Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all will give thumbs up 4. (sport) Given the following information on the dollar and the Russian ruble, a foreign exchange trader at Credit

answer all will give thumbs up

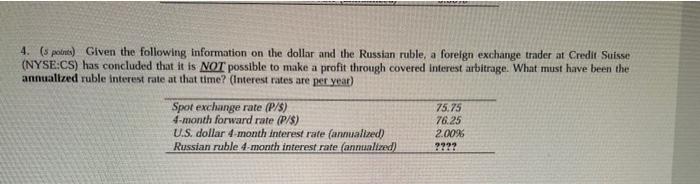

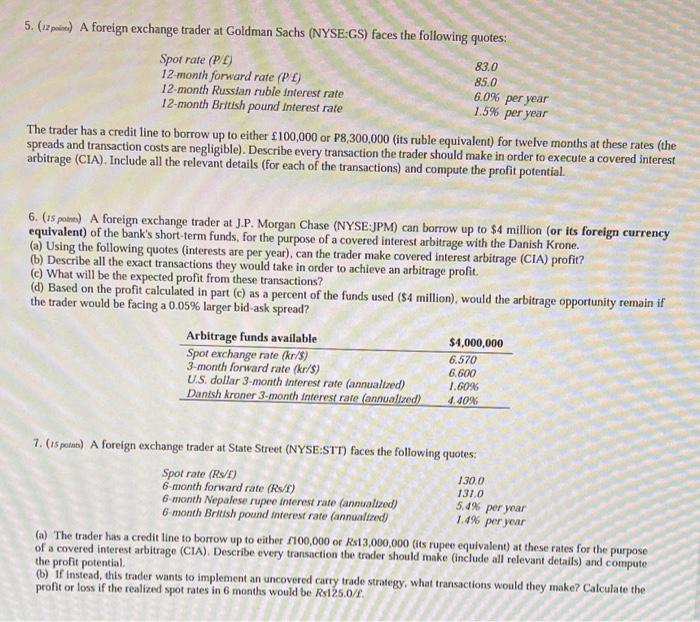

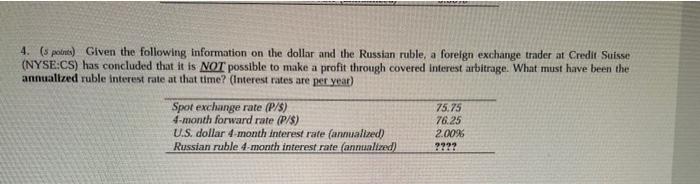

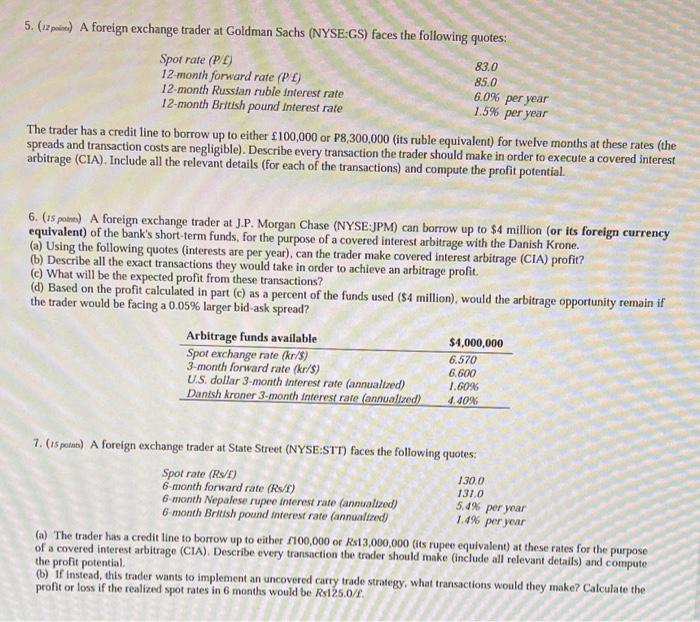

4. (sport) Given the following information on the dollar and the Russian ruble, a foreign exchange trader at Credit Suisse (NYSE:CS) has concluded that it is NOT possible to make a profit through covered interest arbitrage. What must have been the annualized ruble interest rate at that time? (Interest rates are per year) Spor exchange rate (P/8) 4-month forward rate (P/$) U.S. dollar 4-month interest rate (annualized) Russian ruble 4-month interest rate (annualized) 75.75 76.25 2.00% ???? 5. (17 poinen) A foreign exchange trader at Goldman Sachs (NYSE:GS) faces the following quotes: 85.0 Spot rate (PE) 83.0 12 month forward rate (PL) 12 month Russian ruble Interest rate 6.0% per year 12-month British pound Interest rate 1.5% per year The trader has a credit line to borrow up to either 100,000 or P8 300,000 (its ruble equivalent) for twelve months at these rates (the spreads and transaction costs are negligible). Describe every transaction the trader should make in order to execute a covered interest arbitrage (CIA). Include all the relevant details (for each of the transactions) and compute the profit potential . 6. (15 paire) A foreign exchange trader at J.P. Morgan Chase (NYSE:JPM) can borrow up to $4 million (or its foreign currency equivalent) of the bank's short-term funds, for the purpose of a covered interest arbitrage with the Danish Krone. (3) Using the following quotes (interests are per year), can the trader make covered interest arbitrage (CIA) profit? 6) Describe all the exact transactions they would take in order to achieve an arbitrage profit. (c) What will be the expected profit from these transactions? (d) Based on the profit calculated in part (e) as a percent of the funds used (84 million), would the arbitrage opportunity remain if the trader would be facing a 0.05% larger bid-ask spread? Arbitrage funds available $4,000,000 Spot exchange rate (kr/8) 6.570 3-month forward rate (kr/S) 6.600 U.S. dollar 3-month Interest rate (annualized) 1.60% Danish kroner 3-month interest rate (annualized) 4.40% 7. (15 petne) A foreign exchange trader at State Street (NYSE:STT) faces the following quotes: Spot rate (R/E) 130.0 6-month forward rate (Rs/) 131.0 6 month Nepalese rupee Interest rate (annualized) 5.4% per year 6 month British pound interest rate (annualized) 1.4% per year (a) The trader has a credit line to borrow up to either $100,000 or Rs13,000,000 (its rupee equivalent) at these rates for the purpose of a covered interest arbitrage (CIA). Describe every transaction the trader should make (include all relevant details and compute the profit potential. (b) if instead, this trader wants to implement an uncovered carry trade strategy, what transactions would they make? Calculate the profit or loss if the realized spot rates in 6 months would be Rs125.0/4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started