answer B1 and B2

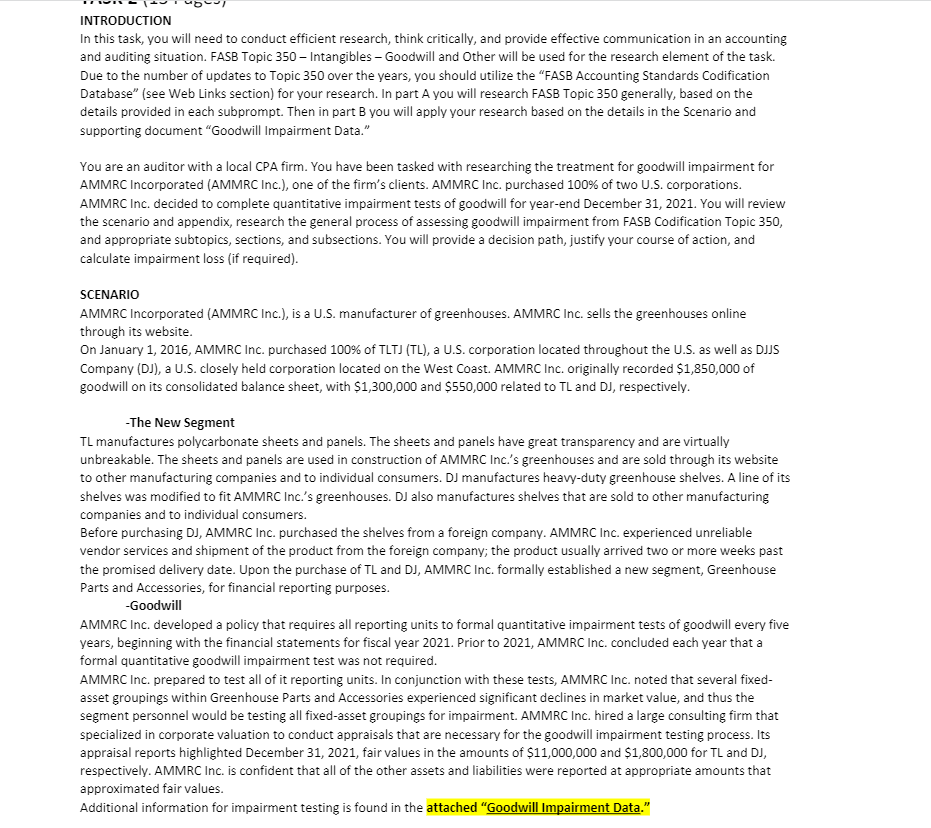

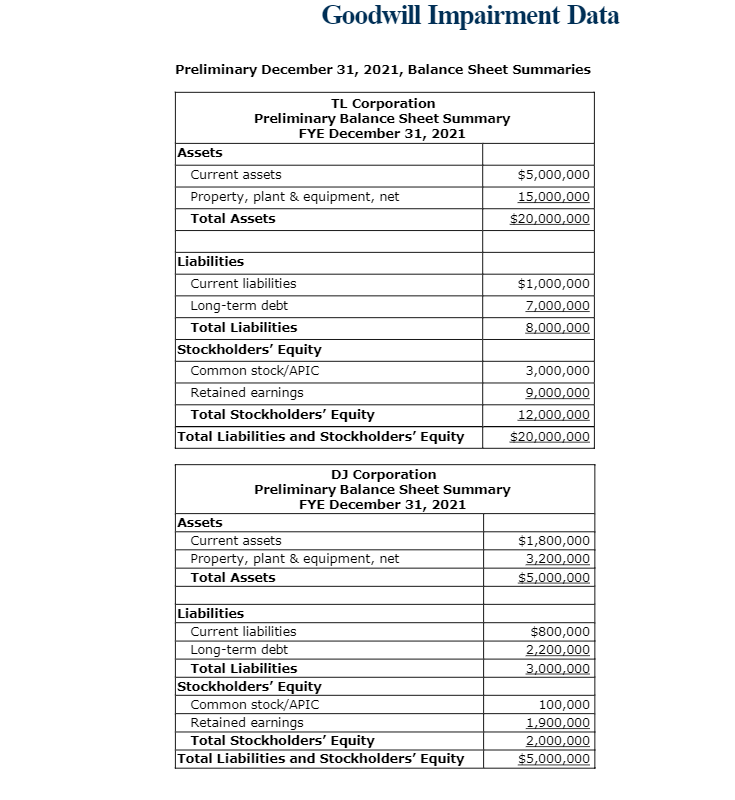

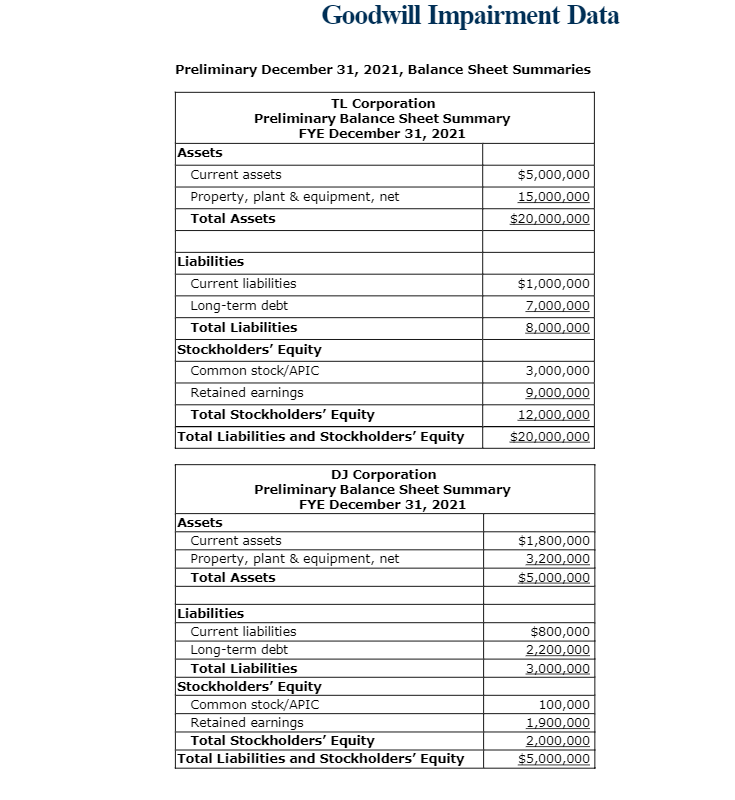

REQUIREMENTS A. Research the FASB Accounting Standards Codification Topic 350 (ASC 350) standards for goodwill impairment using the "FASB Accounting Standards Codification Database" web link, then summarize the relevant ASC 350 standards and components (including topic, subtopic(s), section(s), and subsection(s)) to do the following: A1. Describe the treatment for when a company has similar economic characteristics, including a logical summary of the relevant ASC 350 standards and the given components. A2. Describe the treatment for when a company does not have similar economic characteristics, including a logical summary of the relevant ASC 350 standards and the given components. A3. Describe the treatment for a public company, including a logical summary of the relevant ASC 350 standards and the given components. A4. Describe the treatment for a private company, including a logical summary of the relevant ASC 350 standards and the given components. A5. Describe the treatment for when a company elects the accounting alternative., including a logical summary of the relevant ASC 350 standards and the given components. A6. Describe the treatment for when a company does not elect the accounting alternative, including a logical summary of the relevant ASC 350 standards and the given components. A7. Describe the treatment for when a company has a triggering event occur, including a logical summary of the relevant ASC 350 standards and the given components. A8. Describe the treatment for when a company does not have a triggering event occur, including a logical summary of the relevant ASC 350 standards and the given components. B1. Using the scenario, the attached "Goodwill Impairment Data," and the research completed for part A, determine the best approach for AMMRC Inc.'s treatment of goodwill impairment while justifying your decision on each of the following decision points: - whether the company has similar economic characteristics - whether the company is public or private - whether the company elects the accounting alternative - whether the company has a triggering event occur B2. Determine the goodwill impairment loss, if required, for TL and DJ corporations based on the information provided in the attached "Goodwill Impairment Data" and appropriate authoritative guidance (ASC 350). If goodwill impairment loss is not required, explain why. Web Link: http://aaahq.org/Research/FASB-GARS Username: AAA52071 Password: nU5M4Wu INTRODUCTION In this task, you will need to conduct efficient research, think critically, and provide effective communication in an accounting and auditing situation. FASB Topic 350 - Intangibles - Goodwill and Other will be used for the research element of the task. Due to the number of updates to Topic 350 over the years, you should utilize the "FASB Accounting Standards Codification Database" (see Web Links section) for your research. In part A you will research FASB Topic 350 generally, based on the details provided in each subprompt. Then in part B you will apply your research based on the details in the Scenario and supporting document "Goodwill Impairment