Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap please Kyle Tucker and Tucker Bailey began a new consulting business on January 1, 2022. View the additional information. View the tax rate

answer asap please

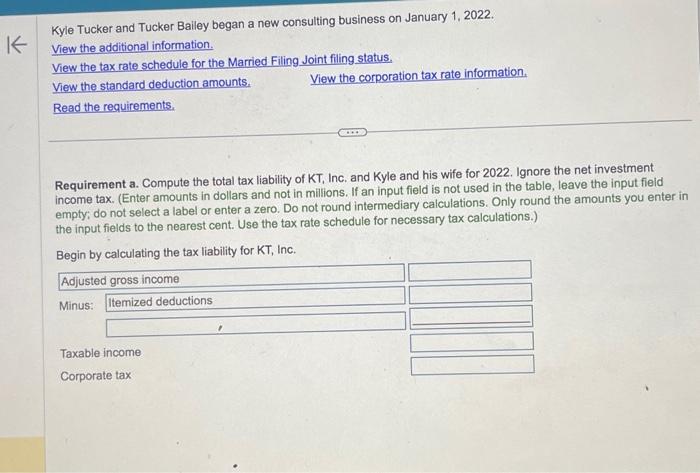

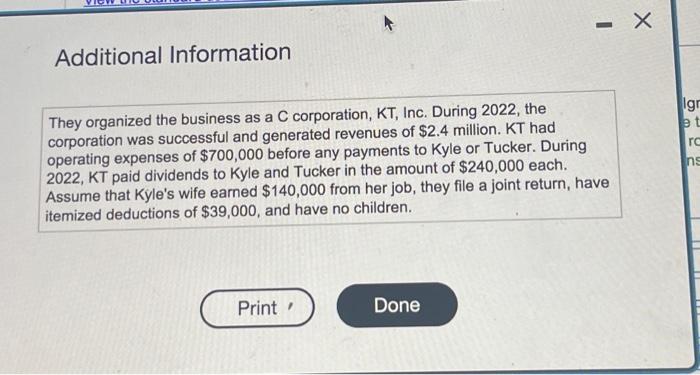

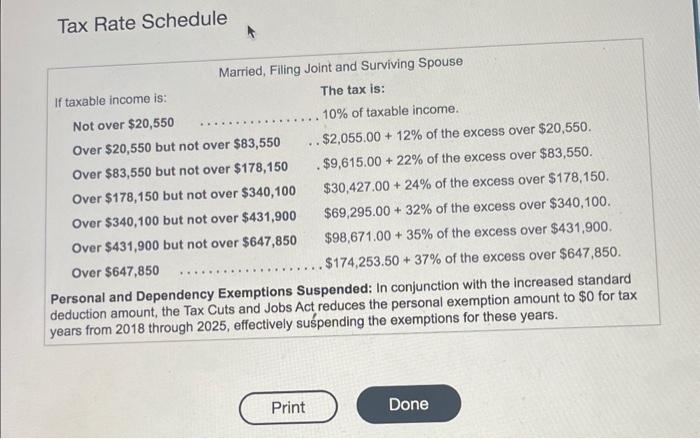

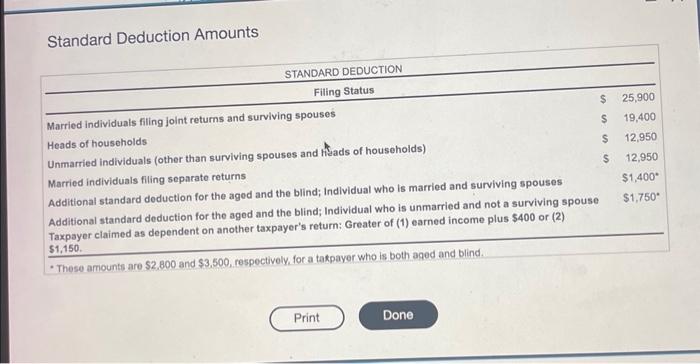

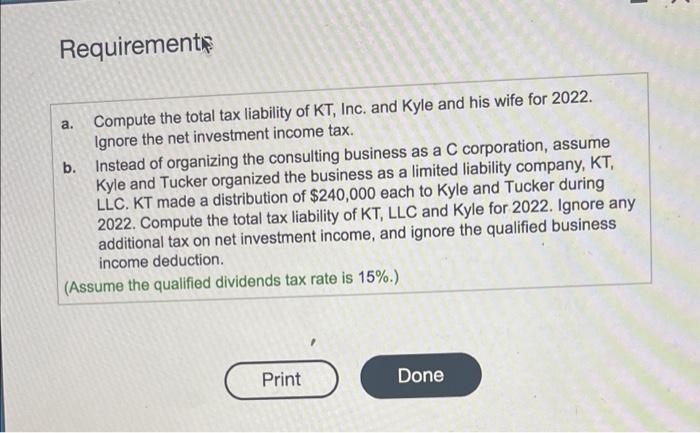

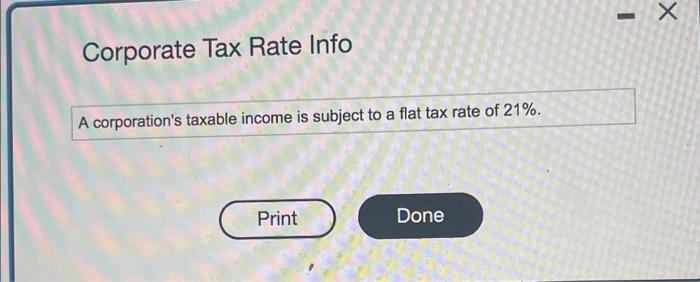

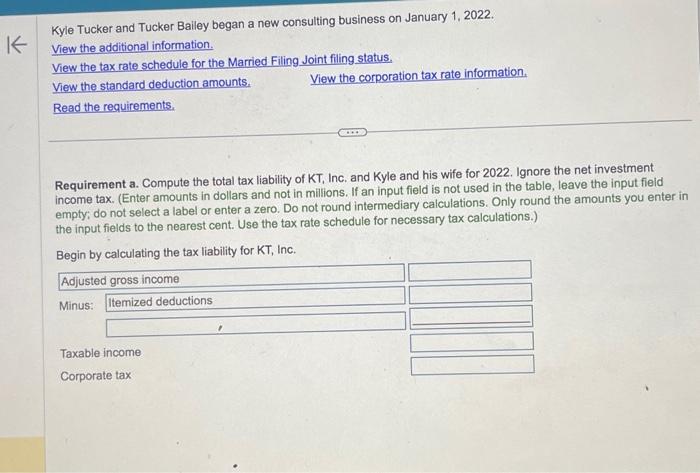

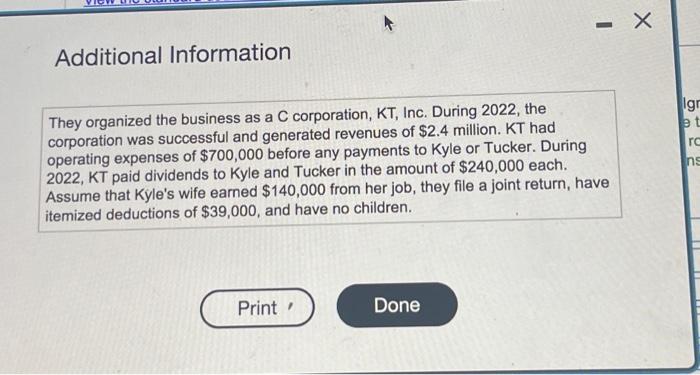

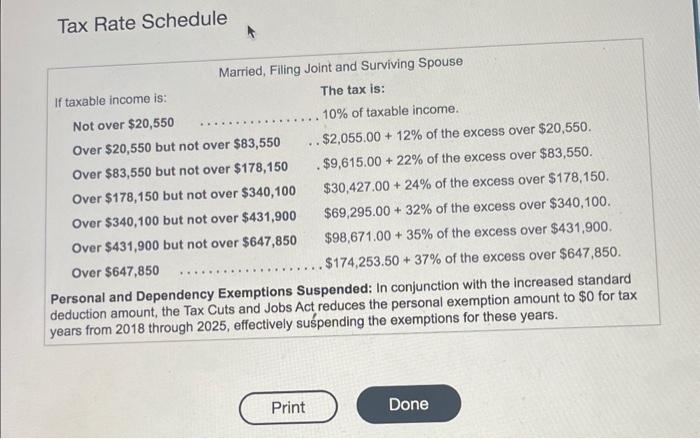

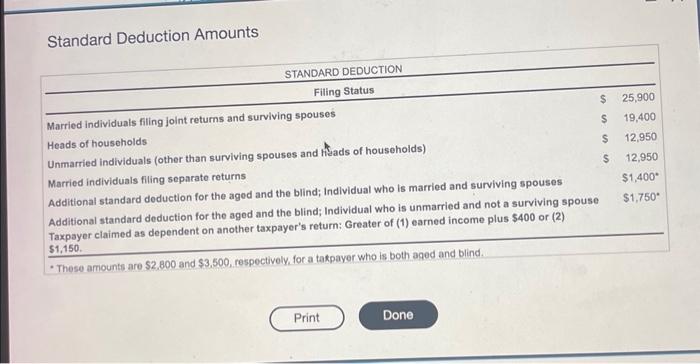

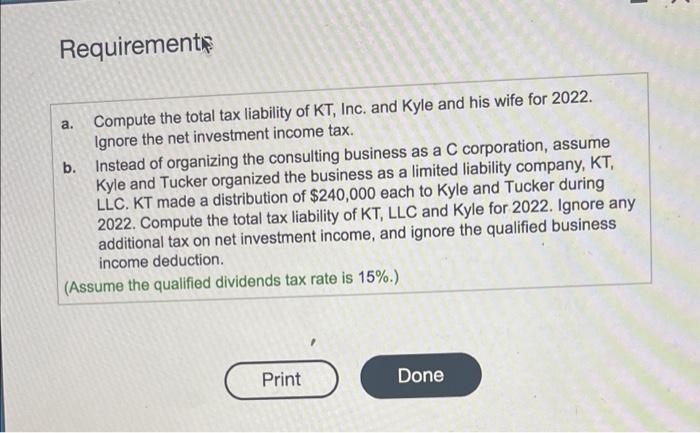

Kyle Tucker and Tucker Bailey began a new consulting business on January 1, 2022. View the additional information. View the tax rate schedule for the Married. Filing Joint filing status. View the standard deduction amounts. View the corporation tax