Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer as soon as possible thank you QUESTION 2 Mebius Printing owned by Jack commenced its business on 1 July 2010 and ends its account

answer as soon as possible thank you

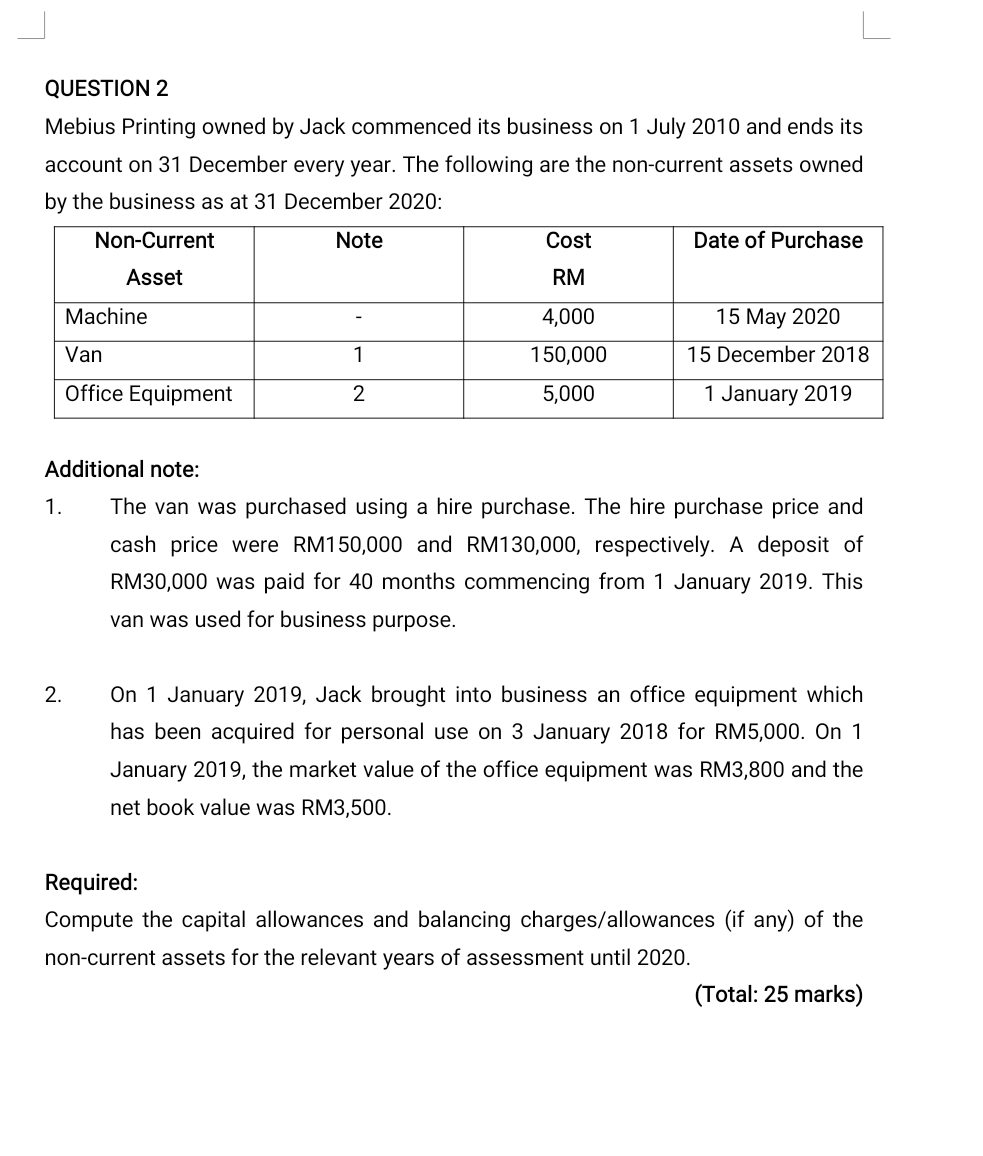

QUESTION 2 Mebius Printing owned by Jack commenced its business on 1 July 2010 and ends its account on 31 December every year. The following are the non-current assets owned by the business as at 31 December 2020: Non-Current Note Cost Date of Purchase Asset RM Machine 4,000 15 May 2020 Van 1 150,000 15 December 2018 Office Equipment 2 5,000 1 January 2019 Additional note: 1. The van was purchased using a hire purchase. The hire purchase price and cash price were RM150,000 and RM130,000, respectively. A deposit of RM30,000 was paid for 40 months commencing from 1 January 2019. This van was used for business purpose. 2. On 1 January 2019, Jack brought into business an office equipment which has been acquired for personal use on 3 January 2018 for RM5,000. On 1 January 2019, the market value of the office equipment was RM3,800 and the net book value was RM3,500. Required: Compute the capital allowances and balancing charges/allowances (if any) of the non-current assets for the relevant years of assessment until 2020. (Total: 25 marks) QUESTION 2 Mebius Printing owned by Jack commenced its business on 1 July 2010 and ends its account on 31 December every year. The following are the non-current assets owned by the business as at 31 December 2020: Non-Current Note Cost Date of Purchase Asset RM Machine 4,000 15 May 2020 Van 1 150,000 15 December 2018 Office Equipment 2 5,000 1 January 2019 Additional note: 1. The van was purchased using a hire purchase. The hire purchase price and cash price were RM150,000 and RM130,000, respectively. A deposit of RM30,000 was paid for 40 months commencing from 1 January 2019. This van was used for business purpose. 2. On 1 January 2019, Jack brought into business an office equipment which has been acquired for personal use on 3 January 2018 for RM5,000. On 1 January 2019, the market value of the office equipment was RM3,800 and the net book value was RM3,500. Required: Compute the capital allowances and balancing charges/allowances (if any) of the non-current assets for the relevant years of assessment until 2020. (Total: 25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started