please help

help

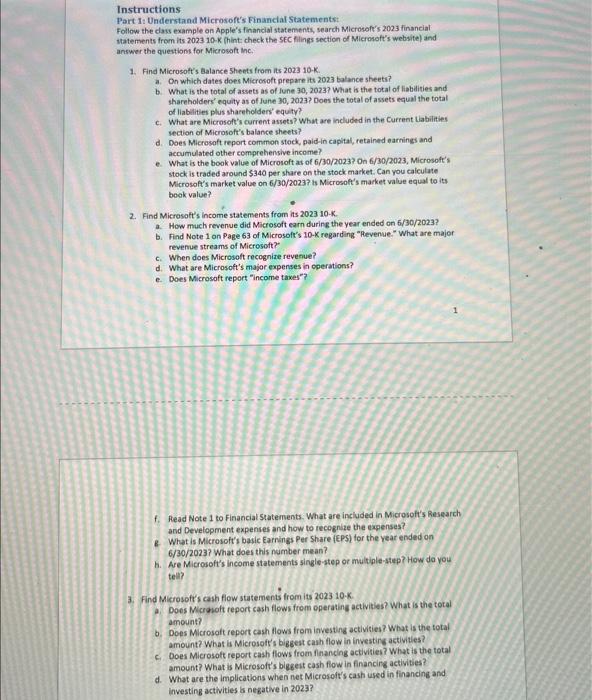

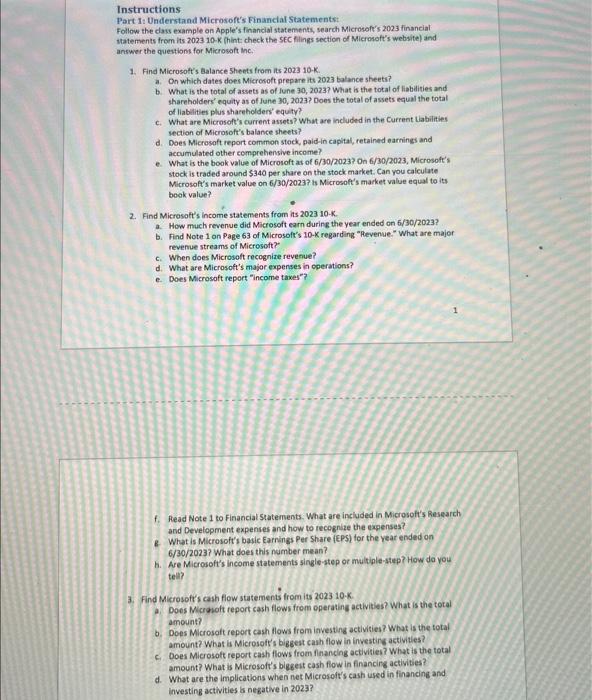

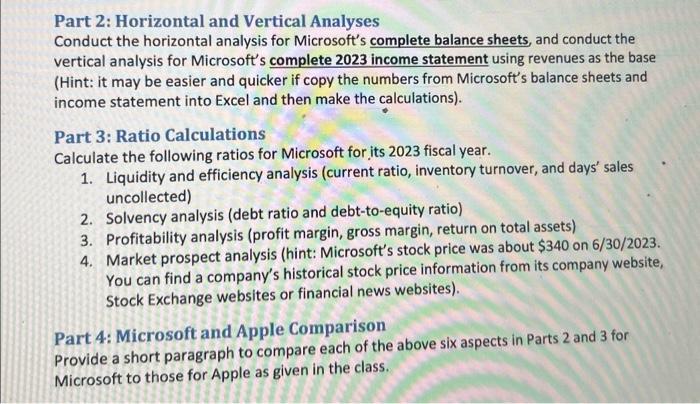

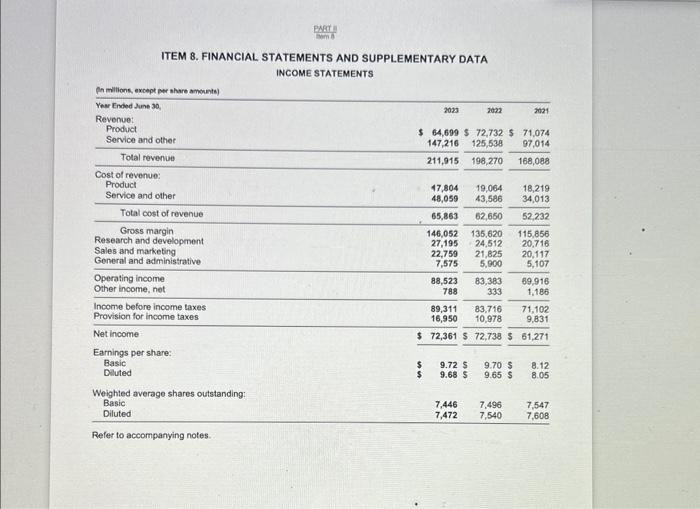

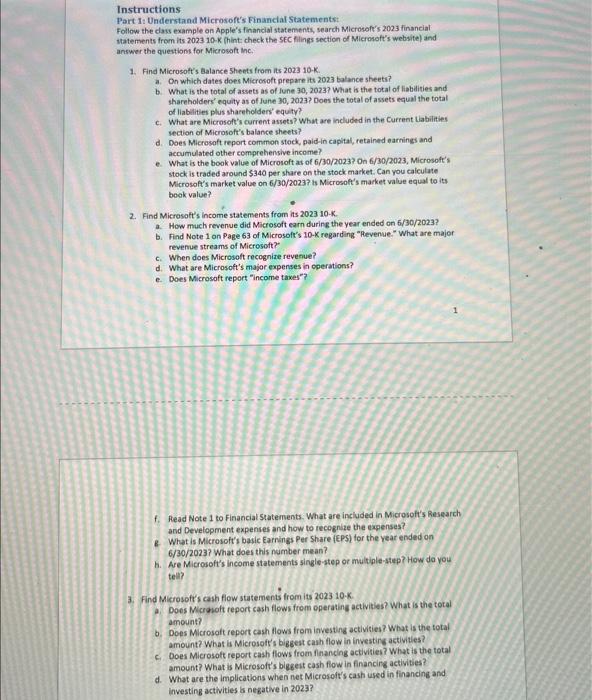

Part 2: Horizontal and Vertical Analyses Conduct the horizontal analysis for Microsoft's complete balance sheets, and conduct the vertical analysis for Microsoft's complete 2023 income statement using revenues as the base (Hint: it may be easier and quicker if copy the numbers from Microsoft's balance sheets and income statement into Excel and then make the calculations). Part 3: Ratio Calculations Calculate the following ratios for Microsoft for its 2023 fiscal year. 1. Liquidity and efficiency analysis (current ratio, inventory turnover, and days' sales uncollected) 2. Solvency analysis (debt ratio and debt-to-equity ratio) 3. Profitability analysis (profit margin, gross margin, return on total assets) 4. Market prospect analysis (hint: Microsoft's stock price was about $340 on 6/30/2023. You can find a company's historical stock price information from its company website, Stock Exchange websites or financial news websites). Part 4: Microsoft and Apple Comparison Provide a short paragraph to compare each of the above six aspects in Parts 2 and 3 for Microsoft to those for Apple as given in the class. Instructions Part 1: Understand Microsoft's Finandal Statements: Follow the dass example on Apple's financial statements, search Microsof's 2023 financial statements from its 202310 - K (hint check the SEC filings section of Microsoft's website) and answer the questions for Microsoft inc. 1. Find Microsott's Balance Sheets from its 202310K. a. On which dates does Microsoft prepare its 2023 balance sheets? b. What is the total of assets as of lune 30,2023 ? What is the total of liabilities and shareholder' equity as of fune 30, 2023? Does the total of assets equal the total of liabilities plus shareholders' equity? c. What are Microsoft's current assets? What are included in the Current Uabilities section of Microsoff's balance sheets? d. Does Microsaft report common stock, paid-in capital, retained earnings and accumulated other comprehensive income? e. What is the book value of Microsoft as of 6/30/2023 ? On 6/30/2023, Microsoft's stock is traded around $340 per share on the stock market. Can you calculate Microsoft's market value on 6/30/2023 ? is Microsoft's market value equal to its beok value? 