Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER BOTH PLEASE!! thank you You are currently thinking about investing in a stock priced at $22.00 per share. The stock recently paid a dividend

ANSWER BOTH PLEASE!! thank you

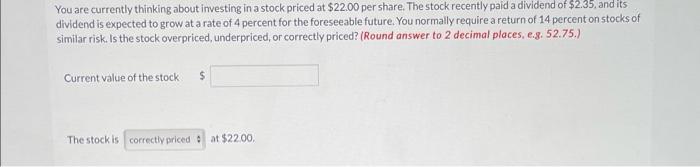

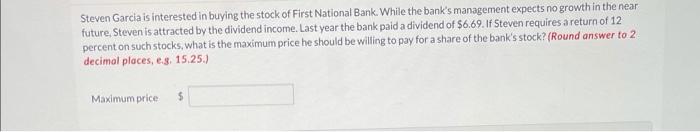

You are currently thinking about investing in a stock priced at $22.00 per share. The stock recently paid a dividend of $2.35, and its dividend is expected to grow at a rate of 4 percent for the foreseeable future. You normally require a return of 14 percent on stocks of similar risk. Is the stock overpriced, underpriced, or correctly priced? (Round answer to 2 decimal places, e.g. 52.75.) Current value of thestock $ The stock is at $2200 Steven Garcia is interested in buying the stock of First National Bank. While the bank's management expects no growth in the near future, Steven is attracted by the dividend income. Last year the bank paid a dividend of $6.69. If Steven requires a return of 12 percent on such stocks, what is the maximum price he should be willing to pay for a share of the bank's stock? (Round answer to 2 decimal ploces, e.s. 15.25.) Maximumprice 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started