Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer and show your solution Problem 17-8 (AICPA Adapted) On July 1, 2019 Blush Company purchased 20% of the outstanding ordinary shares of an investee

answer and show your solution

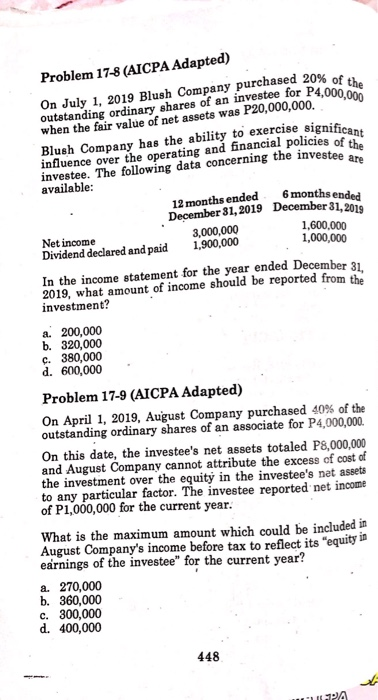

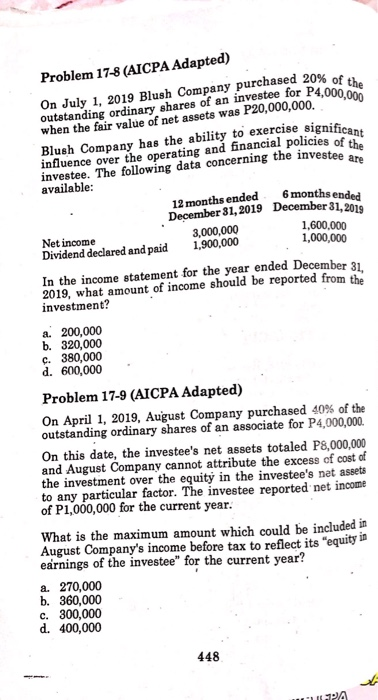

Problem 17-8 (AICPA Adapted) On July 1, 2019 Blush Company purchased 20% of the outstanding ordinary shares of an investee for P4,000,000 when the fair value of net assets was P20,000,000. Blush Company has the ability to exercise significan influence over the operating and financial policies of the investee. The following data concerning the investee are available: 6 months ended 12 months ended December 31,2019 December 31,2019 1,600,000 1,000,000 3,000,000 1,900,000 Net income Dividend declared and paid In the income statement for the year ended December 31, 2019, what amount of income should be reported from the investment? a. 200,000 b. 320,000 c. 380,000 d. 600,000 Problem 17-9 (AICPA Adapted) On April 1, 2019, August Company purchased 40% of the outstanding ordinary shares of an associate for P4,000,000. On this date, the investee's net assets totaled P8,000,000 and August Company cannot attribute the excess of cost of the investment over the equity in the investee's nat assets to any particular factor. The investee reported net income of P1,000,000 for the current year What is the maximum amount which could be included in August Company's income before tax to reflect its "equity in earnings of the investee" for the current year? 270,000 b. 360,000 300,000 d. 400,000 a. C. 448

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started