Answered step by step

Verified Expert Solution

Question

1 Approved Answer

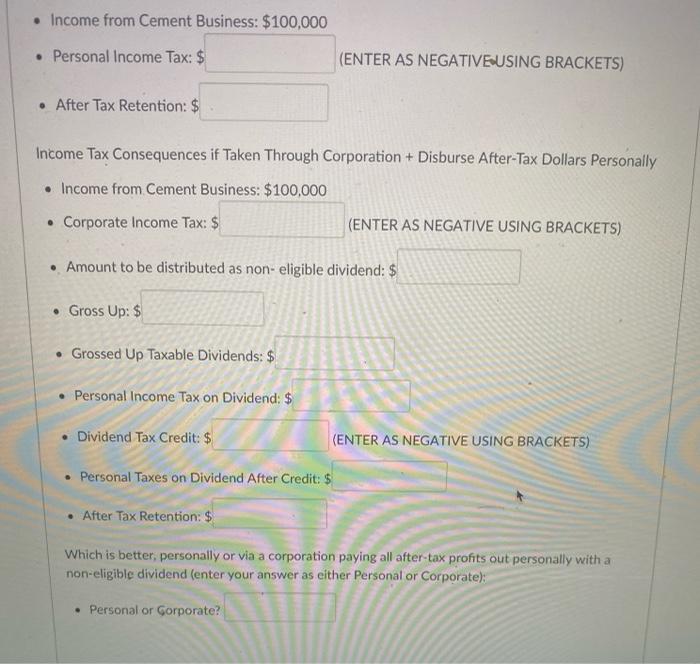

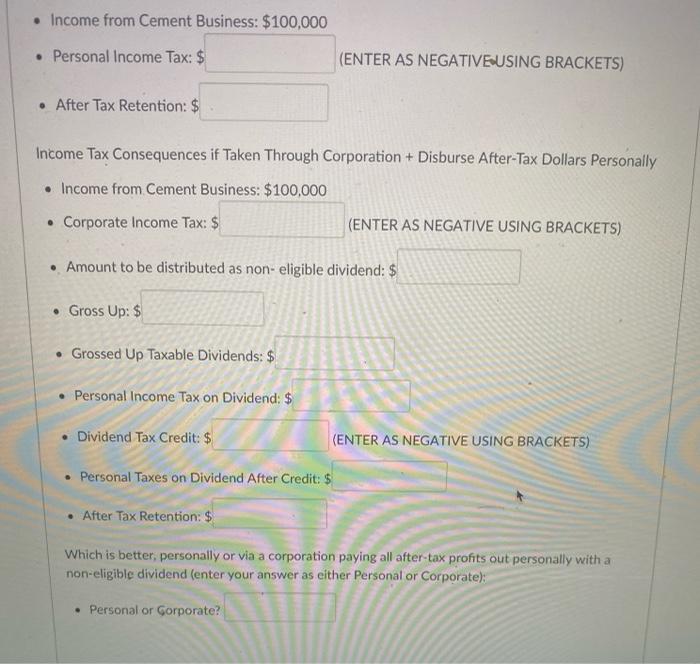

answer asap please and thank you Income from Cement Business: $100,000 Personal Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) . After Tax Retention: $

