Answered step by step

Verified Expert Solution

Question

1 Approved Answer

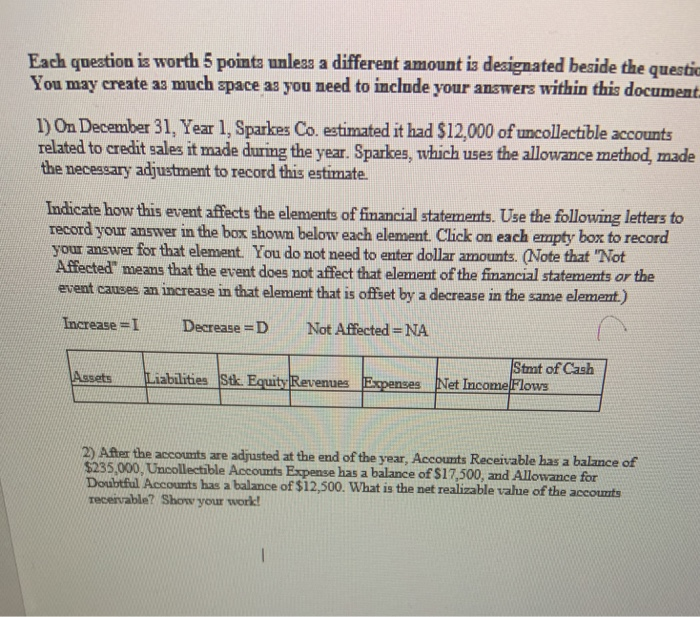

answer both pics please Each question is worth 5 points unless a different amount is designated beside the questi You may create as much space

answer both pics please

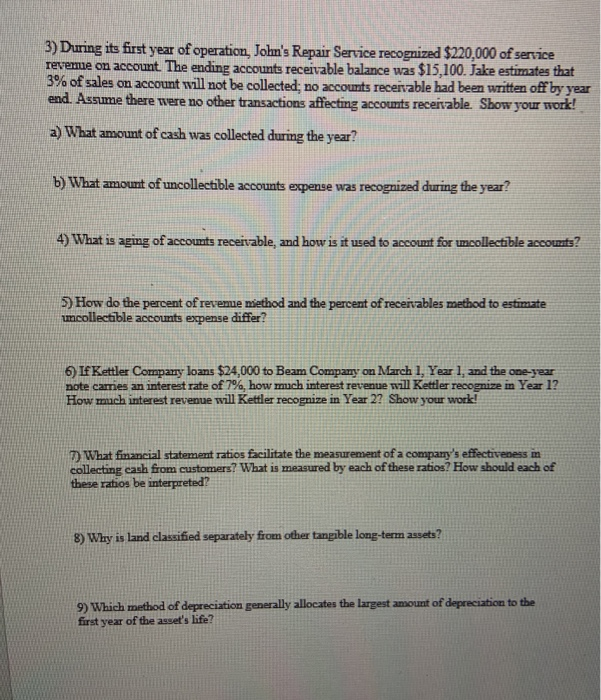

Each question is worth 5 points unless a different amount is designated beside the questi You may create as much space as you need to include your answers within this document 1) On December 31, Year 1, Sparkes Co. estimated it had $12,000 of uncollectible accounts related to credit sales it made during the year. Sparkes, which uses the allowance method, made the necessary adjustment to record this estimate. Indicate how this event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. Click on each empty box to record your answer for that element. You do not need to enter dollar amounts. (Note that "Not Affected" means that the event does not affect that element of the financial statements or the event causes an increase in that element that is offset by a decrease in the same element.) Increase I Decrease =D Not Affected=NA Stmt of Cash Expenses Net Income Flows Assets Liabilities Stk. Equity Revenues 2) After the accounts are adjusted at the end of the year, Accounts Receivable has a balance of $235,000, Uncollectible Accounts Expense has a balance of $17.500, and Allowance for Doubtful Accounts has a balance of $12,500. What is the net realizable value of the accounts receivable? Show your work! 3) During its first year of operation, John's Repair Service recognized $220,000 of service revenue on account. The ending accounts receivable balance was $15,100. Jake estimates that 3% of sales on account will not be collected; no accounts receivable had been written off by year end. Assume there were no other transactions affecting accounts receivable. Show your work! a) What amount of cash was collected during the year? b) What amount of uncollectible accounts expense was recognized during the year? 4) What is aging of accounts receivable, and how is it used to account for collectible accounts? 5) How do the percent of revenue method and the percent of receivables method to estimate imcollectible accounts expense differ? 6 If Kettler Company loans $24,000 to Beam Company on March 1, Year 1, and the one-year note cames an interest rate of 7%, how much interest revenue will Kettler recognize in Year 1? How much interest revenue will Kettler recognize in Year 2? Show your work! 7) What financial statement ratios facilitate the measurement of a company's effectiveness in collecting cash from customers? What is measured by each of these ratios? How should each of these ratios be interpreted? 8) Why is land classified separately from other tangible long-term assets? 9) Which method of depreciation generally allocates the largest amount of depreciation to the first year of the asset's life Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started