Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER BOTH 17. A stock with a beta of 0.25 would be characterized as a. Being 25% as risky as the market average and having

ANSWER BOTH

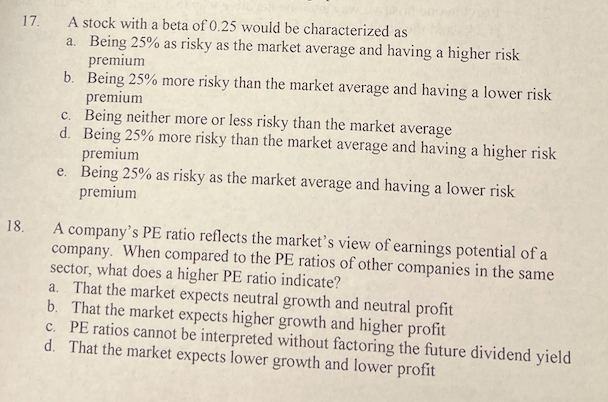

17. A stock with a beta of 0.25 would be characterized as a. Being 25% as risky as the market average and having a higher risk premium b. Being 25% more risky than the market average and having a lower risk premium c. Being neither more or less risky than the market average d. Being 25% more risky than the market average and having a higher risk premium e. Being 25% as risky as the market average and having a lower risk premium a 18. A company's PE ratio reflects the market's view of earnings potential of a company. When compared to the PE ratios of other companies in the same sector, what does a higher PE ratio indicate? a. That the market expects neutral growth and neutral profit b. That the market expects higher growth and higher profit C. PE ratios cannot be interpreted without factoring the future dividend yield d. That the market expects lower growth and lower profitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started