Data." You are an auditor with a local CPA firm. You have been tasked with researching the treatment for goodwill impairment for AMMRC Incorporated (AMMRC Inc.), one of the firm's clients. AMMRC Inc. purchased 100% of two U.S. corporations. AMMRC Inc. decided to complete quantitative impairment tests of goodwill for year-end December 31, 2021. You will review the scenario and appendix, research the general process of assessing goodwill impairment from FASB Codification Topic 350, and appropriate subtopics, sections, and subsections. You will provide a decision path, justify your course of action, and calculate impairment loss (if required). SCENARIO AMMRC Incorporated (AMMRC Inc.), is a U.S. manufacturer of greenhouses. AMMRC Inc. sells the greenhouses online through its website. On January 1, 2016, AMMRC Inc. purchased 100\% of TLTJ (TL), a U.S. corporation located throughout the U.S. as well as DJJS Company (DJ), a U.S. closely held corporation located on the West Coast. AMMRC Inc. originally recorded $1,850,000 of goodwill on its consolidated balance sheet, with $1,300,000 and $550,000 related to TL and DJ, respectively. -The New Segment TL manufactures polycarbonate sheets and panels. The sheets and panels have great transparency and are virtually unbreakable. The sheets and panels are used in construction of AMMRC Inc.'s greenhouses and are sold through its website to other manufacturing companies and to individual consumers. DJ manufactures heavy-duty greenhouse shelves. A line of its shelves was modified to fit AMMRC Inc.'s greenhouses. DJ also manufactures shelves that are sold to other manufacturing companies and to individual consumers. Before purchasing DJ, AMMRC Inc. purchased the shelves from a foreign company. AMMRC Inc. experienced unreliable vendor services and shipment of the product from the foreign company; the product usually arrived two or more weeks past the promised delivery date. Upon the purchase of TL and DJ, AMMRC Inc. formally established a new segment, Greenhouse Parts and Accessories, for financial reporting purposes. -Goodwill AMMRC Inc. developed a policy that requires all reporting units to formal quantitative impairment tests of goodwill every five years, beginning with the financial statements for fiscal year 2021. Prior to 2021, AMMRC Inc. concluded each year that a formal quantitative goodwill impairment test was not required. AMMRC Inc. prepared to test all of it reporting units. In conjunction with these tests, AMMRC Inc. noted that several fixedasset groupings within Greenhouse Parts and Accessories experienced significant declines in market value, and thus the segment personnel would be testing all fixed-asset groupings for impairment. AMMRC Inc. hired a large consulting firm that specialized in corporate valuation to conduct appraisals that are necessary for the goodwill impairment testing process. Its appraisal reports highlighted December 31, 2021, fair values in the amounts of $11,000,000 and $1,800,000 for TL and DJ, respectively. AMMRC Inc. is confident that all of the other assets and liabilities were reported at appropriate amounts that approximated fair values. Additional information for impairment testing is found in the attached "Goodwill Impairment Data." Goodwill