Answered step by step

Verified Expert Solution

Question

1 Approved Answer

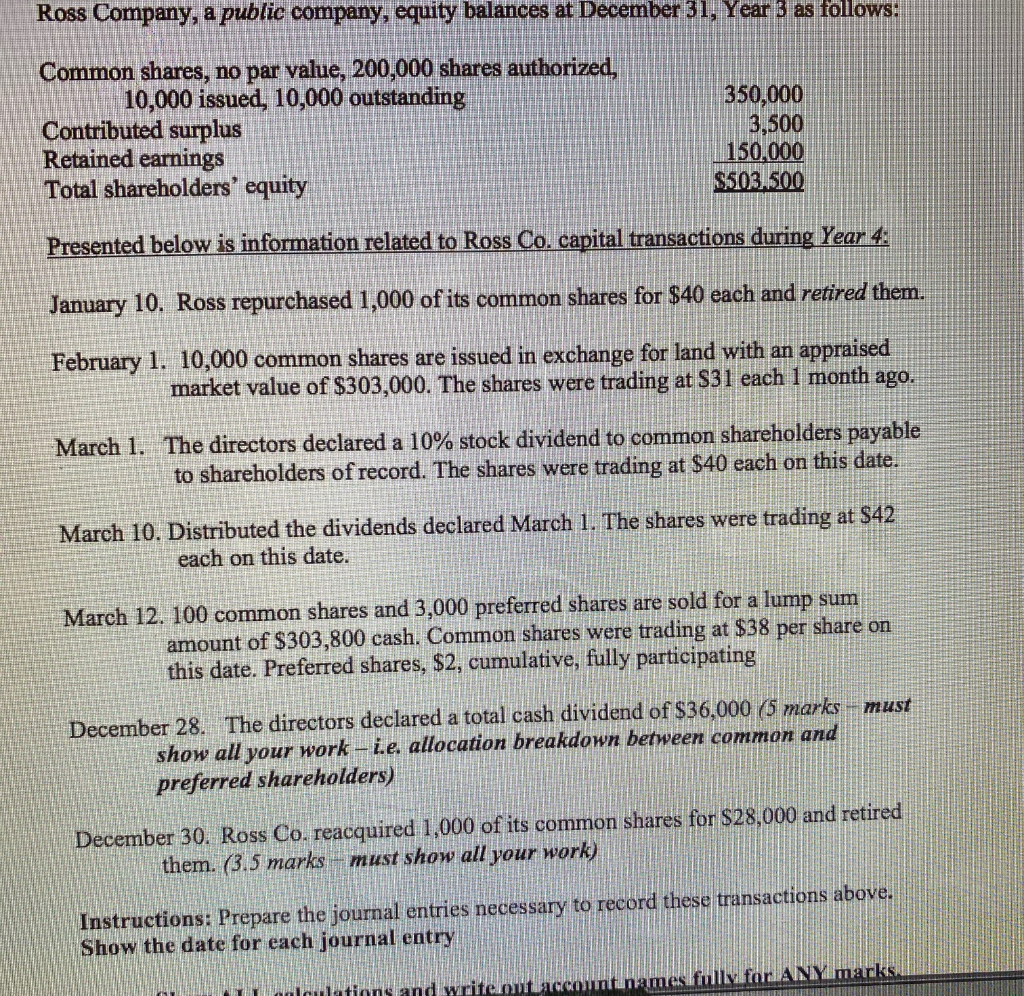

answer asap Ross Company, a public company, equity balances at December 31, Year 3 as follows: Common shares, no par value, 200,000 shares authorized, 110,000

