Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer both questions please Your friend named Easy plans to start a tutoring company for students taking actuarial courses at Uoft, and he asks to

Answer both questions please

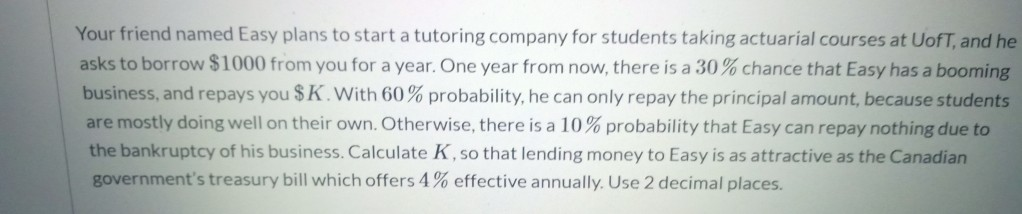

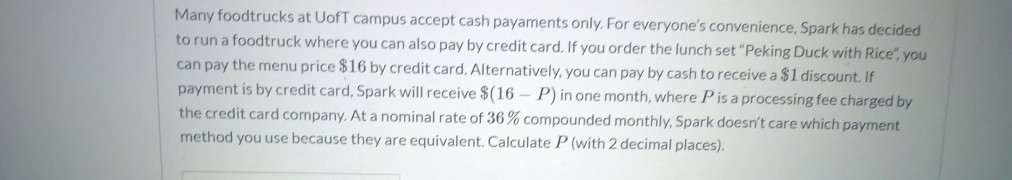

Your friend named Easy plans to start a tutoring company for students taking actuarial courses at Uoft, and he asks to borrow $1000 from you for a year. One year from now, there is a 30% chance that Easy has a booming business, and repays you $K. With 60% probability, he can only repay the principal amount, because students are mostly doing well on their own. Otherwise, there is a 10% probability that Easy can repay nothing due to the bankruptcy of his business. Calculate K, so that lending money to Easy is as attractive as the Canadian government's treasury bill which offers 4% effective annually. Use 2 decimal places. Many foodtrucks at UofT campus accept cash payaments only. For everyone's convenience, Spark has decided to run a foodtruck where you can also pay by credit card. If you order the lunch set "Peking Duck with Rice", you can pay the menu price $16 by credit card. Alternatively, you can pay by cash to receive a $1 discount. If payment is by credit card, Spark will receive $(16 - P) in one month, where P is a processing fee charged by the credit card company. At a nominal rate of 36 % compounded monthly, Spark doesn't care which payment method you use because they are equivalent. Calculate P (with 2 decimal places)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started