Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap will upvote!! Max was party to a cross-purchase, buy-sell agreement when he died and owned 100 shares of TKL Inc. All of the

answer asap will upvote!!

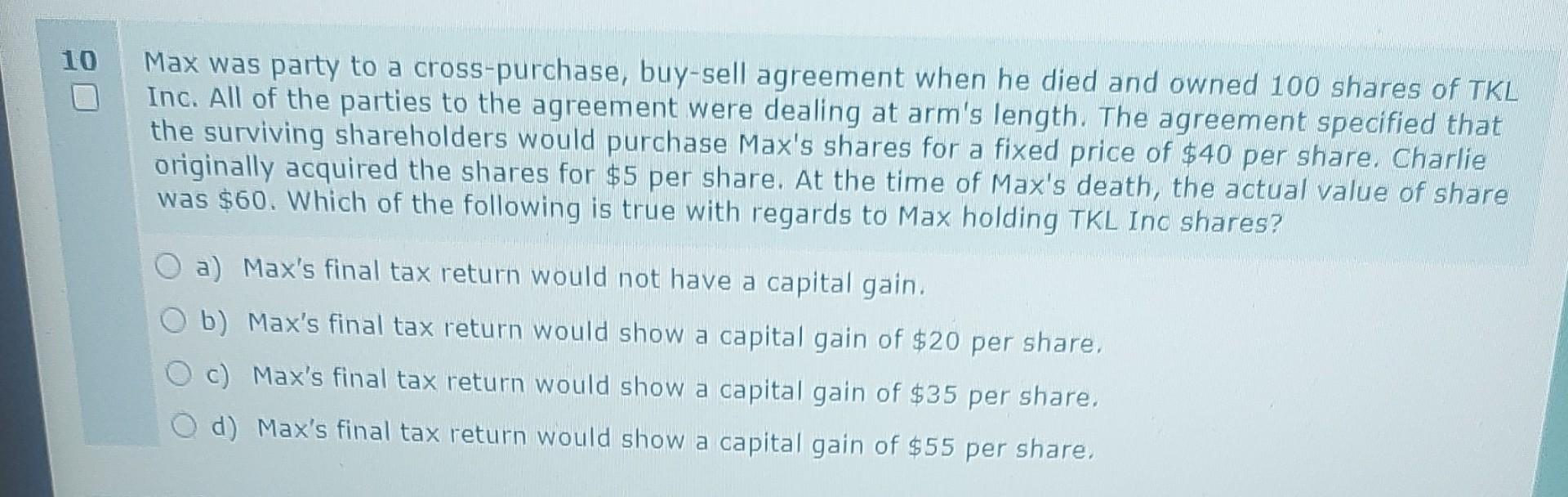

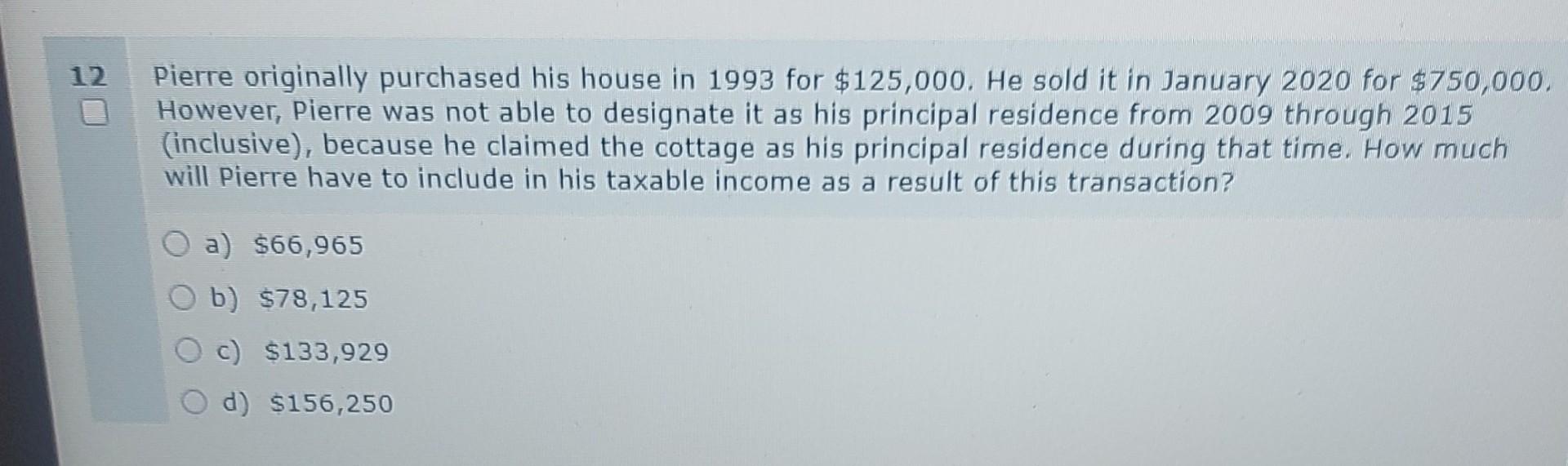

Max was party to a cross-purchase, buy-sell agreement when he died and owned 100 shares of TKL Inc. All of the parties to the agreement were dealing at arm's length. The agreement specified that the surviving shareholders would purchase Max's shares for a fixed price of $40 per share. Charlie originally acquired the shares for $5 per share. At the time of Max's death, the actual value of share was $60. Which of the following is true with regards to Max holding TKL Inc shares? a) Max's final tax return would not have a capital gain. b) Max's final tax return would show a capital gain of $20 per share. c) Max's final tax return would show a capital gain of $35 per share. d) Max's final tax return would show a capital gain of $55 per share. Pierre originally purchased his house in 1993 for $125,000. He sold it in January 2020 for $750,000. However, Pierre was not able to designate it as his principal residence from 2009 through 2015 (inclusive), because he claimed the cottage as his principal residence during that time. How much will Pierre have to include in his taxable income as a result of this transaction? a) $66,965 b) $78,125 C) $133,929 d) 5156,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started