Answered step by step

Verified Expert Solution

Question

1 Approved Answer

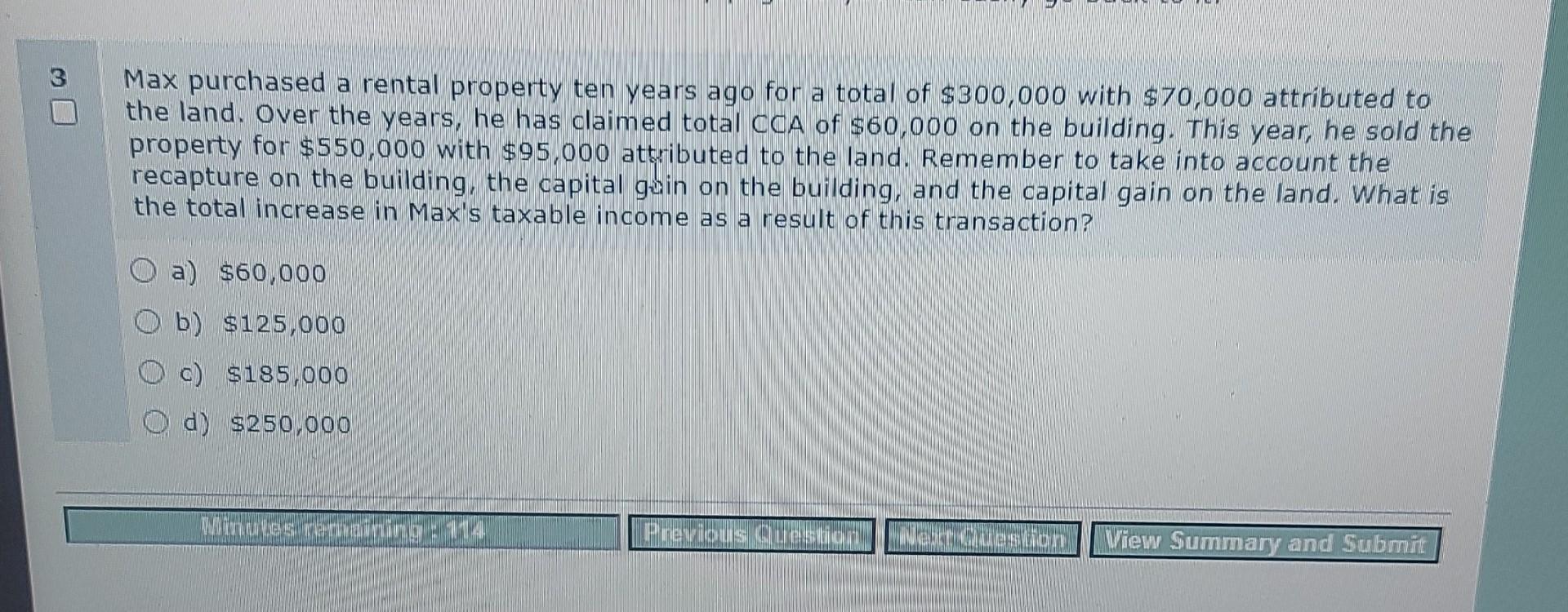

answer asap! will upvote! Max purchased a rental property ten years ago for a total of $300,000 with $70,000 attributed to the land. Over the

answer asap! will upvote!

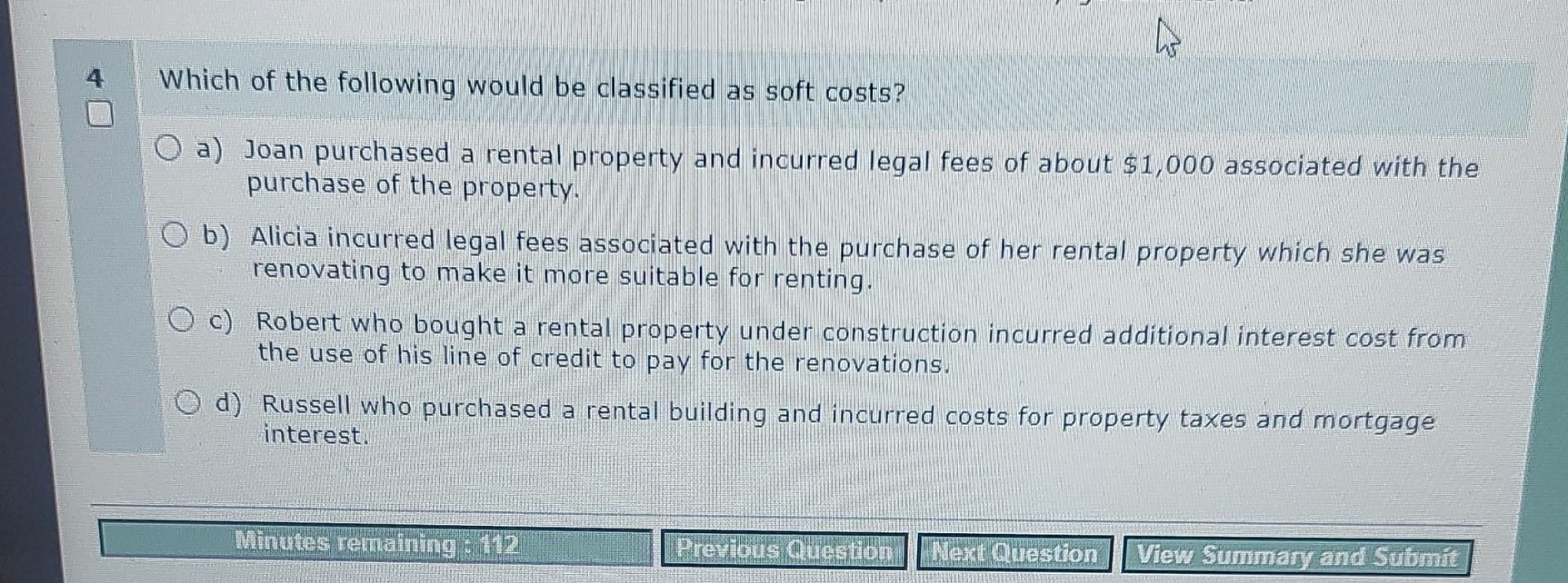

Max purchased a rental property ten years ago for a total of $300,000 with $70,000 attributed to the land. Over the years, he has claimed total CCA of $60,000 on the building. This year, he sold the property for $550,000 with $95,000 attributed to the land. Remember to take into account the recapture on the building, the capital guin on the building, and the capital gain on the land. What is the total increase in Max's taxable income as a result of this transaction? a) $60,000 b) $125,000 c) $185,000 d) $250,000 Which of the following would be classified as soft costs? a) Joan purchased a rental property and incurred legal fees of about $1,000 associated with the purchase of the property. b) Alicia incurred legal fees associated with the purchase of her rental property which she was renovating to make it more suitable for renting. c) Robert who bought a rental property under construction incurred additional interest cost from the use of his line of credit to pay for the renovations. d) Russell who purchased a rental building and incurred costs for property taxes and mortgage interestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started