Answered step by step

Verified Expert Solution

Question

1 Approved Answer

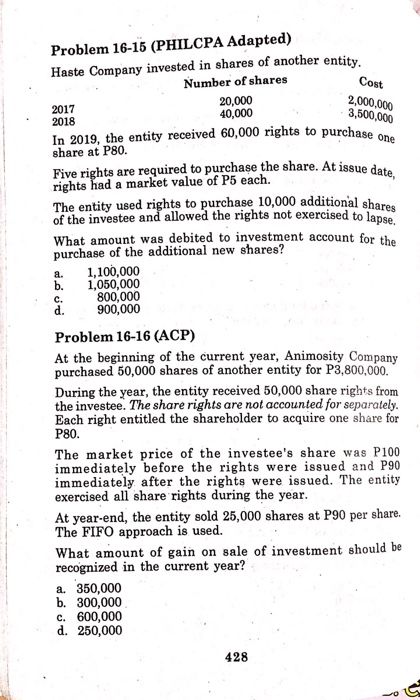

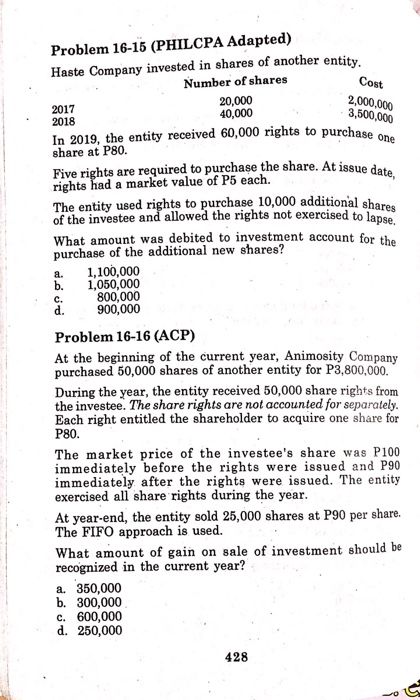

answer and show your solution Problem 16-15 (PHILCPA Adapted) Haste Company invested in shares of another entity. Number of shares Cost 20,000 40,000 2,000,000 3,500,000

answer and show your solution

Problem 16-15 (PHILCPA Adapted) Haste Company invested in shares of another entity. Number of shares Cost 20,000 40,000 2,000,000 3,500,000 2017 2018 In 2019, the entity received 60,000 rights to purchase share at P80 Five rights are required to purchase the share. At issue date, rights had a market value of P5 each The entity used rights to purchase 10,000 additional sharee of the investee and allowed the rights not exercised to lapse. one What amount was debited to investment account for the purchase of the additional new shares? 1,100,000 . 1,050,000 b. 800,000 900,000 C. d. Problem 16-16 (ACP) At the beginning of the current year, Animosity Company purchased 50,000 shares of another entity for P3,800,000. During the year, the entity received 50,000 share rights from the investee. The share rights are not accounted for separately. Each right entitled the shareholder to acquire one share for P80 The market price of the investee's share was P100 immediately before the rights were issued and P90 immediately after the rights were issued. The entity exercised all share rights during the year At year-end, the entity sold 25,000 shares at P90 per share. The FIFO approach is used. What amount of gain on sale of investment should be recognized in the current year? 350,000 b. 300,000 c. 600,000 d. 250,000 . 428

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started