answer asap

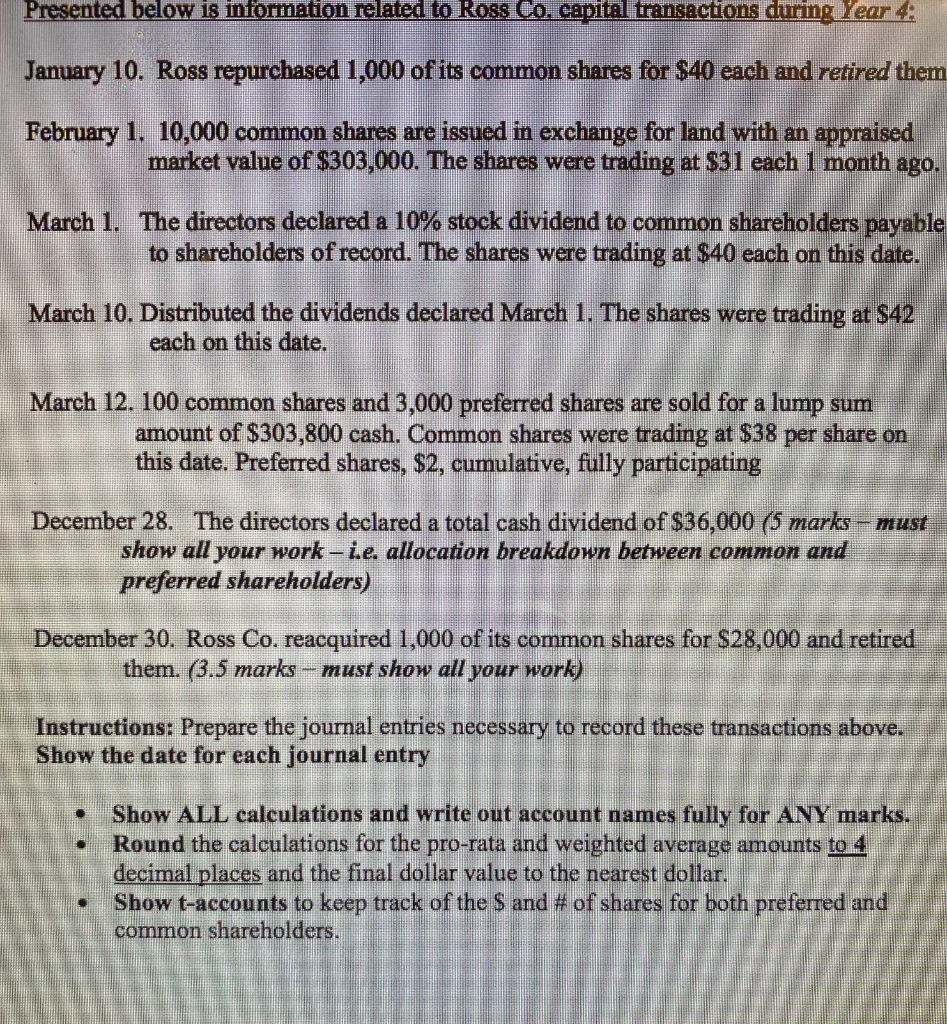

Ross Company, a public company, equity balances at December 31, Year 3 as follows: Common shares, no par value, 200,000 shares authorized, 110,000 issued, 10,000 outstanding Contributed surplus Retained earnings Total shareholders' equity 350,000 3.500 | 150,000 $503.500 Presented below is information related to Ross Co. capital transactions during Year 4: January 10. Ross repurchased 1,000 of its common shares for $40 each and retired them. February 1. 10,000 common shares are issued in exchange for land with an appraised market value of $303,000. The shares were trading at S31 each 1 month ago. March 1. The directors declared a 10% stock dividend to common shareholders payable to shareholders of record. The shares were trading at $40 each on this date." March 10. Distributed the dividends declared March 1. The shares were trading at $42 each on this date. March 12. 100 common shares and 3,000 preferred shares are sold for a lump sum amount of $303,800 cash. Common shares were trading at $38 per share on this date. Preferred shares, $2, cumulative, fully participating December 28. The directors declared a total cash dividend of $36,000 (5 marks - must show all your work - i.e. allocation breakdown between common and preferred shareholders) December 30. Ross Co. reacquired 1,000 of its common shares for $28,000 and retired them. (3.5 marks - must show all your work) Instructions: Prepare the journal entries necessary to record these transactions above. Show the date for each journal entry Innlaulations and writenutelntimamesi full for Presented below is information related to Ross Co. capital transactions during Year 4: January 10. Ross repurchased 1,000 of its common shares for $40 each and retired them February 1. 10,000 common shares are issued in exchange for land with an appraised market value of $303,000. The shares were trading at $31 each 1 month ago. March 1. The directors declared a 10% stock dividend to common shareholders payable to shareholders of record. The shares were trading at $40 each on this date. March 10. Distributed the dividends declared March 1. The shares were trading at $42 each on this date. March 12. 100 common shares and 3,000 preferred shares are sold for a lump sum amount of $303,800 cash. Common shares were trading at $38 per share on this date. Preferred shares, $2, cumulative, fully participating December 28. The directors declared a total cash dividend of $36,000 (5 marks - must show all your work - i.e. allocation breakdown between common and preferred shareholders) December 30. Ross Co. reacquired 1,000 of its common shares for $28.000 and retired them. (3.5 marks - must show all your work) Instructions: Prepare the journal entries necessary to record these transactions above. Show the date for each journal entry Show ALL calculations and write out account names fully for ANY marks. Round the calculations for the pro-rata and weighted average amounts to 4 decimal places and the final dollar value to the nearest dollar Show t-accounts to keep track of the S and # of shares for both preferred and common shareholders. Ross Company, a public company, equity balances at December 31, Year 3 as follows: Common shares, no par value, 200,000 shares authorized, 110,000 issued, 10,000 outstanding Contributed surplus Retained earnings Total shareholders' equity 350,000 3.500 | 150,000 $503.500 Presented below is information related to Ross Co. capital transactions during Year 4: January 10. Ross repurchased 1,000 of its common shares for $40 each and retired them. February 1. 