Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer Answer choices 1. - Higher - Lower 2. - Higher - Lower 3. -process guarine into further into rhydrolite -sell the guarine at split

Answer

Answer choices

1. - Higher - Lower

2. - Higher - Lower

3.

-process guarine into further into rhydrolite

-sell the guarine at split off

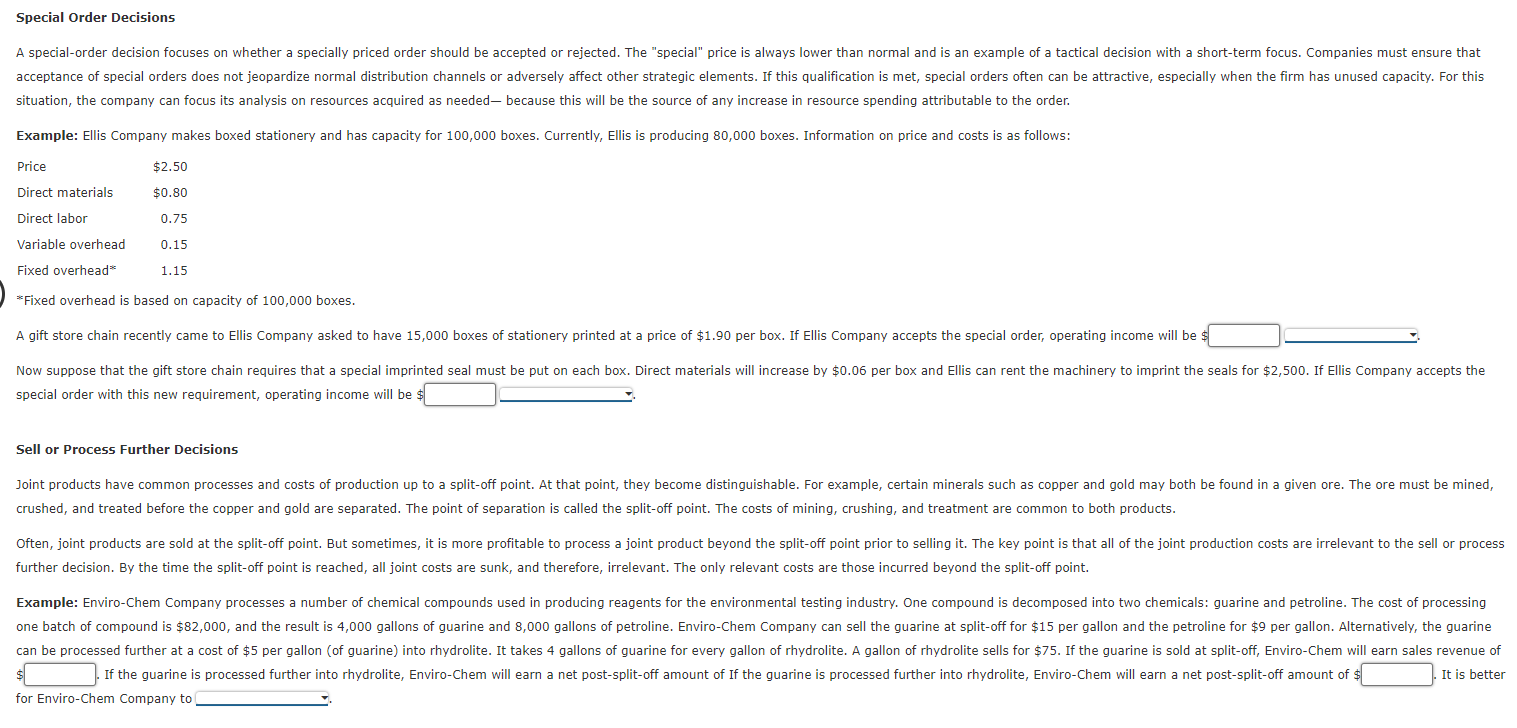

Special Order Decisions A special-order decision focuses on whether a specially priced order should be accepted or rejected. The "special" price is always lower than normal and is an example of a tactical decision with a short-term focus. Companies must ensure that acceptance of special orders does not jeopardize normal distribution channels or adversely affect other strategic elements. If this qualification is met, special orders often can be attractive, especially when the firm has unused capacity. For this situation, the company can focus its analysis on resources acquired as needed, because this will be the source of any increase in resource spending attributable to the order. Example: Ellis Company makes boxed stationery and has capacity for 100,000 boxes. Currently, Ellis is producing 80,000 boxes. Information on price and costs is as follows: Price $2.50 Direct materials $0.80 Direct labor 0.75 Variable overhead 0.15 Fixed overhead 1.15 *Fixed overhead is based on capacity of 100,000 boxes. A gift store chain recently came to Ellis Company asked to have 15,000 boxes of stationery printed at a price of $1.90 per box. If Ellis Company accepts the special order, operating income will be $ Now suppose that the gift store chain requires that a special imprinted seal must be put on each box. Direct materials will increase by $0.06 per box and Ellis can rent the machinery to imprint the seals for $2,500. If Ellis Company accepts the special order with this new requirement, operating income will be $ Sell or Process Further Decisions Joint products have common processes and costs of production up to a split-off point. At that point, they become distinguishable. For example, certain minerals such as copper and gold may both be found in a given ore. The ore must be mined, crushed, and treated before the copper and gold are separated. The point of separation is called the split-off point. The costs of mining, crushing, and treatment are common to both products. Often, joint products are sold at the split-off point. But sometimes, it is more profitable to process a joint product beyond the split-off point prior to selling it. The key point is that all of the joint production costs are irrelevant to the sell or process further decision. By the time the split-off point is reached, all joint costs are sunk, and therefore, irrelevant. The only relevant costs are those incurred beyond the split-off point. Example: Enviro-Chem Company processes a number of chemical compounds used in producing reagents for the environmental testing industry. One compound is decomposed into two chemicals: guarine and petroline. The cost of processing one batch of compound is $82,000, and the result is 4,000 gallons of guarine and 8,000 gallons of petroline. Enviro-Chem Company can sell the guarine at split-off for $15 per gallon and the petroline for $9 per gallon. Alternatively, the guarine can be processed further at a cost of $5 per gallon (of guarine) into rhydrolite. It takes 4 gallons of guarine for every gallon of rhydrolite. A gallon of rhydrolite sells for $75. If the guarine is sold at split-off, Enviro-Chem will earn sales revenue of It is better If the guarine is processed further into rhydrolite, Enviro-Chem will earn a net post-split-off amount of If the guarine is processed further into rhydrolite, Enviro-Chem will earn a net post-split-off amount of $ for Enviro-Chem Company toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started