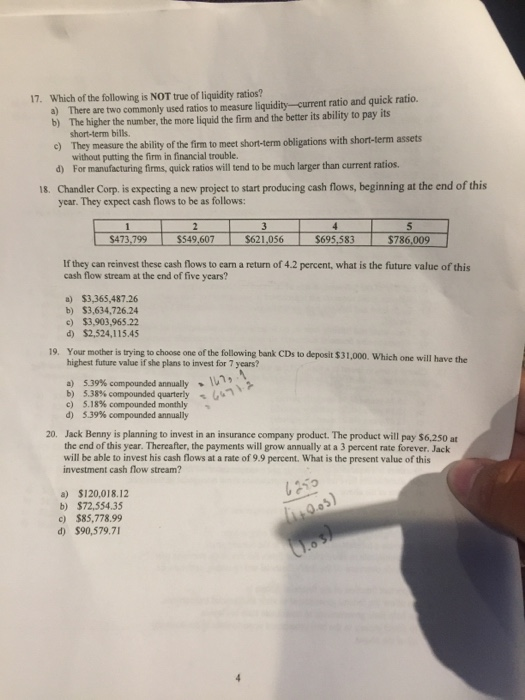

Answer all Which of the following is NOT true of liquidity ratios? a) 17. There are two commonly used ratios to measure liquidity-current ratio and

Answer all

Which of the following is NOT true of liquidity ratios? a) 17. There are two commonly used ratios to measure liquidity-current ratio and quick ratio. The higher the number, the more liquid the firm and the better its ability to pay its short-term bills. b) e) d) For manufacturing firms, quick ratios will tend to be much larger than current ratios Chandler Cop is especting a new project to start producing cash flows, beginning at the end of this They measure the ability of the firm to meet short-term obligations without putting the firm in financial trouble. with short-term assets 11. year. They expect cash flows to be as follows: $473.799 7 $549,607 $621,056 $695,583 $786,009 If they can reinvest these cash flows to eam a return of 4.2 percent, what is the future value of this cash flow stream at the end of five years? a) $3,365,487.26 b) $3,634,726.24 c) $3,903,965.22 d) $2,524,115.45 Your mother is trying to choose one of the following bank CDs to deposit $31,000. Which one will have the highest future value if she plans to invest for 7 years? 19. 539% compounded annually 5.38% compounded quarterly 5.18% compounded monthly a) b) c) d) 5.39% compounded annually 20. Jack Benny is planning to invest in an insurance company product. The product will pay $6,250 at the end of this year. Thereafter, the payments will grow annually at a 3 percent rate forever. Jack will be able to invest his cash flows at a rate of 9.9 percent. What is the present value of this investment cash flow stream? a) $120,018.12 b) $72,554.35 c) $85,778.99 d) $90,579.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started