Answered step by step

Verified Expert Solution

Question

1 Approved Answer

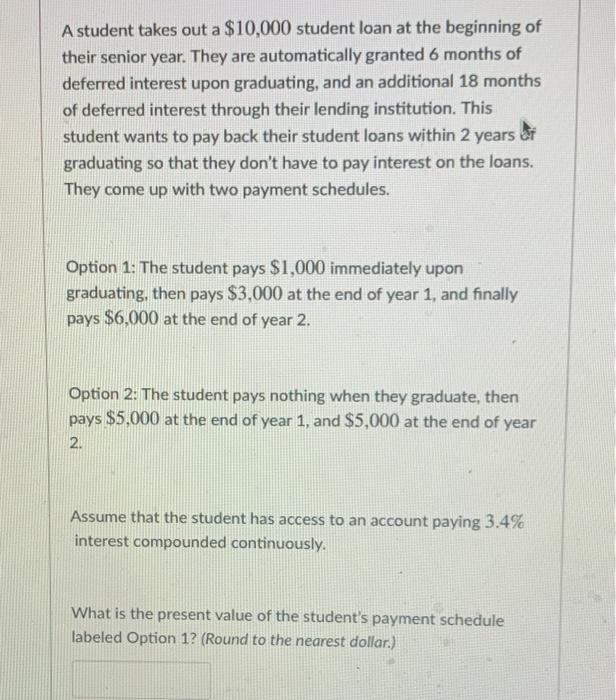

Answer both part one and two for a thumbs up! PART TWO A student takes out a $10,000 student loan at the beginning of their

Answer both part one and two for a thumbs up!

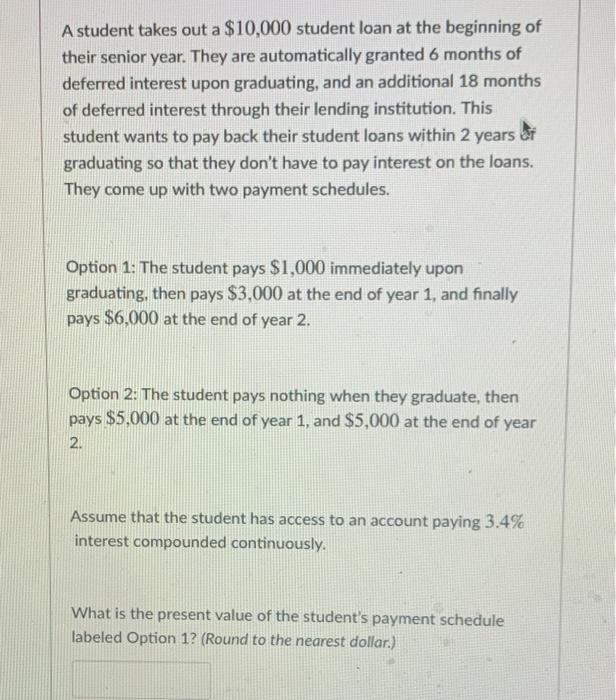

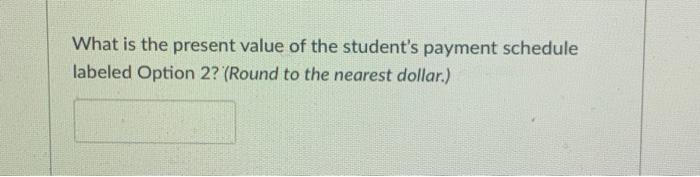

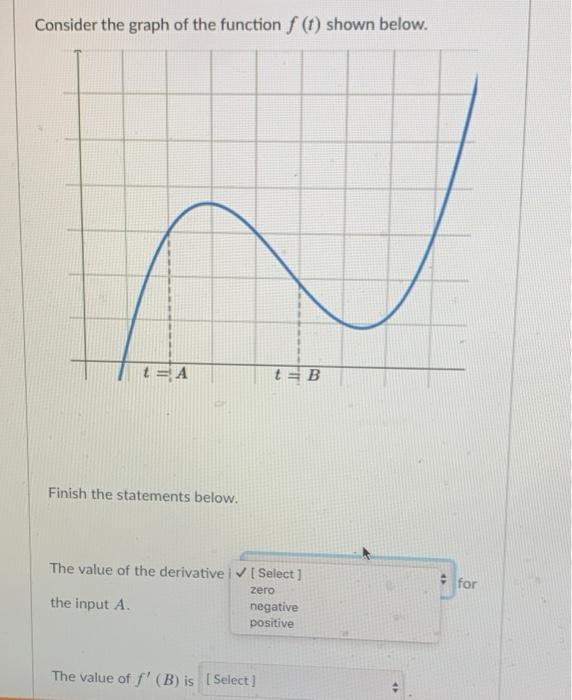

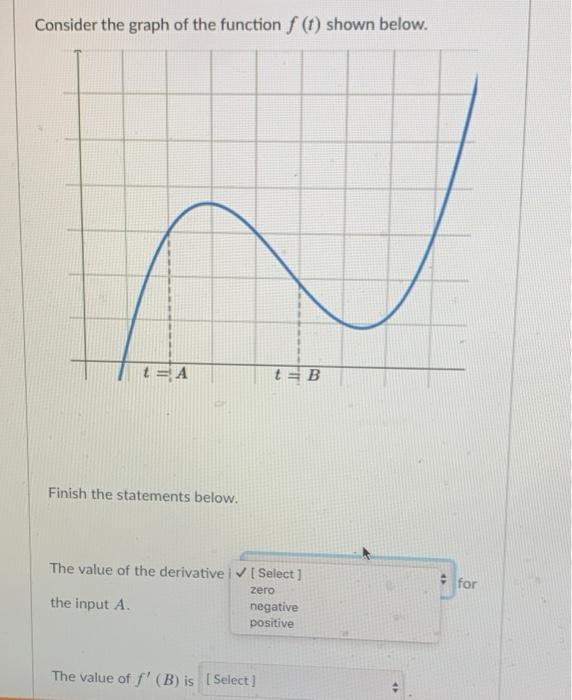

A student takes out a $10,000 student loan at the beginning of their senior year. They are automatically granted 6 months of deferred interest upon graduating, and an additional 18 months of deferred interest through their lending institution. This student wants to pay back their student loans within 2 years er graduating so that they don't have to pay interest on the loans. They come up with two payment schedules. Option 1: The student pays $1,000 immediately upon graduating, then pays $3,000 at the end of year 1, and finally pays $6,000 at the end of year 2. Option 2: The student pays nothing when they graduate, then pays $5.000 at the end of year 1, and $5,000 at the end of year 2. Assume that the student has access to an account paying 3.4% interest compounded continuously. What is the present value of the student's payment schedule labeled Option 1? (Round to the nearest dollar.) What is the present value of the student's payment schedule labeled Option 2? (Round to the nearest dollar.) Consider the graph of the function f () shown below. A t =B Finish the statements below. The value of the derivative Select] for the input A. zero negative positive The value of f' (B) is (Select]

PART TWO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started