Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer and show your solution Problem 20-3 (AICPA Adapted) Ball Company determined as result of a plant rearrangemen that there had been a significant change

answer and show your solution

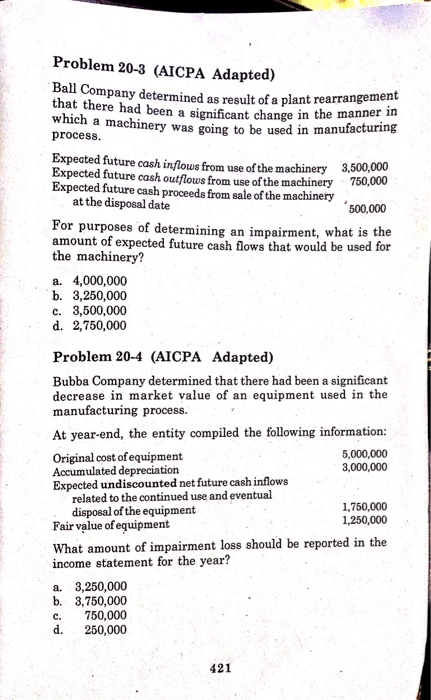

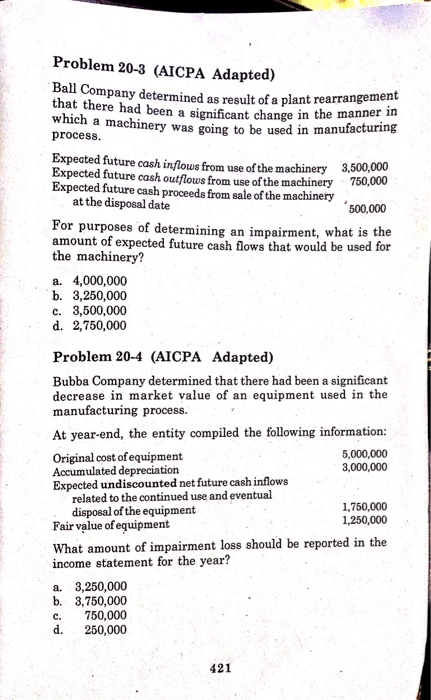

Problem 20-3 (AICPA Adapted) Ball Company determined as result of a plant rearrangemen that there had been a significant change in the mannet which process. in a machinery was going to be used in manufacturing Expected future cash inflows from use of the machinery Expected future cash outflows from use of the machinery Expected future cash proceeds from sale of the machinery 3,500,000 750,000 at the disposal date 500,000 For purposes of determining an impairment, what is amount of expected future cash flows that would be used for the machinery? the a. 4,000,000 b. 3,250,000 c. 3,500,000 d. 2,750,000 Problem 20-4 (AICPA Adapted) Bubba Company determined that there had been a significant decrease in market value of an equipment used in the manufacturing process. At year-end, the entity compiled the following information: Original cost of equipment Accumulated depreciation Expected undiscounted net future cash inflows 5,000,000 3,000,000 related to the continued use and eventual 1,750,000 disposal of the equipment Fair value of equipment 1,250,000 What amount of impairment loss should be reported in the income statement for the year? a. 3,250,000 b. 3,750,000 c. 750,000 d. 250,000 421

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started