Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer both questions please. 1. Michigan Motors is considering the purchase of a land and the construction of a new plant. The land, which would

Answer both questions please.

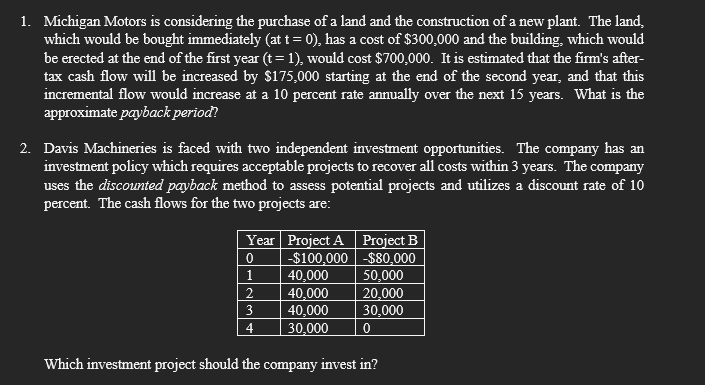

1. Michigan Motors is considering the purchase of a land and the construction of a new plant. The land, which would be bought immediately (at t= 0), has a cost of $300,000 and the building, which would be erected at the end of the first year (t = 1), would cost $700,000. It is estimated that the firm's after- tax cash flow will be increased by $175,000 starting at the end of the second year, and that this incremental flow would increase at a 10 percent rate annually over the next 15 years. What is the approximate payback period? 2. Davis Machineries is faced with two independent investment opportunities. The company has an investment policy which requires acceptable projects to recover all costs within 3 years. The company uses the discounted payback method to assess potential projects and utilizes a discount rate of 10 percent. The cash flows for the two projects are: Year Project A Project B 0 $100,000 $80,000 1 40,000 50,000 2 40,000 20.000 3 40,000 30,000 4 30,000 O Which investment project should the company invest inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started