Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer based on new tax bill 2018 Sandra is single and does considerable business entertaining at home. Because Arthur, Sandra's 80-year-old dependent grandfather who lived

answer based on new tax bill 2018

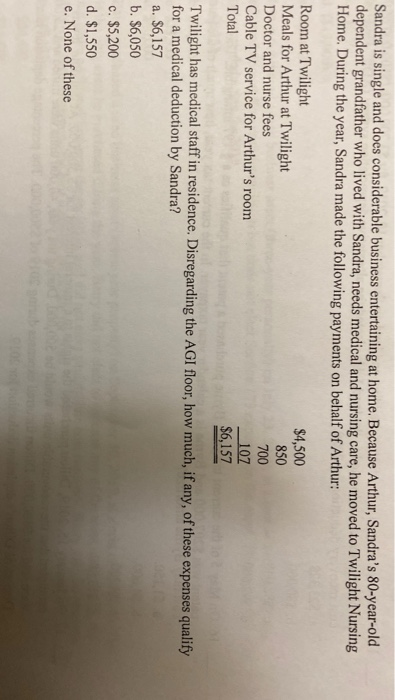

Sandra is single and does considerable business entertaining at home. Because Arthur, Sandra's 80-year-old dependent grandfather who lived with Sandra, needs medical and nursing care, he moved to Twilight Nursing Home. During the year, Sandra made the following payments on behalf of Arthur: Room at Twilight Meals for Arthur at Twilight Doctor and nurse fees Cable TV service for Arthur's room Total $4,500 850 700 107 $6,157 Twilight has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses quality for a medical deduction by Sandra? a. $6,157 b. $6,050 c. $5,200 d. $1,550 e. None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started