Impairment Data Preliminary December 31, 2021, Balance Sheet Summaries REQUIREMENTS A. Research the FASB Accounting Standards Codification Topic 350 (ASC 350) standards for goodwill impairment using the "FASB Accounting Standards Codification Database" web link, then summarize the relevant ASC 350 standards and components (including topic, subtopic(s), section(s), and subsection(s)) to do the following: A1. Describe the treatment for when a company has similar economic characteristics, including a logical summary of the relevant ASC 350 standards and the given components. A2. Describe the treatment for when a company does not have similar economic characteristics, including a logical summary of the relevant ASC 350 standards and the given components. A3. Describe the treatment for a public company, including a logical summary of the relevant ASC 350 standards and the given components. A4. Describe the treatment for a private company, including a logical summary of the relevant ASC 350 standards and the given components. A5. Describe the treatment for when a company elects the accounting alternative., including a logical summary of the relevant ASC 350 standards and the given components. A6. Describe the treatment for when a company does not elect the accounting alternative, including a logical summary of the relevant ASC 350 standards and the given components. A7. Describe the treatment for when a company has a triggering event occur, including a logical summary of the relevant ASC 350 standards and the given components. A8. Describe the treatment for when a company does not have a triggering event occur, including a logical summary of the relevant ASC 350 standards and the given components. B1. Using the scenario, the attached "Goodwill Impairment Data," and the research completed for part A, determine the best approach for AMMRC Inc.'s treatment of goodwill impairment while justifying your decision on each of the following decision points: - whether the company has similar economic characteristics - whether the company is public or private - whether the company elects the accounting alternative - whether the company has a triggering event occur B2. Determine the goodwill impairment loss, if required, for TL and DJ corporations based on the information provided in the attached "Goodwill Impairment Data" and appropriate authoritative guidance (ASC 350). If goodwill impairment loss is not required, explain why. Web Link: http://aaahq.org/Research/FASB-GARS Username: AAA52071 Password: nU5M4Wu INTRODUCTION In this task, you will need to conduct efficient research, think critically, and provide effective communication in an accounting and auditing situation. FASB Topic 350 - Intangibles - Goodwill and Other will be used for the research element of the task. Due to the number of updates to Topic 350 over the years, you should utilize the "FASB Accounting Standards Codification Database" (see Web Links section) for your research. In part A you will research FASB Topic 350 generally, based on the details provided in each subprompt. Then in part B you will apply your research based on the details in the Scenario and supporting document "Goodwill Impairment Data." You are an auditor with a local CPA firm. You have been tasked