Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer as simple as possible is okay, thanks Under the terms of an interest-rate swap, a financial institution has agreed to pay 6% APR Semi-Annual

answer as simple as possible is okay, thanks

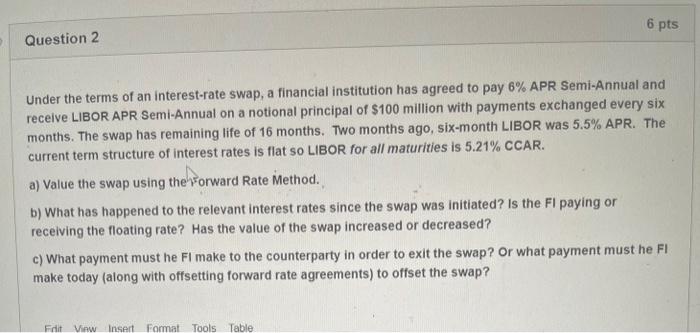

Under the terms of an interest-rate swap, a financial institution has agreed to pay 6% APR Semi-Annual and receive LIBOR APR Semi-Annual on a notional principal of $100 million with payments exchanged every six months. The swap has remaining life of 16 months. Two months ago, six-month LIBOR was 5.5% APR. The current term structure of interest rates is flat so LIBOR for all maturities is 5.21% CCAR. a) Value the swap using therorward Rate Method. b) What has happened to the relevant interest rates since the swap was initiated? Is the FI paying or receiving the floating rate? Has the value of the swap increased or decreased? c) What payment must he FI make to the counterparty in order to exit the swap? Or what payment must he FI make today (along with offsetting forward rate agreements) to offset the swap? Under the terms of an interest-rate swap, a financial institution has agreed to pay 6% APR Semi-Annual and receive LIBOR APR Semi-Annual on a notional principal of $100 million with payments exchanged every six months. The swap has remaining life of 16 months. Two months ago, six-month LIBOR was 5.5% APR. The current term structure of interest rates is flat so LIBOR for all maturities is 5.21% CCAR. a) Value the swap using therorward Rate Method. b) What has happened to the relevant interest rates since the swap was initiated? Is the FI paying or receiving the floating rate? Has the value of the swap increased or decreased? c) What payment must he FI make to the counterparty in order to exit the swap? Or what payment must he FI make today (along with offsetting forward rate agreements) to offset the swapStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started