Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer B part 2. Hari Enterprises purchased equipment by making a $1,700 cash down payment and signing a $26,600, one-year, 11% note paryable. The purchase

answer B part

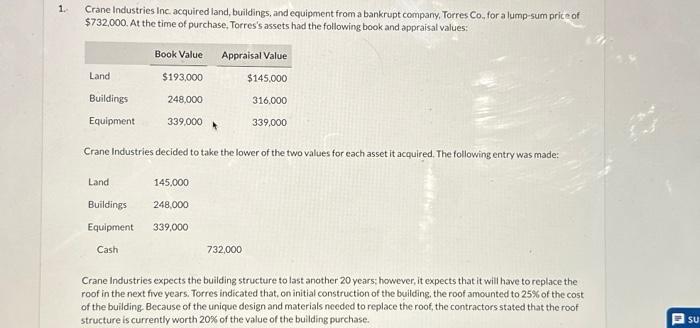

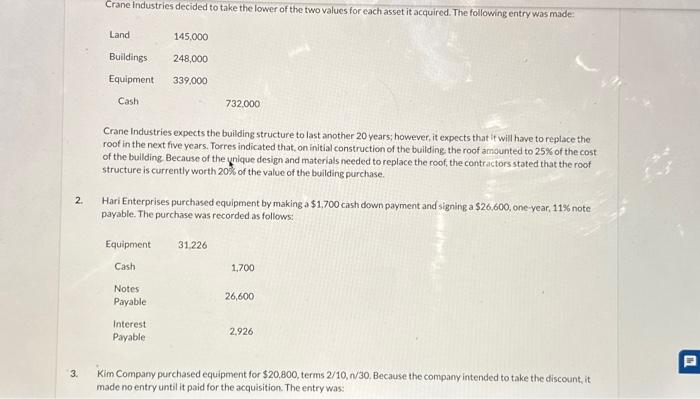

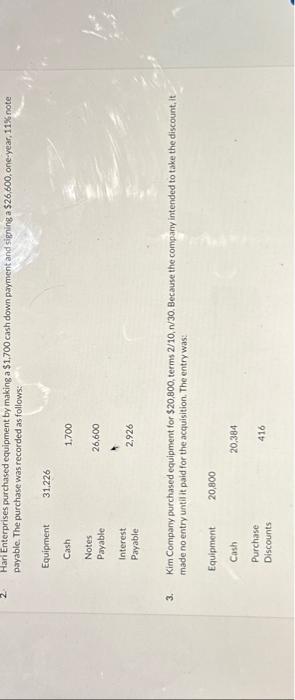

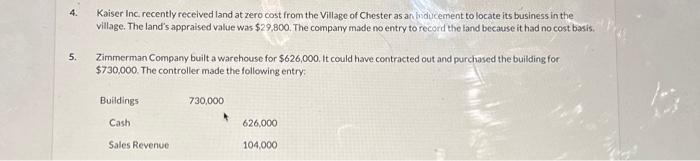

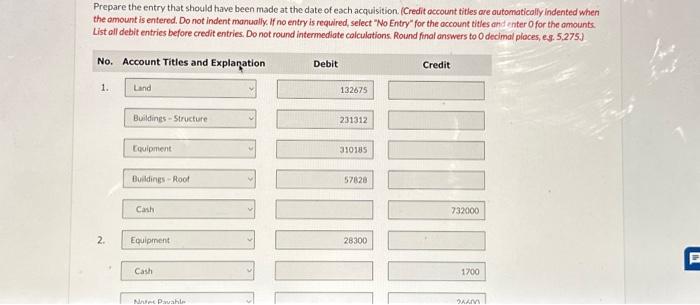

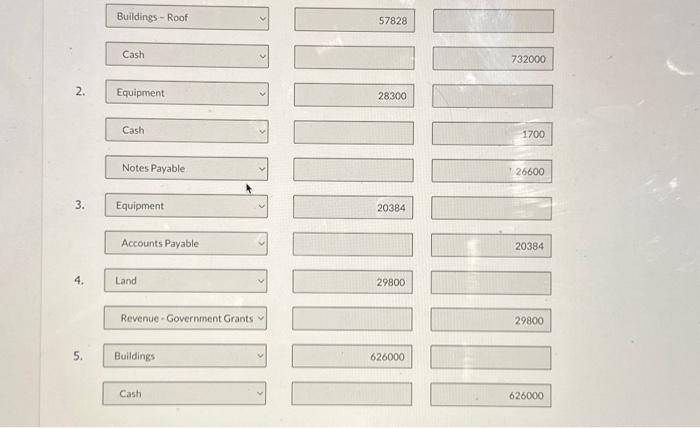

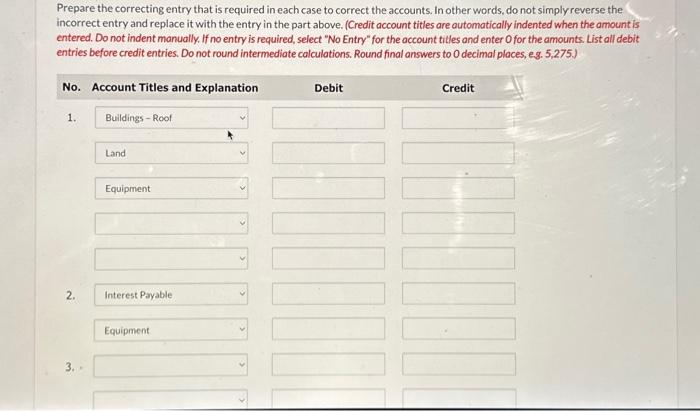

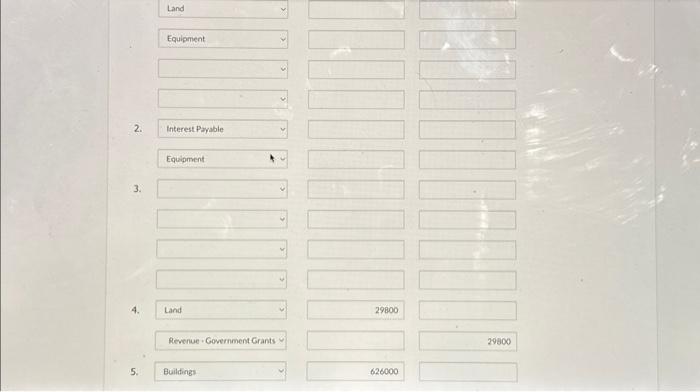

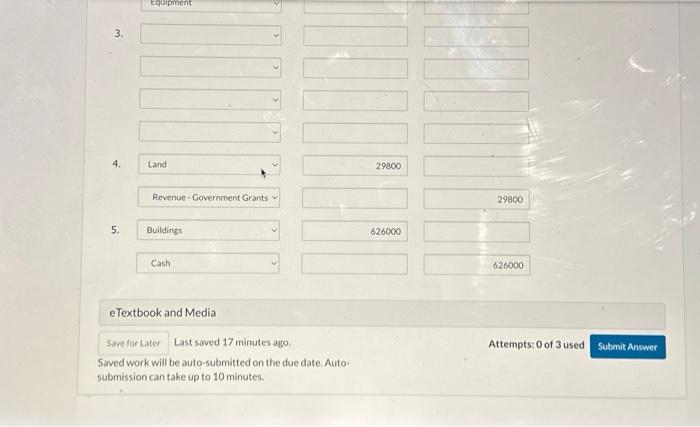

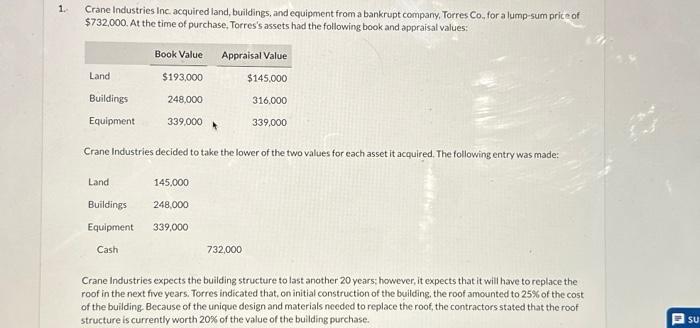

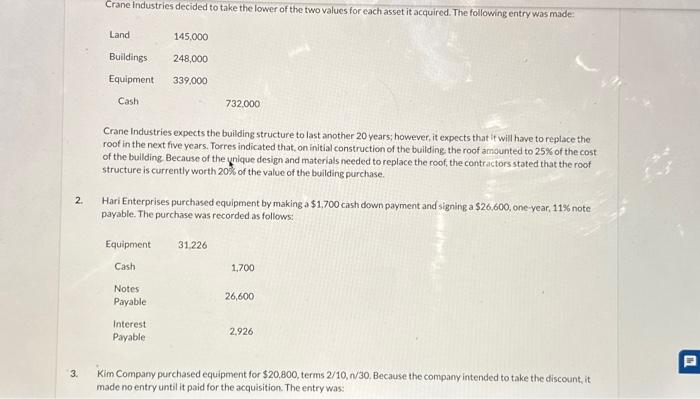

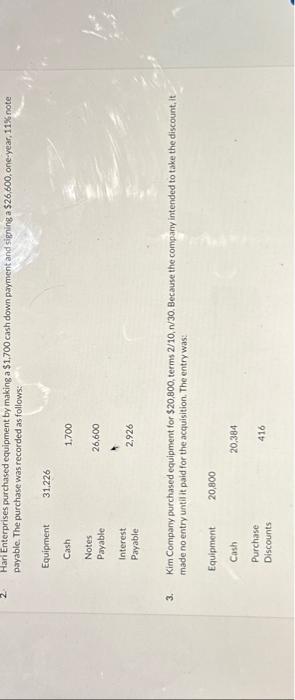

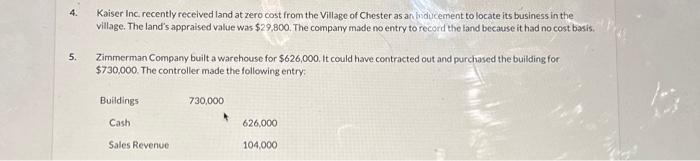

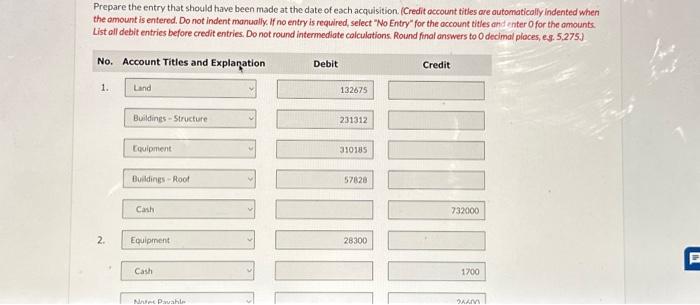

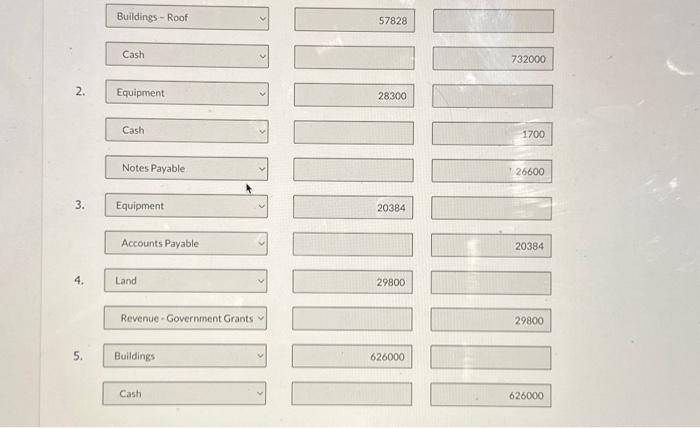

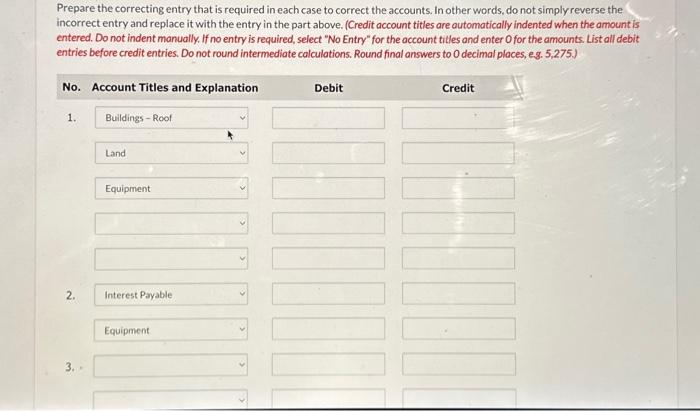

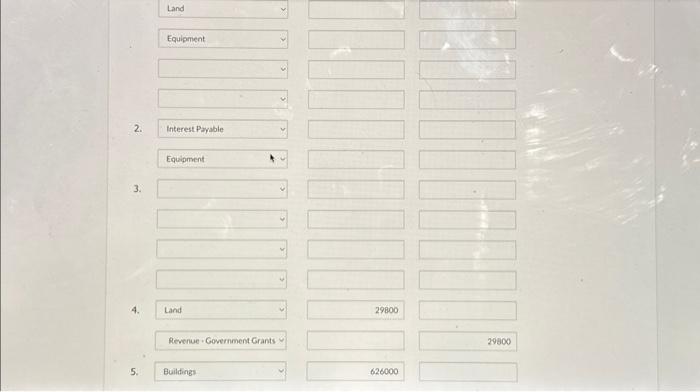

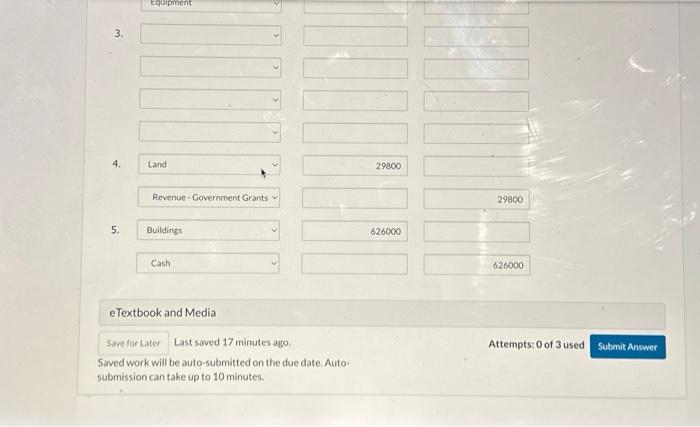