with researching the treatment for goodwill impairment for AMMRC Incorporated (AMMRC Inc.), one of the firm's clients. AMMRC Inc. purchased 100% of two U.S. corporations. AMMRC Inc. decided to complete quantitative impairment tests of goodwill for year-end December 31, 2021. You will review the scenario and appendix, research the general process of assessing goodwill impairment from FASB Codification Topic 350, and appropriate subtopics, sections, and subsections. You will provide a decision path, justify your course of action, and calculate impairment loss (if required). SCENARIO AMMRC Incorporated (AMMRC Inc.), is a U.S. manufacturer of greenhouses. AMMRC Inc. sells the greenhouses online through its website. On January 1, 2016, AMMRC Inc. purchased 100\% of TLTJ (TL), a U.S. corporation located throughout the U.S. as well as DJJS Company (DJ), a U.S. closely held corporation located on the West Coast. AMMRC Inc. originally recorded $1,850,000 of goodwill on its consolidated balance sheet, with $1,300,000 and $550,000 related to TL and DJ, respectively. -The New Segment TL manufactures polycarbonate sheets and panels. The sheets and panels have great transparency and are virtually unbreakable. The sheets and panels are used in construction of AMMRC Inc.'s greenhouses and are sold through its website to other manufacturing companies and to individual consumers. DJ manufactures heavy-duty greenhouse shelves. A line of its shelves was modified to fit AMMRC Inc.'s greenhouses. DJ also manufactures shelves that are sold to other manufacturing companies and to individual consumers. Before purchasing DJ, AMMRC Inc. purchased the shelves from a foreign company. AMMRC Inc. experienced unreliable vendor services and shipment of the product from the foreign company; the product usually arrived two or more weeks past the promised delivery date. Upon the purchase of TL and DJ, AMMRC Inc. formally established a new segment, Greenhouse Parts and Accessories, for financial reporting purposes. -Goodwill AMMRC Inc. developed a policy that requires all reporting units to formal quantitative impairment tests of goodwill every five years, beginning with the financial statements for fiscal year 2021. Prior to 2021, AMMRC Inc. concluded each year that a formal quantitative goodwill impairment test was not required. AMMRC Inc. prepared to test all of it reporting units. In conjunction with these tests, AMMRC Inc. noted that several fixedasset groupings within Greenhouse Parts and Accessories experienced significant declines in market value, and thus the segment personnel would be testing all fixed-asset groupings for impairment. AMMRC Inc. hired a large consulting firm that specialized in corporate valuation to conduct appraisals that are necessary for the goodwill impairment testing process. Its appraisal reports highlighted December 31, 2021, fair values in the amounts of $11,000,000 and $1,800,000 for TL and DJ, respectively. AMMRC Inc. is confident that all of the other assets and liabilities were reported at appropriate amounts that approximated fair values. Additional information for impairment testing is found in the attached "Goodwill Impairment Data." Goodwill Impairment Data Preliminary December 31, 2021, Balance Sheet Summaries