answer asap please and thank you

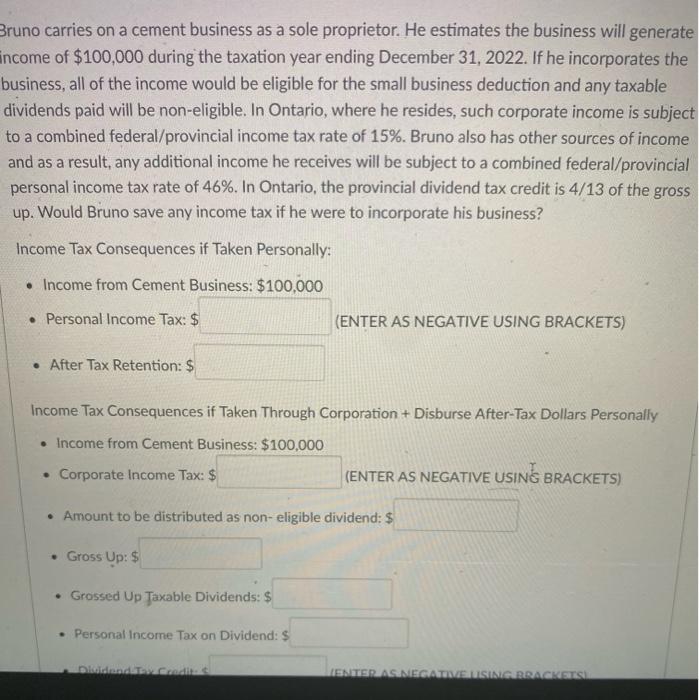

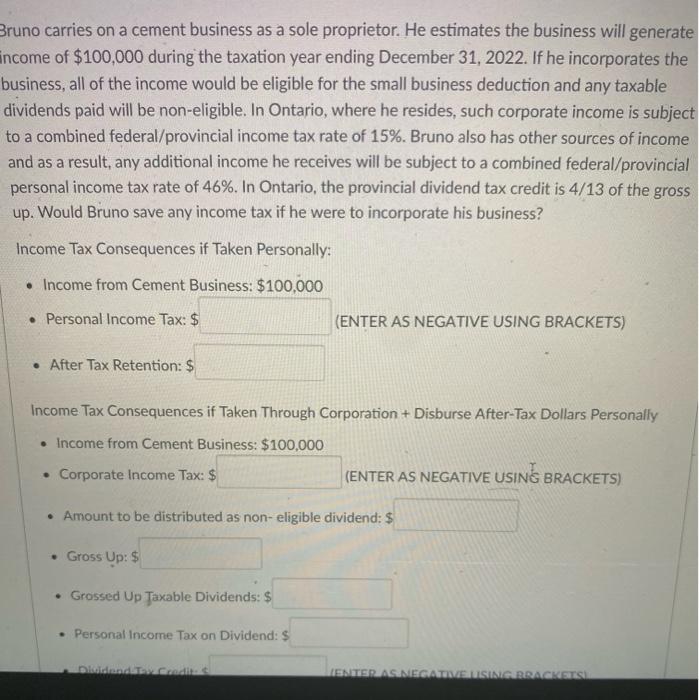

Income from Cement Business: $100,000 Personal Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) . After Tax Retention: $ Income Tax Consequences if Taken Through Corporation + Disburse After-Tax Dollars Personally Income from Cement Business: $100,000 Corporate Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) Amount to be distributed as non- eligible dividend: $ Gross Up: $ Grossed Up Taxable Dividends: $ Personal Income Tax on Dividend: $ Dividend Tax Credit: $ (ENTER AS NEGATIVE USING BRACKETS) Personal Taxes on Dividend After Credit: $ After Tax Retention: $ Which is better personally or via a corporation paying all after-tax profits out personally with a non-eligible dividend (enter your answer as either Personal or Corporate): Personal or Gorporate? Bruno carries on a cement business as a sole proprietor. He estimates the business will generate income of $100,000 during the taxation year ending December 31, 2022. If he incorporates the business, all of the income would be eligible for the small business deduction and any taxable dividends paid will be non-eligible. In Ontario, where he resides, such corporate income is subject to a combined federal/provincial income tax rate of 15%. Bruno also has other sources of income and as a result, any additional income he receives will be subject to a combined federal/provincial personal income tax rate of 46%. In Ontario, the provincial dividend tax credit is 4/13 of the gross up. Would Bruno save any income tax if he were to incorporate his business? Income Tax Consequences if Taken Personally: Income from Cement Business: $100,000 Personal Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) After Tax Retention: $ Income Tax Consequences if Taken Through Corporation + Disburse After-Tax Dollars Personally Income from Cement Business: $100,000 Corporate Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) Amount to be distributed as non- eligible dividend: $ . Gross Up: $ Grossed Up Taxable Dividends: $ Personal Income Tax on Dividend: $ Divideodw.cadia ENTERIASENS GATVESINTERRACKSTS Income from Cement Business: $100,000 Personal Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) . After Tax Retention: $ Income Tax Consequences if Taken Through Corporation + Disburse After-Tax Dollars Personally Income from Cement Business: $100,000 Corporate Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) Amount to be distributed as non- eligible dividend: $ Gross Up: $ Grossed Up Taxable Dividends: $ Personal Income Tax on Dividend: $ Dividend Tax Credit: $ (ENTER AS NEGATIVE USING BRACKETS) Personal Taxes on Dividend After Credit: $ After Tax Retention: $ Which is better personally or via a corporation paying all after-tax profits out personally with a non-eligible dividend (enter your answer as either Personal or Corporate): Personal or Gorporate? Bruno carries on a cement business as a sole proprietor. He estimates the business will generate income of $100,000 during the taxation year ending December 31, 2022. If he incorporates the business, all of the income would be eligible for the small business deduction and any taxable dividends paid will be non-eligible. In Ontario, where he resides, such corporate income is subject to a combined federal/provincial income tax rate of 15%. Bruno also has other sources of income and as a result, any additional income he receives will be subject to a combined federal/provincial personal income tax rate of 46%. In Ontario, the provincial dividend tax credit is 4/13 of the gross up. Would Bruno save any income tax if he were to incorporate his business? Income Tax Consequences if Taken Personally: Income from Cement Business: $100,000 Personal Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) After Tax Retention: $ Income Tax Consequences if Taken Through Corporation + Disburse After-Tax Dollars Personally Income from Cement Business: $100,000 Corporate Income Tax: $ (ENTER AS NEGATIVE USING BRACKETS) Amount to be distributed as non- eligible dividend: $ . Gross Up: $ Grossed Up Taxable Dividends: $ Personal Income Tax on Dividend: $ Divideodw.cadia ENTERIASENS GATVESINTERRACKSTS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started