Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer any of them a. T/F You have $2,000 to invest. MARR would be at least what you need pay for borrowing $2000 b. T/F

answer any of them

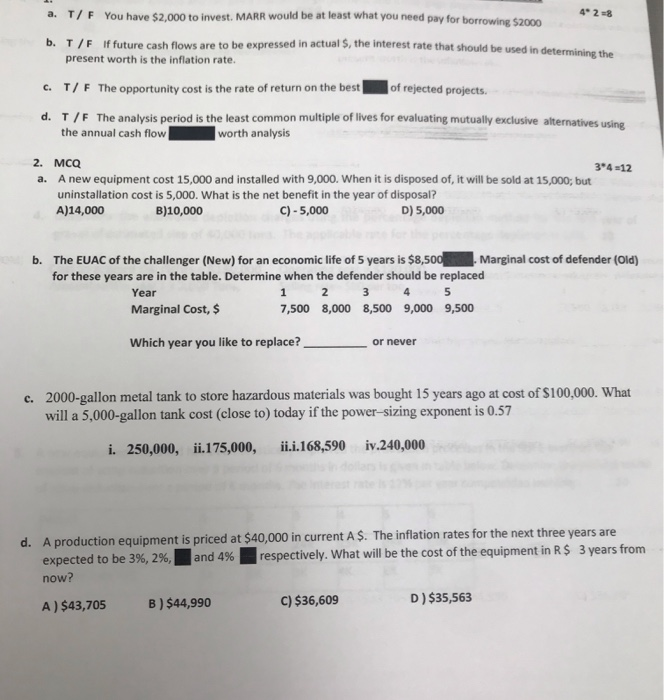

a. T/F You have $2,000 to invest. MARR would be at least what you need pay for borrowing $2000 b. T/F If future cash flows are to be expressed in actual 5, the interest rate that should be used in determining the present worth is the inflation rate. of rejected projects. c. T/F The opportunity cost is the rate of return on the best| T/F The analysis period is the least common multiple of lives for evaluating mutually exclusive alternatives using the annual cash flow d. |worth analysis 2. MCQ 34=12 a. A new equipment cost 15,000 and installed with 9,000. When it is disposed of, it will be sold at 15,000; but uninstallation cost is 5,000. What is the net benefit in the year of disposal? C) - 5,000 D) 5,000 A)14,000 B)10,000 b. The EUAC of the challenger (New) for an economic life of 5 years is $8,500 for these years are in the table. Determine when the defender should be replaced Marginal cost of defender (Old) Year 7,500 8,000 8,500 9,000 9,500 Marginal Cost, $ Which year you like to replace? or never c. 2000-gallon metal tank to store hazardous materials was bought 15 years ago at cost of $100,000. What will a 5,000-gallon tank cost (close to) today if the power-sizing exponent is 0.57 ii.i.168,590 iv.240,000 i. 250,000, ii.175,000, A production equipment is priced at $40,000 in current A $. The inflation rates for the next three years are d. expected to be 3%, 2%, 3 years from respectively. What will be the cost of the equipment in R $ and 4% now? D) $35,563 C) $36,609 B) $44,990 A) $43,705 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started