2. Find Microsott's income statements from its 202310K. a. How much revenue did Microsoft earn during the year ended on 6/30/2023 ? b. Find Note 1 on Page 63 of Microsoft's 10-X regarding "Revenue:" What are major revenue streams of Microsoft? c. When does Microsoft recognize revenue? d. What are Microsoft's major expenses in cperations? e. Does Microsoft report "income taxes"? 1 f. Read Note 1 to Financial Statements. What are included in Microsoff's Research and Development expenses and how to recognize the expenses? 2. What is Microsoft's basic Earnings Per Share (CPS) for the year ended on 6/30/2023 ? What does this number mean? h. Are Microsoft's income statements single-step or multiple-step? How do you telli? 3. Find Microsoft's cash flow statements from its 202310K. a. Does Microsoft report cash flows from operating activities? What is the total amount? b. Does Microsaft report cash flows from investing activities? What is the total amount? What is Microsoff's biggest cash flow in investirs activiles? c. Does Mierosoft report cash flows from financing activities? What is the total amount? What is Microsoft's bigest cash flow in financing activities? d. What are the implications when net Microsoft's cash used in financing and investing activities b negative in 2023 ? ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INCOME STATEMENTS Part 2: Horizontal and Vertical Analyses Conduct the horizontal analysis for Microsoft's complete balance sheets, and conduct the vertical analysis for Microsoft's complete 2023 income statement using revenues as the base (Hint: it may be easier and quicker if copy the numbers from Microsoft's balance sheets and income statement into Excel and then make the calculations). Part 3: Ratio Calculations Calculate the following ratios for Microsoft for its 2023 fiscal year. 1. Liquidity and efficiency analysis (current ratio, inventory turnover, and days' sales uncollected) 2. Solvency analysis (debt ratio and debt-to-equity ratio) 3. Profitability analysis (profit margin, gross margin, return on total assets) 4. Market prospect analysis (hint: Microsoft's stock price was about $340 on 6/30/2023. You can find a company's historical stock price information from its company website, Stock Exchange websites or financial news websites). Part 4: Microsoft and Apple Comparison Provide a short paragraph to compare each of the above six aspects in Parts 2 and 3 for Microsoft to those for Apple as given in the class. Instructions