10,000 common shares are issued in exchange for land with an appraised market value of $303,000. The shares were trading at S31 each 1 month ago. March 1. The directors declared a 10% stock dividend to common shareholders payable to shareholders of record. The shares were trading at $40 each on this date." March 10. Distributed the dividends declared March 1. The shares were trading at $42 each on this date. March 12. 100 common shares and 3,000 preferred shares are sold for a lump sum amount of $303,800 cash. Common shares were trading at $38 per share on this date. Preferred shares, $2, cumulative, fully participating December 28. The directors declared a total cash dividend of $36,000 (5 marks - must show all your work - i.e. allocation breakdown between common and preferred shareholders) December 30. Ross Co. reacquired 1,000 of its common shares for $28,000 and retired them. (3.5 marks - must show all your work) Instructions: Prepare the journal entries necessary to record these transactions above. Show the date for each journal entry Innlaulations and writenutelntimamesi full for Presented below is information related to Ross Co. capital transactions during Year 4: January 10. Ross repurchased 1,000 of its common shares for $40 each and retired them February 1. 10,000 common shares are issued in exchange for land with an appraised market value of $303,000. The shares were trading at $31 each 1 month ago. March 1. The directors declared a 10% stock dividend to common shareholders payable to shareholders of record. The shares were trading at $40 each on this date. March 10. Distributed the dividends declared March 1. The shares were trading at $42 each on this date. March 12. 100 common shares and 3,000 preferred shares are sold for a lump sum amount of $303,800 cash. Common shares were trading at $38 per share on this date. Preferred shares, $2, cumulative, fully participating December 28. The directors declared a total cash dividend of $36,000 (5 marks - must show all your work - i.e. allocation breakdown between common and preferred shareholders) December 30. Ross Co. reacquired 1,000 of its common shares for $28.000 and retired them. (3.5 marks - must show all your work) Instructions: Prepare the journal entries necessary to record these transactions above. Show the date for each journal entry Show ALL calculations and write out account names fully for ANY marks. Round the calculations for the pro-rata and weighted average amounts to 4 decimal places and the final dollar value to the nearest dollar Show t-accounts to keep track of the S and # of shares for both preferred and common shareholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started