Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer c for thumbs up Coronado, Ltd. is a local coat retailer. The store's accountant prepared the following income statement for the month ended January

answer c for thumbs up

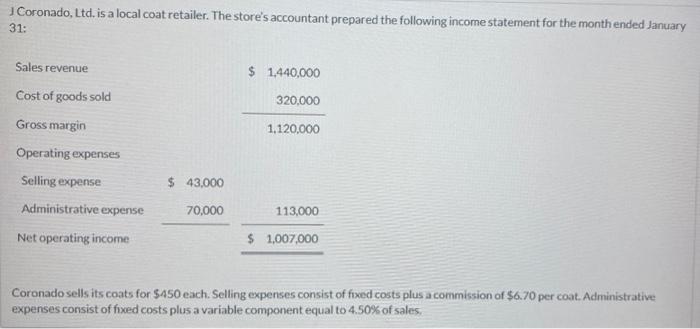

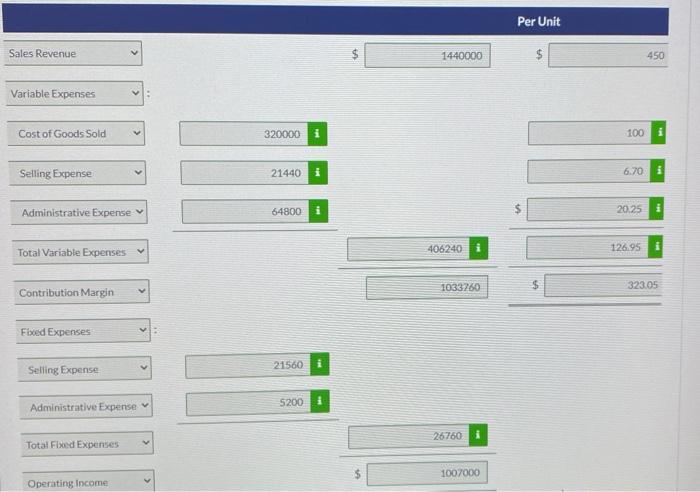

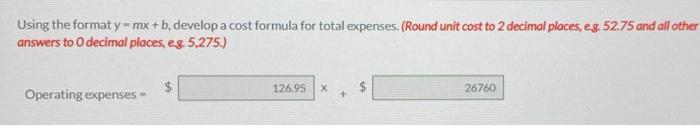

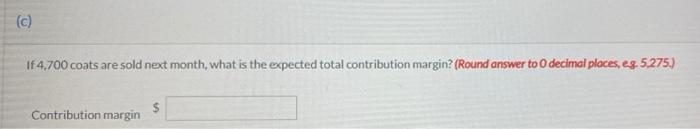

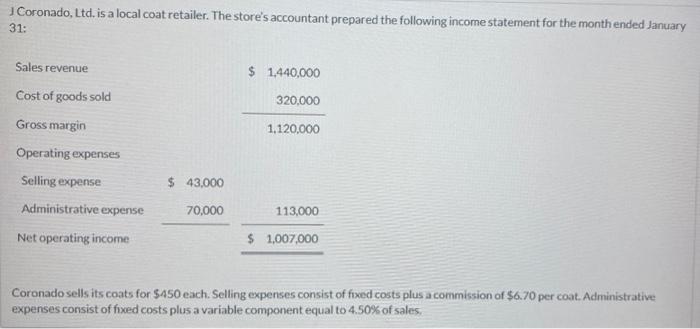

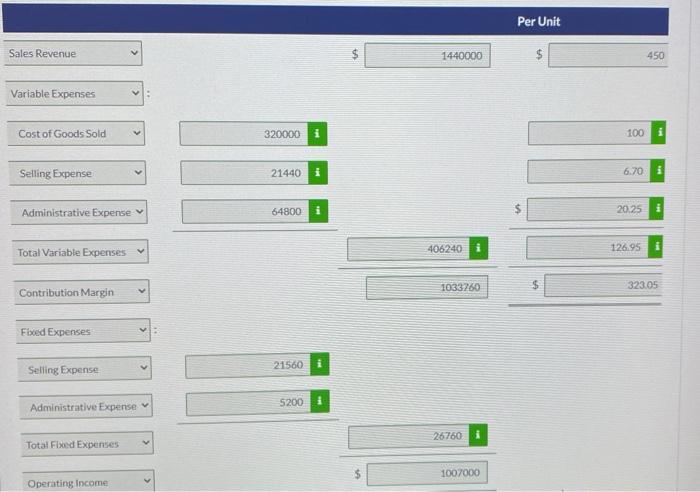

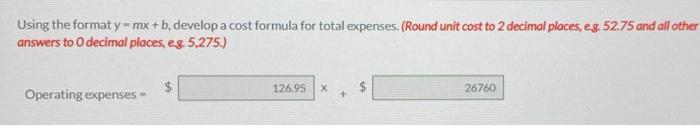

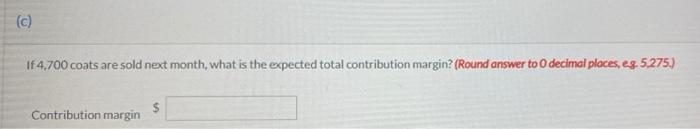

Coronado, Ltd. is a local coat retailer. The store's accountant prepared the following income statement for the month ended January 31: $ 1.440,000 320,000 1,120,000 Sales revenue Cost of goods sold Gross margin Operating expenses Selling expense Administrative expense Net operating income $ 43,000 70,000 113,000 $ 1,007,000 Coronado sells its coats for $450 each. Selling expenses consist of fixed costs plus a commission of $6.70 per coat. Administrative expenses consist of fixed costs plus a variable component equal to 4.50% of sales Per Unit Sales Revenue $ 1440000 $ 450 Variable Expenses Cost of Goods Sold 320000 i 100 Selling Expense 21440 6.70 Administrative Expense 64800 20.25 1 406240 126.95 Total Variable Expenses 1033760 $ $ Contribution Margin 323.05 Fbced Expenses 21560 Selling Expense 5200 Administrative Expense 26760 Total Fixed Expenses 1007000 Operating Income Using the formaty - mx + b. develop a cost formula for total expenses. (Round unit cost to 2 decimal places, eg 52.75 and all other answers to decimal places, eg. 5,275.) $ 126.95 X $ 26760 Operating expenses + (C) If 4.700 coats are sold next month, what is the expected total contribution margin? (Round answer to O decimal places, eg 5,275.) $ Contribution margin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started