Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all Which one of the following is NOT a benefit A. Securitization enables banks to increase loan origination B. Securitization allows investors direct access

answer all

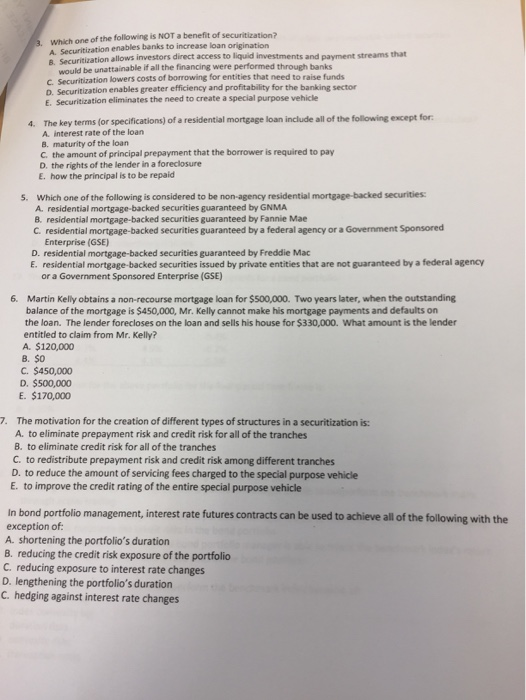

Which one of the following is NOT a benefit A. Securitization enables banks to increase loan origination B. Securitization allows investors direct access to liquid investments and payment streams that of securitization? C. Securitizatioai D. Securitization enables greater efficiency and profitability for the banking sector E. Securitization eliminates the need to create a special purpose vehicle be unattainable if all the financing were performed through banks would lowers costs of borrowing for entities that need to raise funds 4. The key terms (or specifications) of a residential mortgage loan include all of the following except for A. interest rate of the loan 8. maturity of the loan C. the amount of principal prepayment that the borrower is required to pay D. the rights of the lender in a foreclosure E. how the principal is to be repaid Which one of the following is considered to be non-agency residential mortgage-backed securities s. A. residential mortgage-backed securities guaranteed by GNMA B. residential mortgage-backed securities guaranteed by Fannie Mae C. residential mortgage-backed securities guaranteed by a federal agency or a Government Sponsored Enterprise (GSE) D. residential mortgage-backed securities guaranteed by Freddie Mac E. residential mortgage-backed securities issued by private entities that are not guaranteed by a federal agency or a Government Sponsored Enterprise (GSE) 6. Martin Kelly obtains a non-recourse mortgage loan for $500,000. Two years later, when the outstanding balance of the mortgage is $450,000, Mr. Kelly cannot make his mortgage payments and defaults on the loan. The lender forecloses on the loan and sells his house for $330,000. What amount is the lender entitled to claim from Mr. Kelly? A. $120,000 .so C. $450,000 D. $500,000 E. $170,000 7. The motivation for the creation of different types of structures in a securitization is: A. to eliminate prepayment risk and credit risk for all of the tranches B. to eliminate credit risk for all of the tranches C. to redistribute prepayment risk and credit risk among different tranches D. to reduce the amount of servicing fees charged to the special purpose vehicle E. to improve the credit rating of the entire special purpose vehicle In bond portfolio management, interest rate futures contracts can be used to achieve all of the following with the exception of A. shortening the portfolio's duration B. reducing the credit risk exposure of the portfolio C. reducing exposure to interest rate changes D. lengthening the portfolio's duration C. hedging against interest rate changes Which one of the following is NOT a benefit A. Securitization enables banks to increase loan origination B. Securitization allows investors direct access to liquid investments and payment streams that of securitization? C. Securitizatioai D. Securitization enables greater efficiency and profitability for the banking sector E. Securitization eliminates the need to create a special purpose vehicle be unattainable if all the financing were performed through banks would lowers costs of borrowing for entities that need to raise funds 4. The key terms (or specifications) of a residential mortgage loan include all of the following except for A. interest rate of the loan 8. maturity of the loan C. the amount of principal prepayment that the borrower is required to pay D. the rights of the lender in a foreclosure E. how the principal is to be repaid Which one of the following is considered to be non-agency residential mortgage-backed securities s. A. residential mortgage-backed securities guaranteed by GNMA B. residential mortgage-backed securities guaranteed by Fannie Mae C. residential mortgage-backed securities guaranteed by a federal agency or a Government Sponsored Enterprise (GSE) D. residential mortgage-backed securities guaranteed by Freddie Mac E. residential mortgage-backed securities issued by private entities that are not guaranteed by a federal agency or a Government Sponsored Enterprise (GSE) 6. Martin Kelly obtains a non-recourse mortgage loan for $500,000. Two years later, when the outstanding balance of the mortgage is $450,000, Mr. Kelly cannot make his mortgage payments and defaults on the loan. The lender forecloses on the loan and sells his house for $330,000. What amount is the lender entitled to claim from Mr. Kelly? A. $120,000 .so C. $450,000 D. $500,000 E. $170,000 7. The motivation for the creation of different types of structures in a securitization is: A. to eliminate prepayment risk and credit risk for all of the tranches B. to eliminate credit risk for all of the tranches C. to redistribute prepayment risk and credit risk among different tranches D. to reduce the amount of servicing fees charged to the special purpose vehicle E. to improve the credit rating of the entire special purpose vehicle In bond portfolio management, interest rate futures contracts can be used to achieve all of the following with the exception of A. shortening the portfolio's duration B. reducing the credit risk exposure of the portfolio C. reducing exposure to interest rate changes D. lengthening the portfolio's duration C. hedging against interest rate changes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started