Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap ABC Fish Farm, a local fish farm, is considering purchasing a new plot of land for their business for $600,000. The land would

answer asap

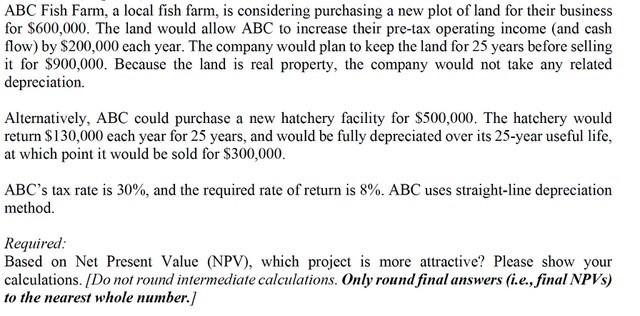

ABC Fish Farm, a local fish farm, is considering purchasing a new plot of land for their business for $600,000. The land would allow ABC to increase their pre-tax operating income (and cash flow) by $200,000 each year. The company would plan to keep the land for 25 years before selling it for $900,000. Because the land is real property, the company would not take any related depreciation. Alternatively, ABC could purchase a new hatchery facility for $500,000. The hatchery would return $130,000 each year for 25 years, and would be fully depreciated over its 25-year useful life, at which point it would be sold for $300,000. ABC's tax rate is 30%, and the required rate of return is 8%. ABC uses straight-line depreciation method. Required: Based on Net Present Value (NPV), which project is more attractive? Please show your calculations. [Do not round intermediate calculations. Only round final answers (i.e., final NPVS) to the nearest whole number.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started