rate information. Read the requirements. Requirement a. Compute the total tax liability of KT, Inc. and Kyle and his wife for 2022. Ignore the net investment income tax. (Enter amounts in dollars and not in millions. If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero. Do not round intermediary calculations. Only round the amounts you enter in the input fields to the nearest cent. Use the tax rate schedule for necessary tax calculations.) Additional Information They organized the business as a C corporation, KT, Inc. During 2022, the corporation was successful and generated revenues of $2.4 million. KT had operating expenses of $700,000 before any payments to Kyle or Tucker. During 2022, KT paid dividends to Kyle and Tucker in the amount of $240,000 each. Assume that Kyle's wife earned $140,000 from her job, they file a joint return, have itemized deductions of $39,000, and have no children. Tax Rate Schedule deduction amount, the Tax Cuts and Jobs Act reduces the personal exempuUin anlumin. years from 2018 through 2025, effectively supending the exemptions for these years. Standard Deduction Amounts Requirements a. Compute the total tax liability of KT, Inc. and Kyle and his wife for 2022. Ignore the net investment income tax. b. Instead of organizing the consulting business as a C corporation, assume Kyle and Tucker organized the business as a limited liability company, KT, LLC. KT made a distribution of $240,000 each to Kyle and Tucker during 2022. Compute the total tax liability of KT, LLC and Kyle for 2022 . Ignore any additional tax on net investment income, and ignore the qualified business income deduction. (Assume the qualified dividends tax rate is 15%.) Corporate Tax Rate Info A corporation's taxable income is subject to a flat tax rate of 21%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started