Part 1: Understand Microsoft's Finandal Statements: Follow the dass example on Apple's financial statements, search Microsof's 2023 financial statements from its 202310 - K (hint check the SEC filings section of Microsoft's website) and answer the questions for Microsoft inc. 1. Find Microsott's Balance Sheets from its 202310K. a. On which dates does Microsoft prepare its 2023 balance sheets? b. What is the total of assets as of lune 30,2023 ? What is the total of liabilities and shareholder' equity as of fune 30, 2023? Does the total of assets equal the total of liabilities plus shareholders' equity? c. What are Microsoft's current assets? What are included in the Current Uabilities section of Microsoff's balance sheets? d. Does Microsaft report common stock, paid-in capital, retained earnings and accumulated other comprehensive income? e. What is the book value of Microsoft as of 6/30/2023 ? On 6/30/2023, Microsoft's stock is traded around $340 per share on the stock market. Can you calculate Microsoft's market value on 6/30/2023 ? is Microsoft's market value equal to its beok value? 2. Find Microsott's income statements from its 202310K. a. How much revenue did Microsoft earn during the year ended on 6/30/2023 ? b. Find Note 1 on Page 63 of Microsoft's 10-X regarding "Revenue:" What are major revenue streams of Microsoft? c. When does Microsoft recognize revenue? d. What are Microsoft's major expenses in cperations? e. Does Microsoft report "income taxes"? 1 f. Read Note 1 to Financial Statements. What are included in Microsoff's Research and Development expenses and how to recognize the expenses? 2. What is Microsoft's basic Earnings Per Share (CPS) for the year ended on 6/30/2023 ? What does this number mean? h. Are Microsoft's income statements single-step or multiple-step? How do you telli? 3. Find Microsoft's cash flow statements from its 202310K. a. Does Microsoft report cash flows from operating activities? What is the total amount? b. Does Microsaft report cash flows from investing activities? What is the total amount? What is Microsoff's biggest cash flow in investirs activiles? c. Does Mierosoft report cash flows from financing activities? What is the total amount? What is Microsoft's bigest cash flow in financing activities? d. What are the implications when net Microsoft's cash used in financing and investing activities b negative in 2023 ? ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INCOME STATEMENTS