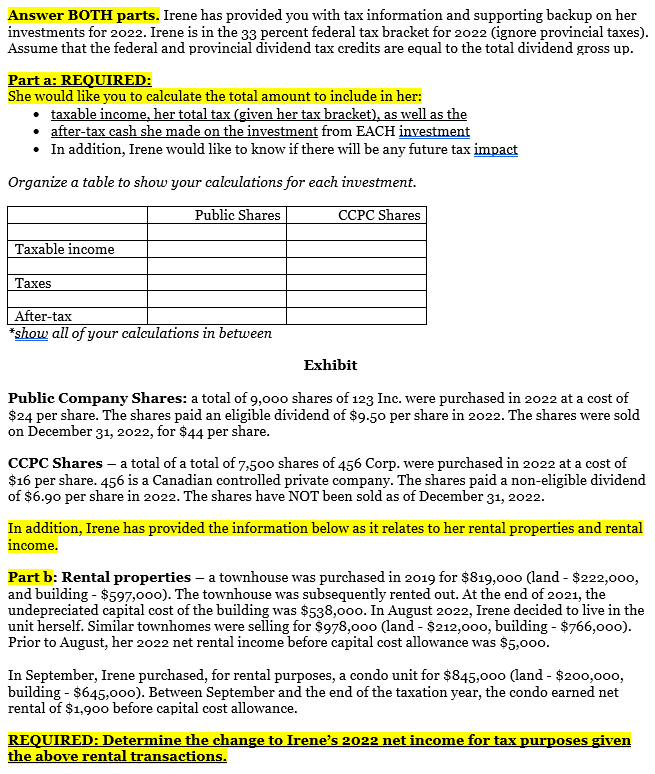

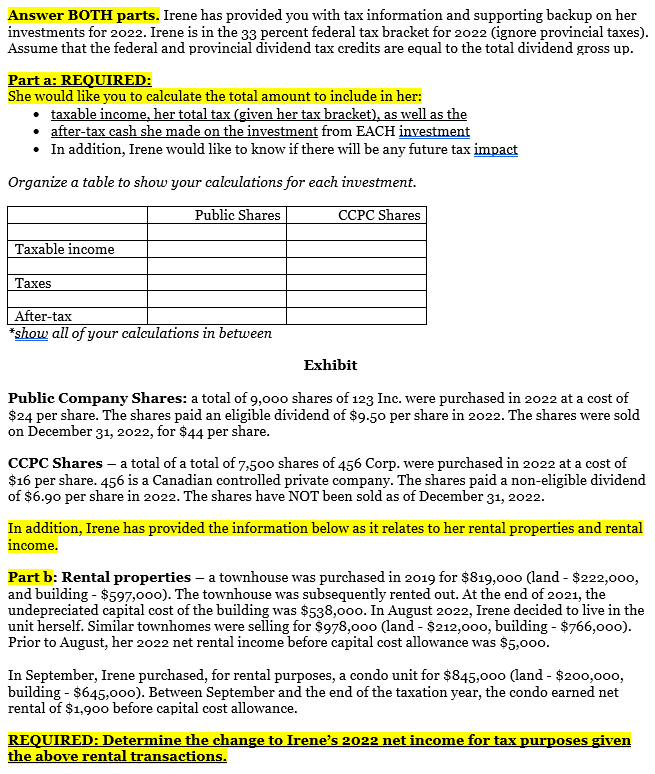

Answer BOTH parts. Irene has provided you with tax information and supporting backup on her investments for 2022 . Irene is in the 33 percent federal tax bracket for 2022 (ignore provincial taxes). Assume that the federal and provincial dividend tax credits are equal to the total dividend gross up. Part a: REQUIRED: She would like you to calculate the total amount to include in her: - taxable income, her total tax (given her tax bracket), as well as the - after-tax cash she made on the investment from EACH investment - In addition, Irene would like to know if there will be any future tax impact Organize a table to show your calculations for each investment. * show all of your calculations in between Exhibit Public Company Shares: a total of 9,00o shares of 123 Inc. were purchased in 2022 at a cost of $24 per share. The shares paid an eligible dividend of $9.50 per share in 2022 . The shares were sold on December 31,2022 , for $44 per share. CCPC Shares - a total of a total of 7,500 shares of 456 Corp. were purchased in 2022 at a cost of $16 per share. 456 is a Canadian controlled private company. The shares paid a non-eligible dividend of $6.90 per share in 2022 . The shares have NOT been sold as of December 31,2022. In addition, Irene has provided the information below as it relates to her rental properties and rental income. Part b: Rental properties - a townhouse was purchased in 2019 for $819,000 (land - $222,000, and building - $597,000 ). The townhouse was subsequently rented out. At the end of 2021 , the undepreciated capital cost of the building was $53, ooo. In August 2022, Irene decided to live in the unit herself. Similar townhomes were selling for $978,000 (land - $212,000, building - $766,000 ). Prior to August, her 2022 net rental income before capital cost allowance was $5,000. In September, Irene purchased, for rental purposes, a condo unit for $845,000 (land - $200,000, building - $645,000). Between September and the end of the taxation year, the condo earned net rental of $1,900 before capital cost allowance. REQUIRED: Determine the change to Irene's 2022 net income for tax purposes given the above rental transactions