2. Hari Enterprises purchased equipment by making a $1,700 cash down payment and signing a $26,600, one-year, 11% note paryable. The purchase was recorded as follows: 3. Kim Company purchased equipment for $20,800, terms 2/10,n/30. Because the company intended to take the discount, it made no entry untilit paid for the acquisition. The entry was: Land Equipment 2. Interest Payole Equipment 3. 4. Land Revenue + Government Grants : 5. Building: 626000 Crane Industries expects the building structure to last another 20 years; however, it expects that if will have to replace the roof in the next five years. Torres indicated that, on initial construction of the bulilding the roof amounted to 25% or the cost. of the bullding Because of the ynique design and materials needed to replace the roof, the contractors stated that the roof structure is currently worth 20% of the value of the building purchase. 2. Hari Enterprises purchased equipment by making a $1,700 cash down payment and signing a $26,600, one-year, 11% note payable. The purchase was recorded as follows: Kim Company purchased equipment for $20,800, terms 2/10,n/30. Because the company intended to take the discount, it made no entry until it paid for the acquisition. The entry was: 4. Kaiser inc, recently received land at zero cost from the Village of Chester as an biducement to locate its business in the village. The land's appraised value was $29,800. The compary made no entry to record the land because it had no cost basis. 5. Zimmerman Company built a warehouse for $626,000. It could have contracted out and purchased the building for $730,000. The controller made the following entry: Prepare the entry that should have been made at the date of each acquisition. (Credit account titles are outomatically indented when the amount is entered. Do not indent manuatly. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries. Do not round intermedlate colculations. Round final answers to 0 decimal ploces, es. 5,275.j Prepare the correcting entry that is required in each case to correct the accounts. In other words, do not simply reverse the incorrect entry and replace it with the entry in the part above. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tilles and enter O for the amounts. List all debit entries before credit entries. Do not round intermediate calculations. Round final answers to 0 decimal places, eg. 5,275 .) Saved work will be auto-submitted on the due date. Autosubmission can take up to 10 minutes. Crane Industries Inc acquired land, buildings, and equipment from a bankrupt company, Torres C0. for a lump-sum price of $732,000. At the time of purchase, Torres's assets had the following book and appraisal values: Crane Industries decided to take the lower of the two values for each asset it acquired. The following entry was made: Crane Industries expects the building structure to last another 20 years; however, it expects that it will have to replace the roof in the next five years. Torres indicated that, on initial construction of the building, the roof amounted to 25% of the cost of the building. Because of the unique design and materials needed to replace the roof, the contractors stated that the roof structure is currently worth 20% of the value of the building purchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started