Answered step by step

Verified Expert Solution

Question

1 Approved Answer

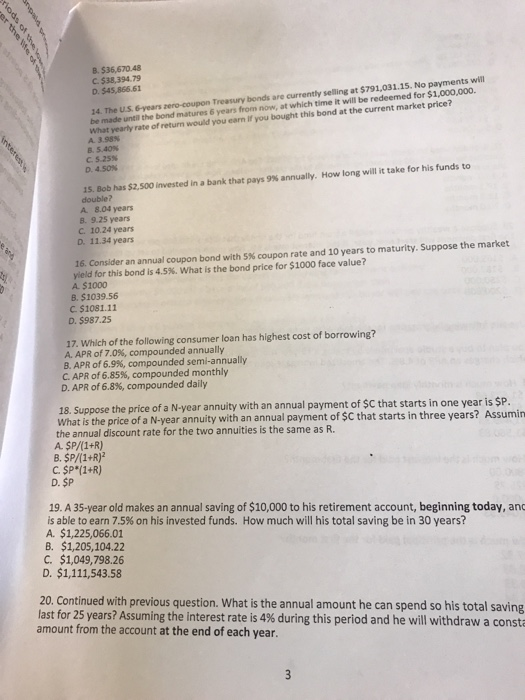

answer any B. $36,670.48 C$38,394.79 D. 14. The U.S. 6-years zero-coupon Treasury bonds are currently seling at $791,031.15. No payments will be made until the

answer any

B. $36,670.48 C$38,394.79 D. 14. The U.S. 6-years zero-coupon Treasury bonds are currently seling at $791,031.15. No payments will be made until the bond matures 6 years from now, at which time it will be redeemed for $1,000,000. What yearly rate of return would you earn if you bought this bond at the current market price? A.3.98% B. 5.40% C. s25% D.4S0% 15. Bob has $2.500 invested in a bank that pays 9% annually. double? How long will it take for his funds to A 8.04 years B. 9.25 years C. 10.24 years D. 11.34 years 16. Consider an annual coupon bond with S% coupon rate and 10 years to maturity. Suppose the market yield for this bond is 4.5%. What is the bond price for $1000 face value? A $1000 B. $1039.56 c s1081.11 D. $987.25 17. Which of the following consumer loan has highest cost of borrowing? A. APR of 7.0%, compounded annually B. APR of 6.9%, compounded semi-annually C. APR of 6.85%, compounded monthly D. APR of 6.8%, compounded daily 18. Suppose the price of a N-year annuity with an annual payment of $C that starts in one year is $P What is the price of a N-year annuity with an annual payment of $C that starts in three years? Assumin the annual discount rate for the two annuities is the same as R A $P/(1+R) B. SP/(1+R)2 C. $P (1+R) 19. A 35-year old makes an annual saving of $10,000 to his retirement account, beginning today, and is able to earn 7.5% on his invested funds. How much will his total saving be in 30 years? A. $1,225,066.01 B. $1,205,104.22 C. $1,049,798.26 D. $1,111,543.58 20. Continued with previous question. What is the annual amount he can spend so his total saving last for 25 years? Assuming the interest rate is 4% during this period and he will withdraw a const amount from the account at the end of each year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started