Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer ASAP please for good rating Consolidation for Less than Wholly-Owned Subsidiary Acquired at More Than Book Value Peerless acquires 85% of Special Foods outstanding

Answer ASAP please for good rating

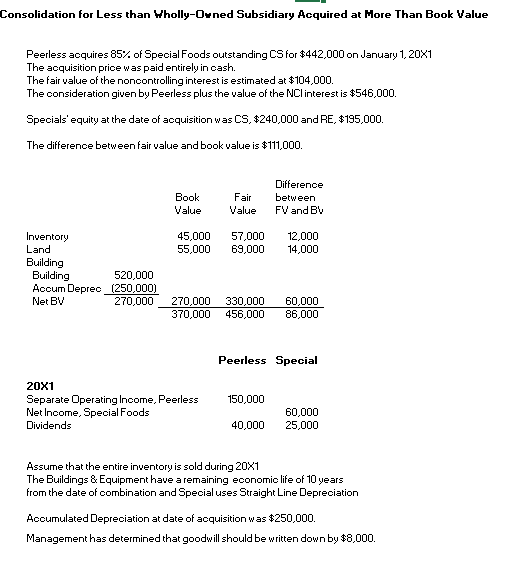

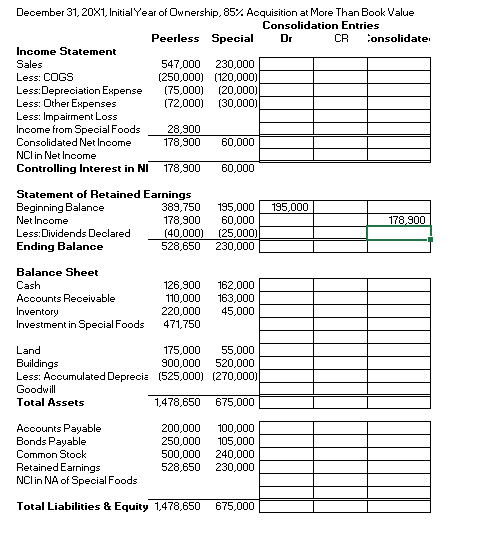

Consolidation for Less than Wholly-Owned Subsidiary Acquired at More Than Book Value Peerless acquires 85% of Special Foods outstanding CS for $442,000 on January 1, 20X1 The acquisition price was paid entirely in cash. The fair value of the noncontrolling interest is estimated at $104,000. The consideration given by Peerless plus the value of the NCl interest is $546,000. Specials' equity at the date of acquisition was CS $240,000 and RE. $195,000. The difference between fair value and book value is $111,000. Book Value Fair Value Difference between FV and BV 45,000 55,000 57,000 69,000 12,000 14,000 Inventory Land Building Building 520,000 Accum Deprec (250,000) Net BV 270,000 270,000 370,000 330,000 456,000 60,000 86,000 Peerless Special 20x1 Separate Operating Income, Peerless Net Income, Special Foods Dividends 150,000 60,000 25,000 40,000 Assume that the entire inventory is sold during 20X1 The Buildings & Equipment have a remaining economic life of 10 years from the date of combination and Special uses Straight Line Depreciation Accumulated Depreciation at date of acquisition was $250,000. Management has determined that goodwill should be written down by $8,000. December 31, 20X1. Initial Year of Ownership, 85%. Acquisition at More Than Book Value Consolidation Entries Peerless Special Dr CR Consolidate Income Statement Sales 547,000 230,000 Less: COGS (250,000) (120,000) Less:Depreciation Expense (75,000) (20,000) Less: Other Expenses (72,000) (30,000) Less: Impairment Loss Income from Special Foods 28,900 Consolidated Net Income 178,900 60,000 NClin Net Income Controlling Interest in NI 178,900 60,000 195,000 Statement of Retained Earnings Beginning Balance 389,750 Net Income 178,900 Less:Dividends Declared (40,000) Ending Balance 528,650 178,900 195,000 60,000 (25,000) 230,000 Balance Sheet Cash Accounts Receivable Inventory Investment in Special Foods 126,900 110,000 220,000 471,750 162,000 163,000 45,000 Land 175,000 55,000 Buildings 900,000 520,000 Less: Accumulated Deprecia (525,000) (270,000) Goodwill Total Assets 1,478,650 675,000 Accounts Payable Bonds Payable Common Stock Retained Earnings NClin NA of Special Foods 200,000 250,000 500,000 528,650 100,000 105,000 240,000 230,000 Total Liabilities & Equity 1,478,650 675,000 Consolidation for Less than Wholly-Owned Subsidiary Acquired at More Than Book Value Peerless acquires 85% of Special Foods outstanding CS for $442,000 on January 1, 20X1 The acquisition price was paid entirely in cash. The fair value of the noncontrolling interest is estimated at $104,000. The consideration given by Peerless plus the value of the NCl interest is $546,000. Specials' equity at the date of acquisition was CS $240,000 and RE. $195,000. The difference between fair value and book value is $111,000. Book Value Fair Value Difference between FV and BV 45,000 55,000 57,000 69,000 12,000 14,000 Inventory Land Building Building 520,000 Accum Deprec (250,000) Net BV 270,000 270,000 370,000 330,000 456,000 60,000 86,000 Peerless Special 20x1 Separate Operating Income, Peerless Net Income, Special Foods Dividends 150,000 60,000 25,000 40,000 Assume that the entire inventory is sold during 20X1 The Buildings & Equipment have a remaining economic life of 10 years from the date of combination and Special uses Straight Line Depreciation Accumulated Depreciation at date of acquisition was $250,000. Management has determined that goodwill should be written down by $8,000. December 31, 20X1. Initial Year of Ownership, 85%. Acquisition at More Than Book Value Consolidation Entries Peerless Special Dr CR Consolidate Income Statement Sales 547,000 230,000 Less: COGS (250,000) (120,000) Less:Depreciation Expense (75,000) (20,000) Less: Other Expenses (72,000) (30,000) Less: Impairment Loss Income from Special Foods 28,900 Consolidated Net Income 178,900 60,000 NClin Net Income Controlling Interest in NI 178,900 60,000 195,000 Statement of Retained Earnings Beginning Balance 389,750 Net Income 178,900 Less:Dividends Declared (40,000) Ending Balance 528,650 178,900 195,000 60,000 (25,000) 230,000 Balance Sheet Cash Accounts Receivable Inventory Investment in Special Foods 126,900 110,000 220,000 471,750 162,000 163,000 45,000 Land 175,000 55,000 Buildings 900,000 520,000 Less: Accumulated Deprecia (525,000) (270,000) Goodwill Total Assets 1,478,650 675,000 Accounts Payable Bonds Payable Common Stock Retained Earnings NClin NA of Special Foods 200,000 250,000 500,000 528,650 100,000 105,000 240,000 230,000 Total Liabilities & Equity 1,478,650 675,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started